Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Huawei Technologies Company is launching a new product in Europe which requires capital investment in European region. Thus, the company's German affiliate is considering

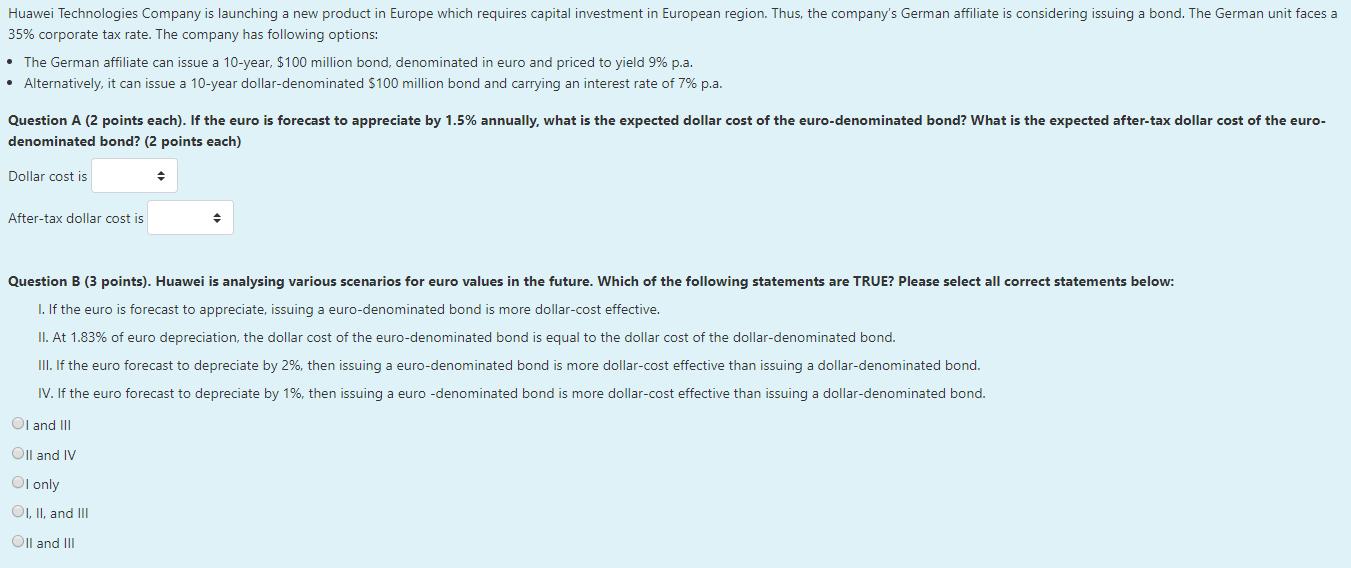

Huawei Technologies Company is launching a new product in Europe which requires capital investment in European region. Thus, the company's German affiliate is considering issuing a bond. The German unit faces a 35% corporate tax rate. The company has following options: The German affiliate can issue a 10-year, $100 million bond, denominated in euro and priced to yield 9% p.a. Alternatively, it can issue a 10-year dollar-denominated $100 million bond and carrying an interest rate of 7% p.a. Question A (2 points each). If the euro is forecast to appreciate by 1.5% annually, what is the expected dollar cost of the euro-denominated bond? What is the expected after-tax dollar cost of the euro- denominated bond? (2 points each) Dollar cost is After-tax dollar cost is Question B (3 points). Huawei is analysing various scenarios for euro values in the future. Which of the following statements are TRUE? Please select all correct statements below: I. If the euro is forecast to appreciate, issuing a euro-denominated bond is more dollar-cost effective. II. At 1.83% of euro depreciation, the dollar cost of the euro-denominated bond is equal to the dollar cost of the dollar-denominated bond. III. If the euro forecast to depreciate by 2%, then issuing a euro-denominated bond is more dollar-cost effective than issuing a dollar-denominated bond. IV. If the euro forecast to depreciate by 1%, then issuing a euro -denominated bond is more dollar-cost effective than issuing a dollar-denominated bond. Ol and III Oll and IV Ol only O1, II, and II Oll and III

Step by Step Solution

★★★★★

3.31 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Without loss of generality let the exchange rate today be 1 Eruo 1 The Euro denominated bond will re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started