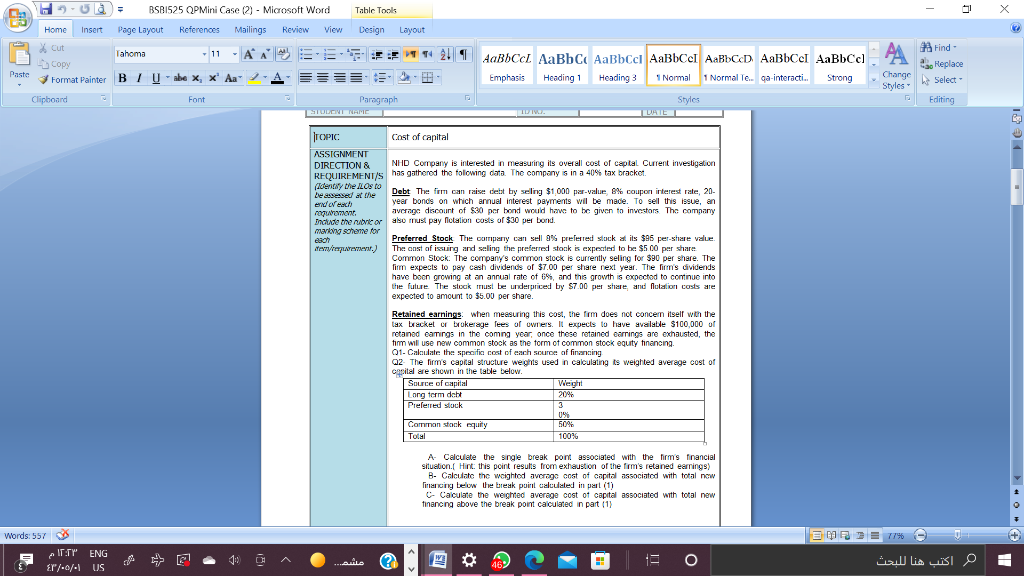

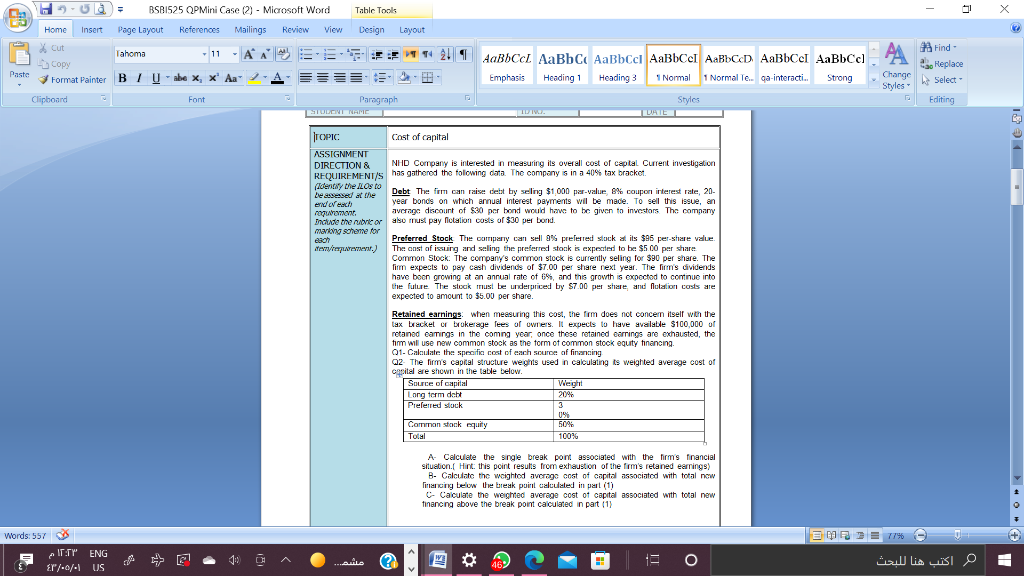

H-UD BSB1525 QPMini Case (2) - Microsoft Word Table Tools Home Insert Page Layout References Mailings Review View Design Layout * Cut Tag - 11 AN FEET 2! | - Copy Paste Format Painter BI U be x, x' Aa Clipboard Font Paragraph TODONT NAME A AaBSCL AaBb C AaBbcci AaBbCcl AaBDCD AaBbcl AaBb c] Emphasis Heading 1 Heading 3 1 Normal 1 Normal Te.. ga-interacti. Strong Change Hind - 43. Heplace Select- Editing Styles - Styles - TOPIC Cost of capital ASSIGNMENT DIRECTION & NHD Company is interested in measuring its overall cost of capital Current investigation REQUIREMENT/S has gathered the folowing corta The company is in a 40% tax bracket Identay the Losto be assessed at the Debt The firm can raise detst by seling $1,000 par-value 8% coupon interest rate, 20- end of each year bonds on which annual interest payments will be made. To sell this issue, an nepromont. average discount of $30 per bond would have to be given to investors. The company include the ribor also must pay Notalion costs of $30 per bond. marking scheme for each Preferred Stock The company can sell 9% preferred stock at its 395 per-stare value den/reparar.) ) The anst of issuing and selling the preferred stock is expected to be $5.00 per share Common Stock: The company's common stock is currently seling for $90 per share. The fimm expects to pay cash dividends of $7.00 per share next year. The firm's dividends have boon growing at an annual rate of 6%, and this growth is expected to continue into the future. The stock must be underpriced by S7.00 per share and flulation costs are expected to amount to $5.00 per share. Retained earnings when measuring this cost, the firm does not concem itself with the tax bracket or brokerage fees of owners. It expects to have available $100,000 of retained eamings in the coming year, once these retained earnings are exhausted, the tim will use new common stock as the form of common stock equity financing 01- Calculate the specific cost of each source of financing Q2 The firm's capital structure weights used in calculating to weighted average cost of capital are shown in the table below. Source of capital Weight Long term debt 20% Preferred stock 3 0% Common stock equity 50% Total 100% A Calculate the single break pont associated with the firm's financial situation. Hint this point results from exhaustion of the firm's retained earnings) B- Calculate the weighted average cost of capital associated with total new Tinancing below the break point calculated in part (1) C Calculate the weighted average cost of capital associated with total new financng above the break point calculated in part (1) SEDE 77% 2 Words: 557 INTY ENG EY"/-/- US " ? 