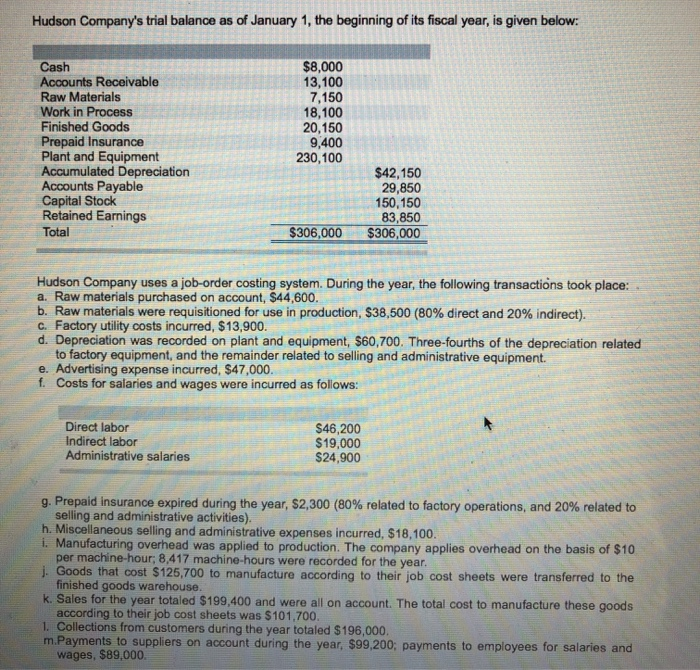

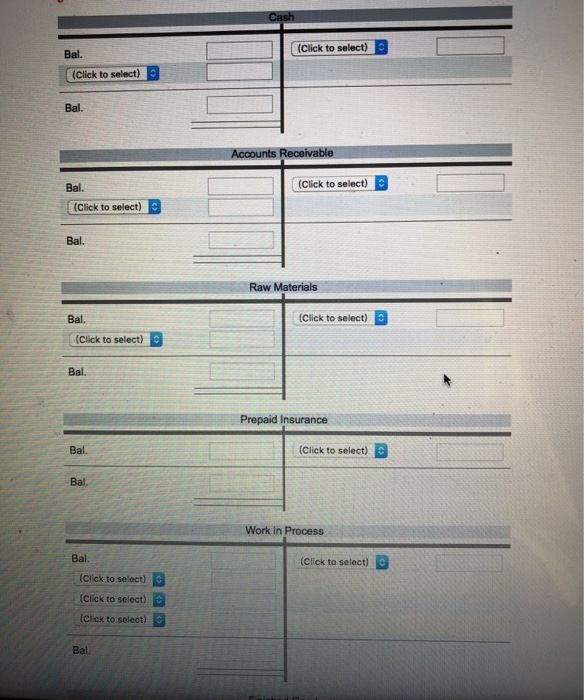

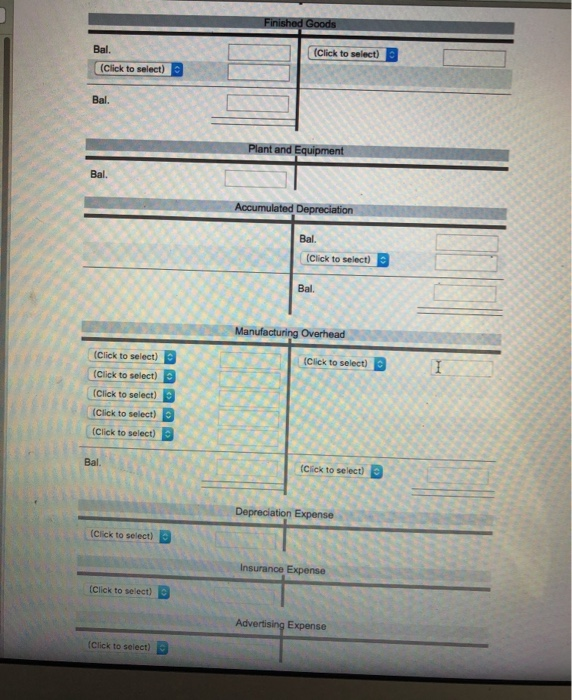

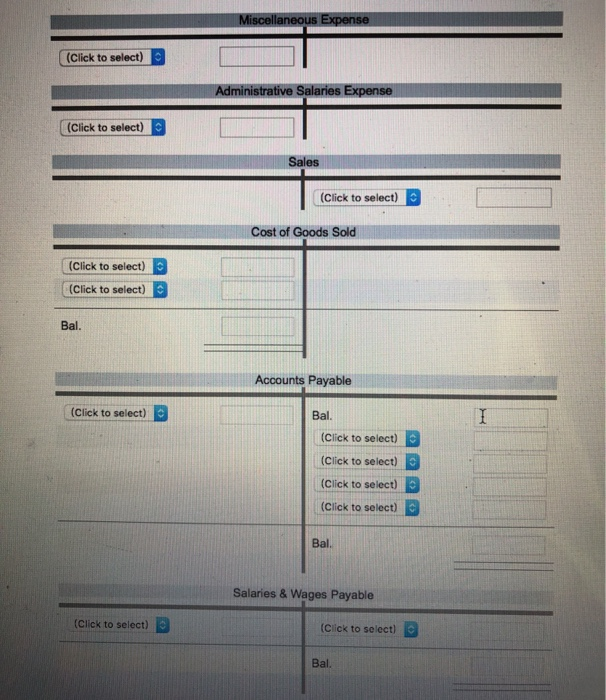

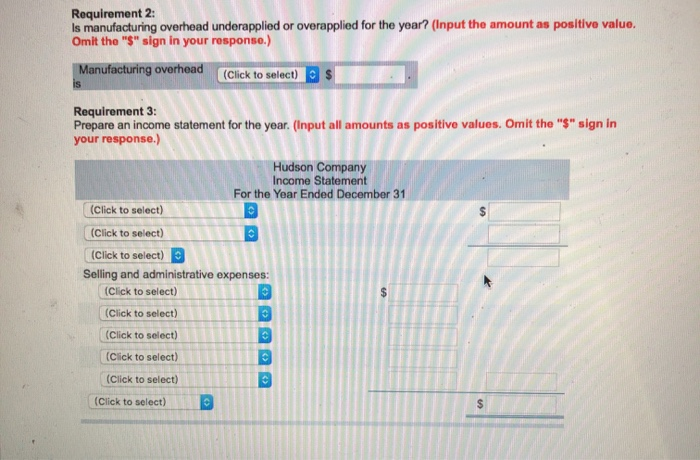

Hudson Company's trial balance as of January 1, the beginning of its fiscal year, is given below: Cash Accounts Receivable Raw Materials Work in Process Finished Goods Prepaid Insurance Plant and Equipment Accumulated Depreciation Accounts Payable Capital Stock Retained Earnings Total $8,000 13,100 7,150 18,100 20,150 9,400 230,100 S $42,150 29,850 150, 150 83,850 $306,000 $306,000 Hudson Company uses a job-order costing system. During the year, the following transactions took place: a. Raw materials purchased on account, $44,600. b. Raw materials were requisitioned for use in production, $38,500 (80% direct and 20% indirect). C. Factory utility costs incurred, $13,900. d. Depreciation was recorded on plant and equipment, $60,700. Three-fourths of the depreciation related to factory equipment, and the remainder related to selling and administrative equipment. e. Advertising expense incurred, $47,000. f. Costs for salaries and wages were incurred as follows: Direct labor Indirect labor Administrative salaries $46,200 $19,000 $24,900 g. Prepaid insurance expired during the year, $2,300 (80% related to factory operations, and 20% related to selling and administrative activities). h. Miscellaneous selling and administrative expenses incurred. $18,100. 1. Manufacturing overhead was applied to production. The company applies overhead on the basis of $10 per machine-hour; 8,417 machine-hours were recorded for the year. J. Goods that cost $125,700 to manufacture according to their job cost sheets were transferred to the finished goods warehouse. k. Sales for the year totaled $199,400 and were all on account. The total cost to manufacture these goods according to their job cost sheets was $101.700. 