Answered step by step

Verified Expert Solution

Question

1 Approved Answer

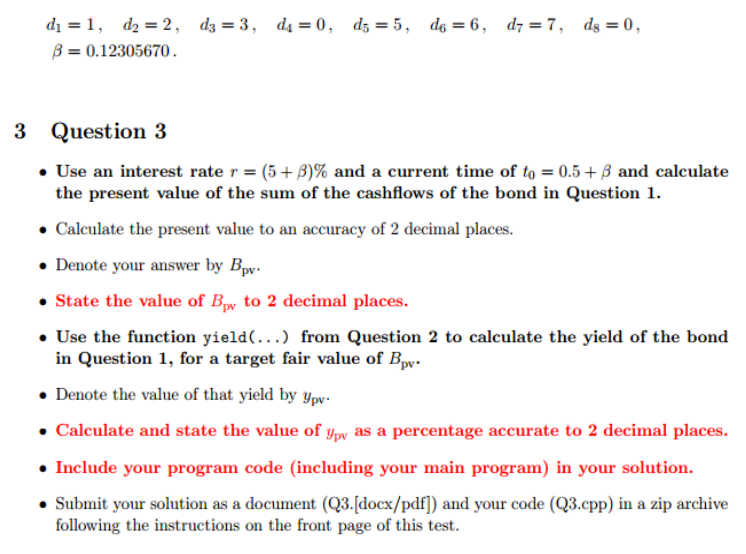

https://venus.cs.qc.cuny.edu/~smane/cs365/lectures/CS365_765_lecture2.pdf 0.12305670 3 Question 3 . Use an interest rate r (5+)% and a current time of to-0.5+ and calculate the present value of the

https://venus.cs.qc.cuny.edu/~smane/cs365/lectures/CS365_765_lecture2.pdf

0.12305670 3 Question 3 . Use an interest rate r (5+)% and a current time of to-0.5+ and calculate the present value of the sum of the cashflows of the bond in Question 1. Calculate the present value to an accuracy of 2 decimal places. Denote your answer by Bp State the value of Bpy to 2 decimal places. . Use the function yieldC...) from Question 2 to calculate the yield of the bond in Question 1, for a target fair value of Bpy Denote the value of that yield by p . Calculate and state the value of ypv as a percentage accurate to 2 decimal places . Include your program code (including your main program) in your solution. Submit your solution as a document (Q3.[docx/pdf) and your code (Q3.cpp) in a zip archive following the instructions on the front page of this test 0.12305670 3 Question 3 . Use an interest rate r (5+)% and a current time of to-0.5+ and calculate the present value of the sum of the cashflows of the bond in Question 1. Calculate the present value to an accuracy of 2 decimal places. Denote your answer by Bp State the value of Bpy to 2 decimal places. . Use the function yieldC...) from Question 2 to calculate the yield of the bond in Question 1, for a target fair value of Bpy Denote the value of that yield by p . Calculate and state the value of ypv as a percentage accurate to 2 decimal places . Include your program code (including your main program) in your solution. Submit your solution as a document (Q3.[docx/pdf) and your code (Q3.cpp) in a zip archive following the instructions on the front page of this testStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started