Answered step by step

Verified Expert Solution

Question

1 Approved Answer

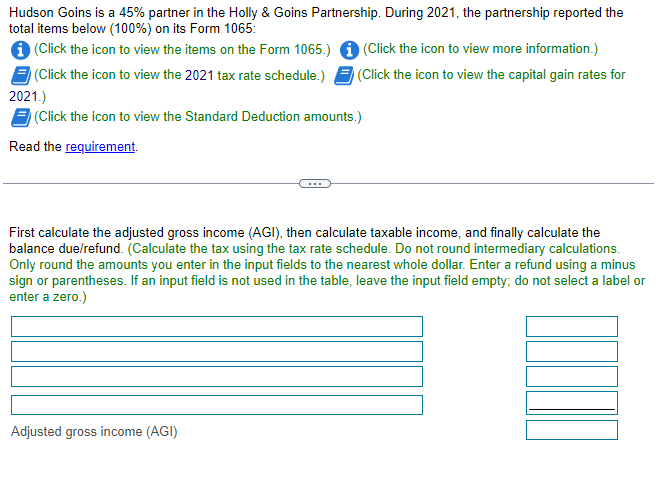

Hudson Goins is a 45% partner in the Holly & Goins Partnership. During 2021, the partnership reported the total items below (100%) on its