46 O H-UD BSB1525 QPMini Case (2) - Microsoft Word Table Tools Home Insert Page Layout References Mailings Review View Design Layout * Cut Tag - 11 AN FEET 2! | - Copy Paste Format Painter BI U be x, x' Aa Clipboard Font Paragraph TODONT NAME A AaBSCL AaBb C AaBbcci AaBbCcl AaBDCD AaBbcl AaBb c] Emphasis Heading 1 Heading 3 1 Normal 1 Normal Te.. ga-interacti. Strong Change Hind - 43. Heplace Select- Editing Styles - Styles - TOPIC Cost of capital ASSIGNMENT DIRECTION & NHD Company is interested in measuring its overall cost of capital Current investigation REQUIREMENT/S has gathered the folowing corta The company is in a 40% tax bracket Identay the Losto be assessed at the Debt The firm can raise detst by seling $1,000 par-value 8% coupon interest rate, 20- end of each year bonds on which annual interest payments will be made. To sell this issue, an nepromont. average discount of $30 per bond would have to be given to investors. The company include the ribor also must pay Notalion costs of $30 per bond. marking scheme for each Preferred Stock The company can sell 9% preferred stock at its 395 per-stare value den/reparar.) ) The anst of issuing and selling the preferred stock is expected to be $5.00 per share Common Stock: The company's common stock is currently seling for $90 per share. The fimm expects to pay cash dividends of $7.00 per share next year. The firm's dividends have boon growing at an annual rate of 6%, and this growth is expected to continue into the future. The stock must be underpriced by S7.00 per share and flulation costs are expected to amount to $5.00 per share. Retained earnings when measuring this cost, the firm does not concem itself with the tax bracket or brokerage fees of owners. It expects to have available $100,000 of retained eamings in the coming year, once these retained earnings are exhausted, the tim will use new common stock as the form of common stock equity financing 01- Calculate the specific cost of each source of financing Q2 The firm's capital structure weights used in calculating to weighted average cost of capital are shown in the table below. Source of capital Weight Long term debt 20% Preferred stock 3 0% Common stock equity 50% Total 100% A Calculate the single break pont associated with the firm's financial situation. Hint this point results from exhaustion of the firm's retained earnings) B- Calculate the weighted average cost of capital associated with total new Tinancing below the break point calculated in part (1) C Calculate the weighted average cost of capital associated with total new financng above the break point calculated in part (1) SEDE 77% 2 Words: 557 INTY ENG EY"/-/- US " ? 46 O