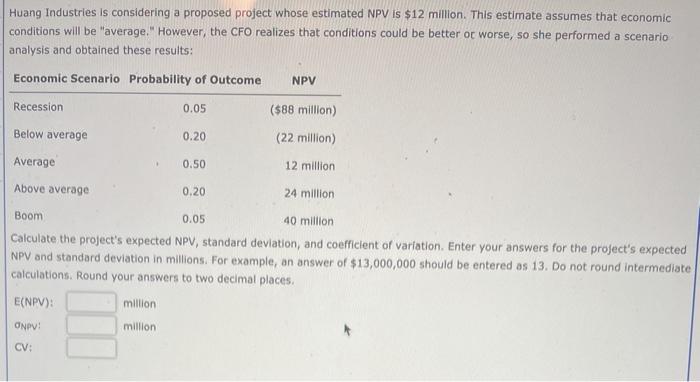

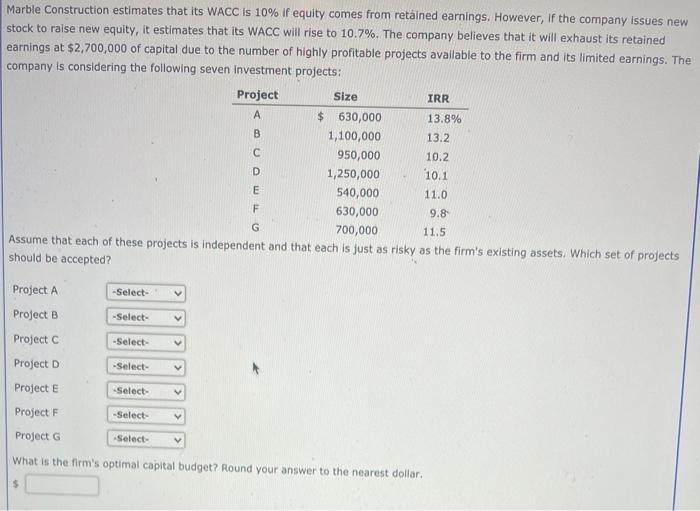

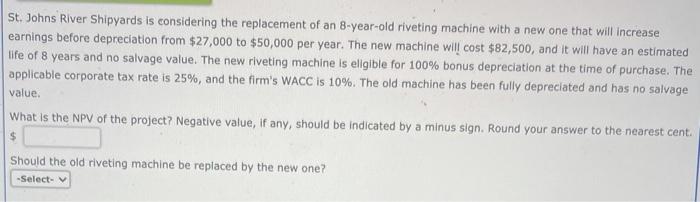

Huang Industries is considering a proposed project whose estimated NPV is $12 million. This estimate assumes that economic conditions will be "average. However, the CFO realizes that conditions could be better or worse, so she performed a scenario analysis and obtained these results: Economic Scenario Probability of Outcome NPV Recession 0.05 ($88 million) Below average 0.20 (22 million) Average 1 0.50 12 million Above average 0.20 24 million Boom 0.05 40 million Calculate the project's expected NPV, standard deviation, and coefficient of variation Enter your answers for the project's expected NPV and standard deviation in millions. For example, an answer of $13,000,000 should be entered as 13. Do not round intermediate calculations. Round your answers to two decimal places. E(NPV): million ONPV million CV: A Marble Construction estimates that its WACC is 10% if equity comes from retained earnings. However, if the company issues new stock to raise new equity, it estimates that its WACC will rise to 10.7%. The company believes that it will exhaust its retained earnings at $2,700,000 of capital due to the number of highly profitable projects available to the firm and its limited earnings. The company is considering the following seven Investment projects: Project Size IRR $ 630,000 13.8% B 1,100,000 13.2 950,000 10.2 1,250,000 10.1 E 540,000 11.0 F 630,000 9.8 G 700,000 11.5 Assume that each of these projects is Independent and that each is just as risky as the firm's existing assets. Which set of projects should be accepted? D -Select- Project A Project B -Select- Project C -Select- Project D -Select- Project E -Select V Project F -Select- Project G -Select- What is the firm's optimal capital budget? Round your answer to the nearest dollar, St. Johns River Shipyards is considering the replacement of an 8-year-old riveting machine with a new one that will increase earnings before depreciation from $27,000 to $50,000 per year. The new machine will cost $82,500, and it will have an estimated life of 8 years and no salvage value. The new riveting machine is eligible for 100% bonus depreciation at the time of purchase. The applicable corporate tax rate is 25%, and the firm's WACC is 10%. The old machine has been fully deprecated and has no salvage value. What is the NPV of the project? Negative value, if any, should be indicated by a minus sign. Round your answer to the nearest cent. $ Should the old riveting machine be replaced by the new one? -Select