Answered step by step

Verified Expert Solution

Question

1 Approved Answer

https://www.sec.gov/Archives/edgar/data/320193/000032019317000070/a10-k20179302017.htm How to calculate the Capital Expednitures in APPLE company 2017 ? Go to EDGAR (http://www.sec.gov/edgar/searchedgar/companysearch.html) and look up the 10-K for Apple Inc. (AAPL)

https://www.sec.gov/Archives/edgar/data/320193/000032019317000070/a10-k20179302017.htm

How to calculate the Capital Expednitures in APPLE company 2017 ?

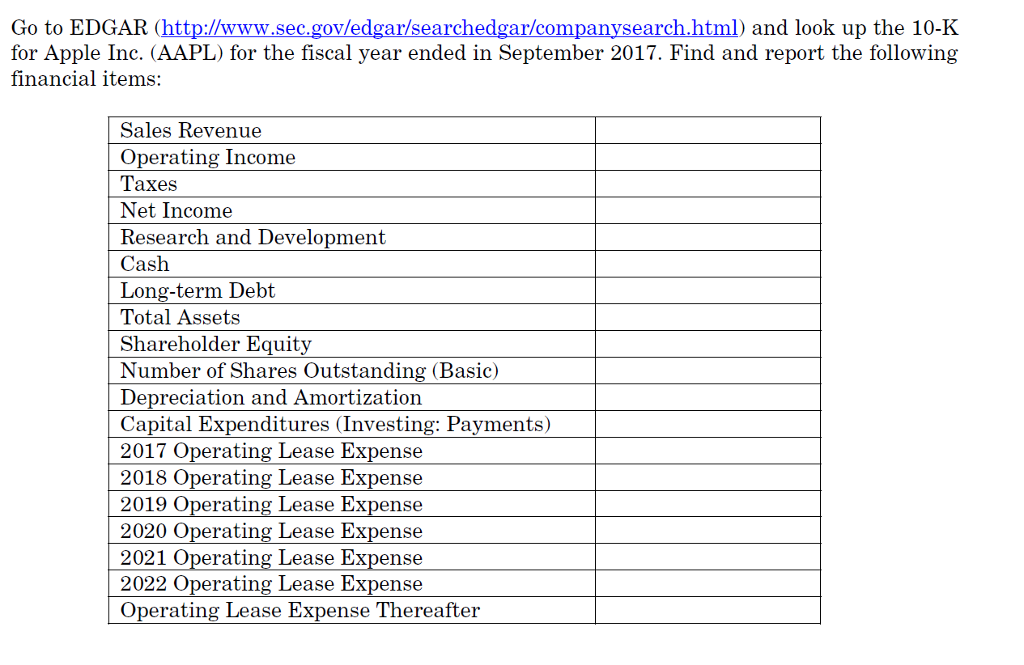

Go to EDGAR (http://www.sec.gov/edgar/searchedgar/companysearch.html) and look up the 10-K for Apple Inc. (AAPL) for the fiscal vear ended in September 2017. Find and report the following financial items Sales Revenue Operating Income Taxes Net Income Research and Development Cash Long-term Debt Total Assets Shareholder Equity Number of Shares Outstanding (Basic) Depreciation and Amortization Capital Expenditures (Investing: Payments) 2017 Operating Lease Expense 2018 Operating Lease Expense 2019 Operating Lease Expense 2020 Operating Lease Expense 2021 Operating Lease Expense 2022 Operating Lease Expense Operating Lease Expense Thereafter Go to EDGAR (http://www.sec.gov/edgar/searchedgar/companysearch.html) and look up the 10-K for Apple Inc. (AAPL) for the fiscal vear ended in September 2017. Find and report the following financial items Sales Revenue Operating Income Taxes Net Income Research and Development Cash Long-term Debt Total Assets Shareholder Equity Number of Shares Outstanding (Basic) Depreciation and Amortization Capital Expenditures (Investing: Payments) 2017 Operating Lease Expense 2018 Operating Lease Expense 2019 Operating Lease Expense 2020 Operating Lease Expense 2021 Operating Lease Expense 2022 Operating Lease Expense Operating Lease Expense ThereafterStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started