Answered step by step

Verified Expert Solution

Question

1 Approved Answer

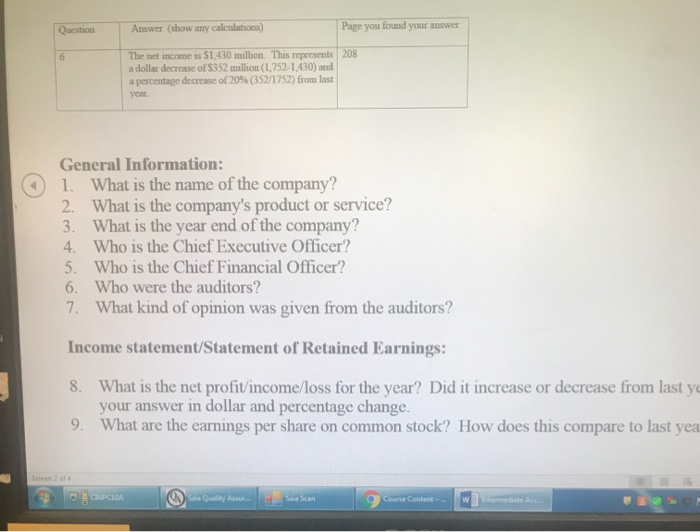

https://www.pepsico.com/docs/album/annual-reports/pepsico-inc-2017-annual-report.pdf QuestionAwer(show any calculations) Page you found your answer The net income is $1.430 million. This represents 208 a dollar decrease of $352 million (1,752-1,430)

https://www.pepsico.com/docs/album/annual-reports/pepsico-inc-2017-annual-report.pdf

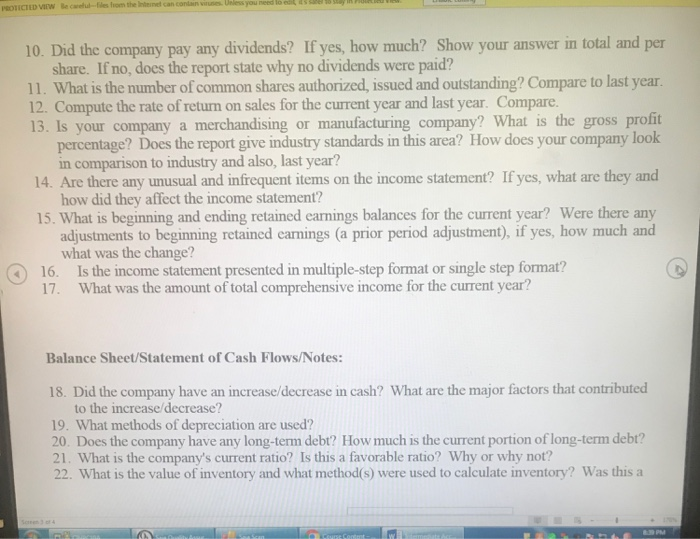

QuestionAwer(show any calculations) Page you found your answer The net income is $1.430 million. This represents 208 a dollar decrease of $352 million (1,752-1,430) amd a percentage decrease of20% (3521752) from last | ycar General Information: 1. What is the name of the company? What is the company's product or service? 3. 2. What is the year end of the company? 4. Who is the Chief Executive Officer? Who is the Chief Financial Officer? 5. 6. Who were the auditors? 7. What kind of opinion was given from the auditors? Income statement/Statement of Retained Earnings: 8. What is the net profit/income/loss for the year? Did it increase or decrease from last ye your answer in dollar and percentage change. 9. What are the earnings per share on common stock? How does this compare to last yea Course Content-. W 10. Did the company pay any dividends? If yes, how much? Show your answer in total and per share. If no, does the report state why no dividends were paid? 11. What is the number of common shares authorized, issued and outstanding? Compare to last year 13. Is your company a merchandising or manufacturing company? What is the gross profit 12. Compute the rate of return on sales for the current year and last year. Compare. percentage? Does the report give industry standards in this area? How does your company look 14. Are there any unusual and infrequent items on the income statement? If yes, what are they and 15. What is beginning and ending retained earnings balances for the current year? Were there any in comparison to industry and also, last year? how did they affect the income statement? what was the change? adjustments to beginning retained carnings (a prior period adjustment), if yes, how much and 16. Is the income statement presented in multiple-step format or single step format? 17. What was the amount of total comprehensive income for the current year? Balance Sheet/Statement of Cash Flows/Notes: 18. Did the company have an increase/decrease in cash? What are the major factors that contributed to the increase/decrease? 19. What methods of depreciation are used? 20. Does the company have any long-term debt? How much is the current portion of long-term debt? 21. What is the company's current ratio? Is this a favorable ratio? Why or why not? 22. What is the value of inventory and what method(s) were used to calculate inventory? Was this a QuestionAwer(show any calculations) Page you found your answer The net income is $1.430 million. This represents 208 a dollar decrease of $352 million (1,752-1,430) amd a percentage decrease of20% (3521752) from last | ycar General Information: 1. What is the name of the company? What is the company's product or service? 3. 2. What is the year end of the company? 4. Who is the Chief Executive Officer? Who is the Chief Financial Officer? 5. 6. Who were the auditors? 7. What kind of opinion was given from the auditors? Income statement/Statement of Retained Earnings: 8. What is the net profit/income/loss for the year? Did it increase or decrease from last ye your answer in dollar and percentage change. 9. What are the earnings per share on common stock? How does this compare to last yea Course Content-. W 10. Did the company pay any dividends? If yes, how much? Show your answer in total and per share. If no, does the report state why no dividends were paid? 11. What is the number of common shares authorized, issued and outstanding? Compare to last year 13. Is your company a merchandising or manufacturing company? What is the gross profit 12. Compute the rate of return on sales for the current year and last year. Compare. percentage? Does the report give industry standards in this area? How does your company look 14. Are there any unusual and infrequent items on the income statement? If yes, what are they and 15. What is beginning and ending retained earnings balances for the current year? Were there any in comparison to industry and also, last year? how did they affect the income statement? what was the change? adjustments to beginning retained carnings (a prior period adjustment), if yes, how much and 16. Is the income statement presented in multiple-step format or single step format? 17. What was the amount of total comprehensive income for the current year? Balance Sheet/Statement of Cash Flows/Notes: 18. Did the company have an increase/decrease in cash? What are the major factors that contributed to the increase/decrease? 19. What methods of depreciation are used? 20. Does the company have any long-term debt? How much is the current portion of long-term debt? 21. What is the company's current ratio? Is this a favorable ratio? Why or why not? 22. What is the value of inventory and what method(s) were used to calculate inventory? Was this a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started