1. Collections from customers during the year totaled $196,000. m.Payments to suppliers on account during the year. $99, 200payments to employees for salaries and wages, $89,000. Cash (Click to select) Bal. (Click to select) Bal. Accounts Receivable Bal. (Click to select) (Click to select) Bal. Raw Materials (Click to select) Bal. (Click to select) Bal. Prepaid Insurance Bal. (Click to select) Work in Process Bal (Click to select) (Click to select) (Click to select) Click to select) Bal. Finished Goods (Click to select) Plant and Equipment Accumulated Depreciation Bal. (Click to select) Manufacturing Overhead Click to select) (Click to select) Click to select) (Click to select) Click to select) (Click to select) Click to select) > Depreciation Expense (Click to select) Insurance Expense Click to seect) D Advertising Expense Click to select) Miscellaneous Expense (Click to select) Administrative Salaries Expense (Click to select) Sales (Click to select) Cost of Goods Sold (Click to select) (Click to select) Bal. Accounts Payable (Click to select) Bal. (Click to select) (Click to select) (Click to select) (Click to select) Bal. Salaries & Wages Payable (Click to select) (Click to select) Bal. Capital Stock Bal. Retained Earnings Bal. Requirement 2: Is manufacturing overhead underapplied or overapplied for the year? (Input the amount as positive value. Omit the "S" sign in your response.) Manufacturing overhead Manufacturing overhead (Click to select) $ Requirement 3: Prepare an income statement for the year. (Input all amounts as positive values. Omit the "S" sign in your response.) Hudson Company Income Statement For the Year Ended December 31 (Click to select) (Click to select) (Click to select) Selling and administrative expenses: (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select)