Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hubbard's Pet Foods is financed 6 0 % by common stock and 4 0 % by bonds. The expected return on the common stock is

Hubbard's Pet Foods is financed by common stock and by bonds. The expected return on the common stock is and

the rate of interest on the bonds is Assume that the bonds are defaultfree and that there are no taxes. Now assume that

Hubbard's issues more debt and uses the proceeds to retire equity. The new financing mix is equity and debt. Assume the

debt is still default free.

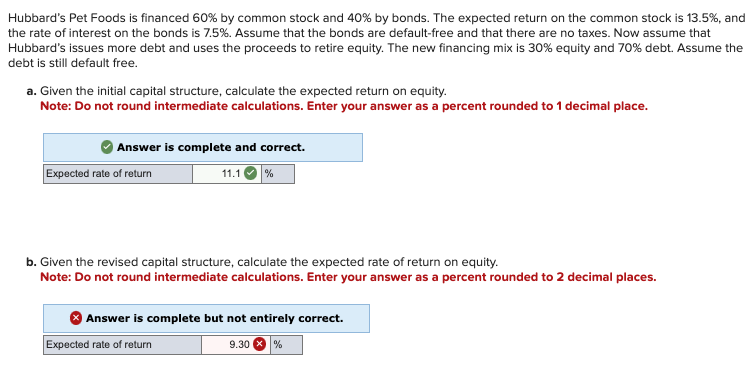

a Given the initial capital structure, calculate the expected return on equity.

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to decimal place.

Answer is complete and correct.

b Given the revised capital structure, calculate the expected rate of return on equity.

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to decimal places.

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started