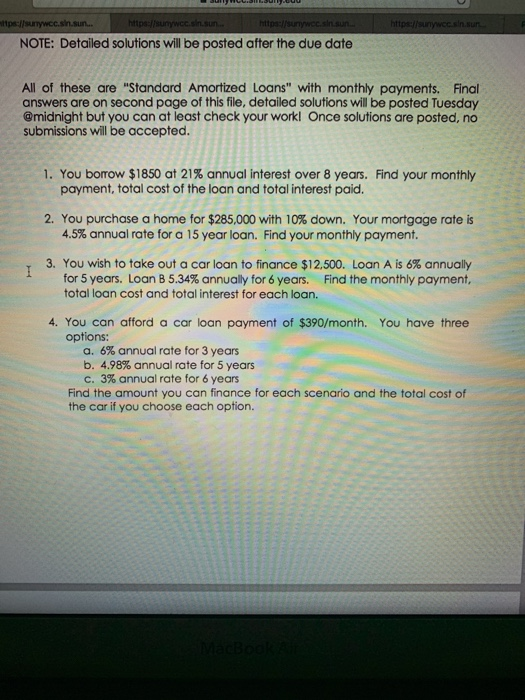

https://sunywcc sin.sun ps://surywce.sin.sun... https://sunywcc.sin.sun... https://surywcc sinun NOTE: Detailed solutions will be posted after the due date All of these are "Standard Amortized Loans" with monthly payments. Final answers are on second page of this file, detailed solutions will be posted Tuesday @midnight but you can at least check your work! Once solutions are posted, no submissions will be accepted. 1. You borrow $1850 at 21% annual interest over 8 years. Find your monthly payment, total cost of the loan and total interest paid. 2. You purchase a home for $285,000 with 10% down. Your mortgage rate is 4.5% annual rate for a 15 year loan. Find your monthly payment. 3. You wish to take out a car loan to finance $12,500. Loan A is 6% annually for 5 years. Loan B 5.34% annually for 6 years. Find the monthly payment, total loan cost and total interest for each loan. 4. You can afford a car loan payment of $390/month. You have three options: a. 6% annual rate for 3 years b. 4.98% annual rate for 5 years C. 3% annual rate for 6 years Find the amount you can finance for each scenario and the total cost of the car if you choose each option. BE https://sunywcc sin.sun ps://surywce.sin.sun... https://sunywcc.sin.sun... https://surywcc sinun NOTE: Detailed solutions will be posted after the due date All of these are "Standard Amortized Loans" with monthly payments. Final answers are on second page of this file, detailed solutions will be posted Tuesday @midnight but you can at least check your work! Once solutions are posted, no submissions will be accepted. 1. You borrow $1850 at 21% annual interest over 8 years. Find your monthly payment, total cost of the loan and total interest paid. 2. You purchase a home for $285,000 with 10% down. Your mortgage rate is 4.5% annual rate for a 15 year loan. Find your monthly payment. 3. You wish to take out a car loan to finance $12,500. Loan A is 6% annually for 5 years. Loan B 5.34% annually for 6 years. Find the monthly payment, total loan cost and total interest for each loan. 4. You can afford a car loan payment of $390/month. You have three options: a. 6% annual rate for 3 years b. 4.98% annual rate for 5 years C. 3% annual rate for 6 years Find the amount you can finance for each scenario and the total cost of the car if you choose each option. BE