Answered step by step

Verified Expert Solution

Question

1 Approved Answer

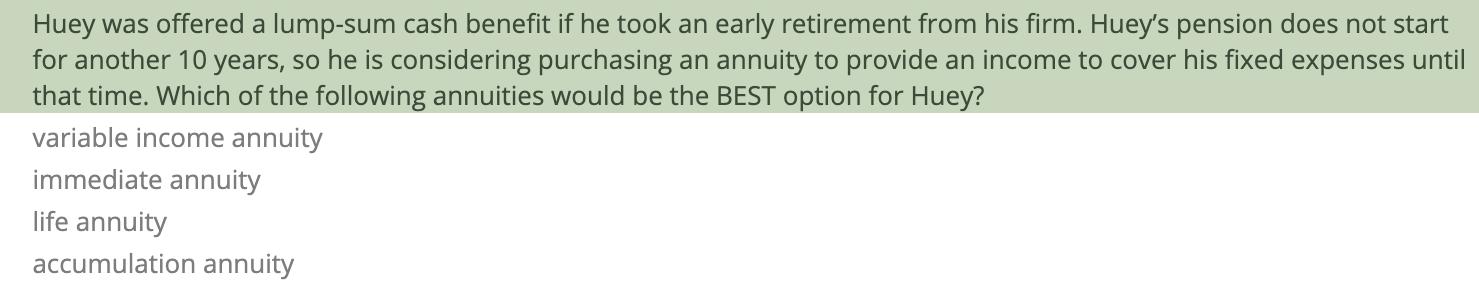

Huey was offered a lump-sum cash benefit if he took an early retirement from his firm. Huey's pension does not start for another 10

Huey was offered a lump-sum cash benefit if he took an early retirement from his firm. Huey's pension does not start for another 10 years, so he is considering purchasing an annuity to provide an income to cover his fixed expenses until that time. Which of the following annuities would be the BEST option for Huey? variable income annuity immediate annuity life annuity accumulation annuity Huey was offered a lump-sum cash benefit if he took an early retirement from his firm. Huey's pension does not start for another 10 years, so he is considering purchasing an annuity to provide an income to cover his fixed expenses until that time. Which of the following annuities would be the BEST option for Huey? variable income annuity immediate annuity life annuity accumulation annuity

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Variable income annuity A variable income annuity is the type of annuity which can rise or fa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started