Answered step by step

Verified Expert Solution

Question

1 Approved Answer

http://www.gm.com/content/dam/gm/en_us/english/Group4/InvestorsPDFDocuments/02-pdfs/10-K.pdf http://shareholder.ford.com/~/media/Files/F/Ford-IR-V2/events-and-presentations/2018/F-2017-10-K-report.pdf Choose two firms in the US that compete within the same industry (e.g., J.C. Penney and Sears, Johnson & Johnson and Merck, Ford

http://www.gm.com/content/dam/gm/en_us/english/Group4/InvestorsPDFDocuments/02-pdfs/10-K.pdf

http://shareholder.ford.com/~/media/Files/F/Ford-IR-V2/events-and-presentations/2018/F-2017-10-K-report.pdf

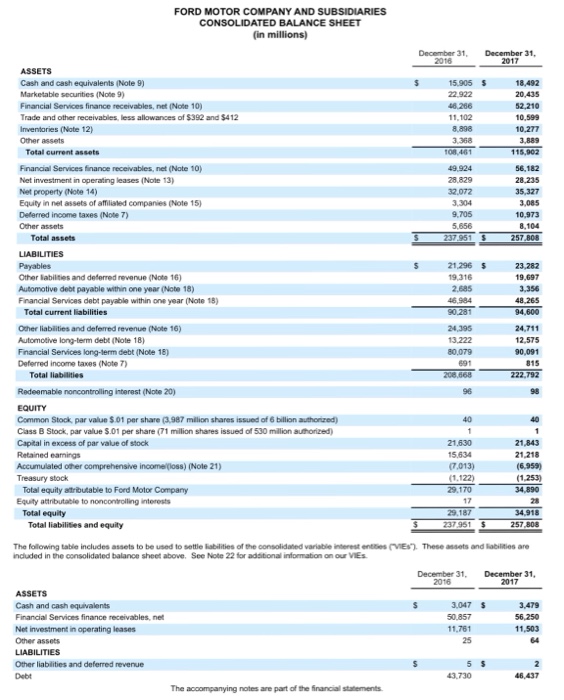

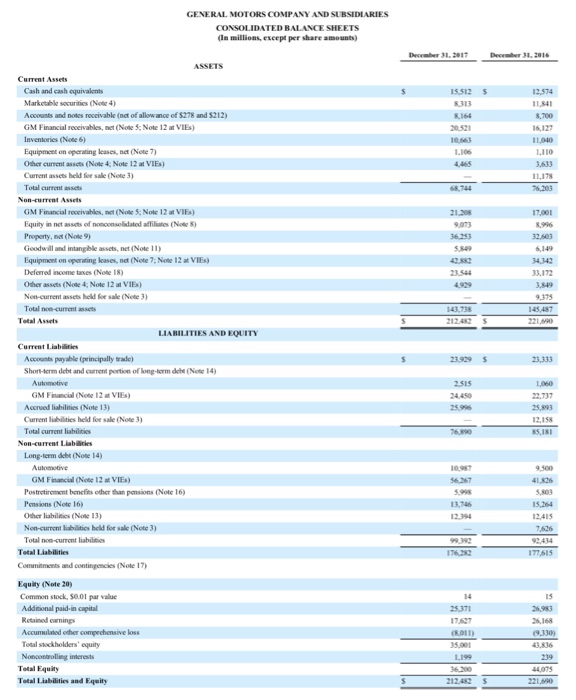

Choose two firms in the US that compete within the same industry (e.g., J.C. Penney and Sears, Johnson & Johnson and Merck, Ford and GM). Go to each firm's website, and then access and download their annual reports (financial statements). Using the accounting data from the firms' financial statements and the ratios, calculate all ratios for each firm (liquidity ratios, activity ratios, profitability ratios, leverage ratios, and coverage ratios). Analyze and compare your calculations for the two firms. I need a detailed answer please, it's for a project. I have attached below the financial links for GM and Ford http://www.gm.com/content/dam/gm/en_us/english/Group4/InvestorsPDFDocuments/02- pdfs/10-K.pdf http://shareholder.ford.com/ /media/Files/F/Ford-IR-V2/events-and- presentations/2018/F-2017-10-K-report.pdfStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started