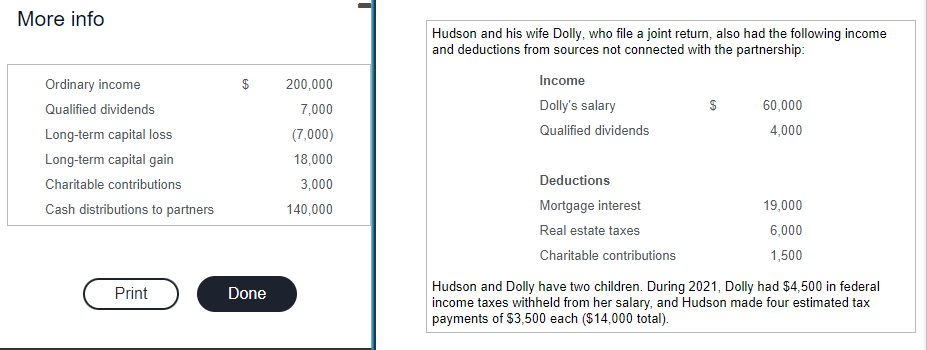

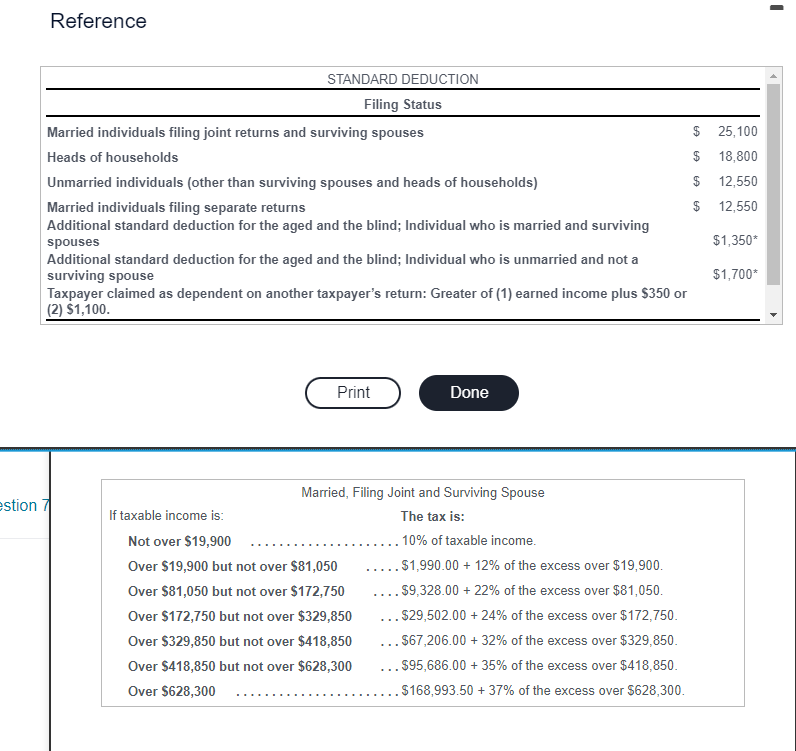

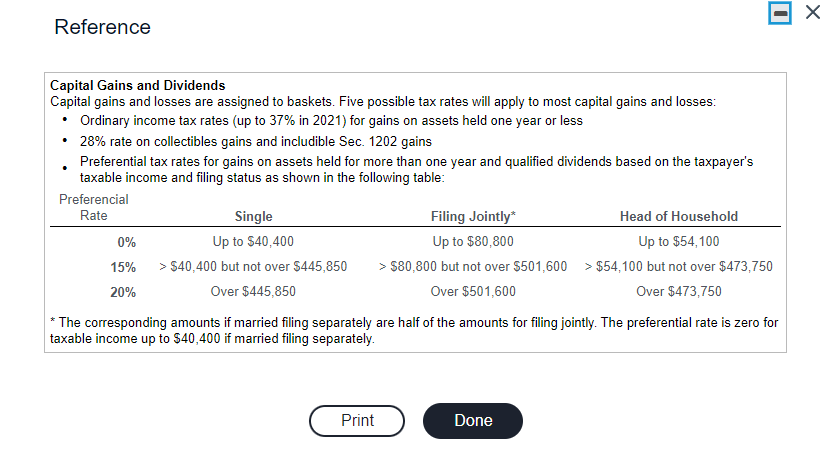

Hudson Goins is a 45% partner in the Holly & Goins Partnership. During 2021, the partnership reported the total items below (100%) on its Form 1065: i (Click the icon to view the items on the Form 1065.) (Click the icon to view the 2021 tax rate schedule.) 2021.) (Click the icon to view the Standard Deduction amounts.) Read the requirement. (Click the icon to view more information.) (Click the icon to view the capital gain rates for First calculate the adjusted gross income (AGI), then calculate taxable income, and finally calculate the balance due/refund. (Calculate the tax using the tax rate schedule. Do not round intermediary calculations. Only round the amounts you enter in the input fields to the nearest whole dollar. Enter a refund using a minus sign or parentheses. If an input field is not used in the table, leave the input field empty; do not select a label or enter a zero.) Adjusted gross income (AGI) More info Ordinary income 200,000 Qualified dividends 7,000 Long-term capital loss (7,000) Long-term capital gain 18,000 Charitable contributions 3,000 Cash distributions to partners 140,000 Print Done Hudson and his wife Dolly, who file a joint return, also had the following income and deductions from sources not connected with the partnership: Income Dolly's salary $ 60,000 Qualified dividends 4,000 Deductions Mortgage interest Real estate taxes Charitable contributions 19,000 6,000 1,500 Hudson and Dolly have two children. During 2021, Dolly had $4,500 in federal income taxes withheld from her salary, and Hudson made four estimated tax payments of $3,500 each ($14,000 total). Reference STANDARD DEDUCTION Filing Status Married individuals filing joint returns and surviving spouses Heads of households $ 25,100 $ 18,800 Unmarried individuals (other than surviving spouses and heads of households) $ 12,550 Married individuals filing separate returns $ 12,550 Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses $1,350* Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,100. $1,700* Print Done Married, Filing Joint and Surviving Spouse estion 7 If taxable income is: Not over $19,900 Over $19,900 but not over $81,050 Over $81,050 but not over $172,750 Over $172,750 but not over $329,850 Over $329,850 but not over $418,850 Over $418,850 but not over $628,300 Over $628,300 The tax is: 10% of taxable income. .....$1,990.00 + 12% of the excess over $19,900. ... $9,328.00 + 22% of the excess over $81,050. ... $29,502.00 +24% of the excess over $172,750. ... $67,206.00 + 32% of the excess over $329,850. ... $95,686.00 + 35% of the excess over $418,850. $168,993.50 + 37% of the excess over $628,300. Reference Capital Gains and Dividends Capital gains and losses are assigned to baskets. Five possible tax rates will apply to most capital gains and losses: Ordinary income tax rates (up to 37% in 2021) for gains on assets held one year or less 28% rate on collectibles gains and includible Sec. 1202 gains Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable income and filing status as shown in the following table: Preferencial Rate 0% Single Up to $40,400 15% 20% > $40,400 but not over $445,850 Over $445,850 Filing Jointly* Up to $80,800 Head of Household Up to $54,100 > $80,800 but not over $501,600 > $54,100 but not over $473,750 Over $501,600 Over $473,750 *The corresponding amounts if married filing separately are half of the amounts for filing jointly. The preferential rate is zero for taxable income up to $40,400 if married filing separately. Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started