Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hugh and Woo are a married couple. They disposed of the following assets during the tax year 2022-23: Freehold warehouse On 27 April 2022, Hugh

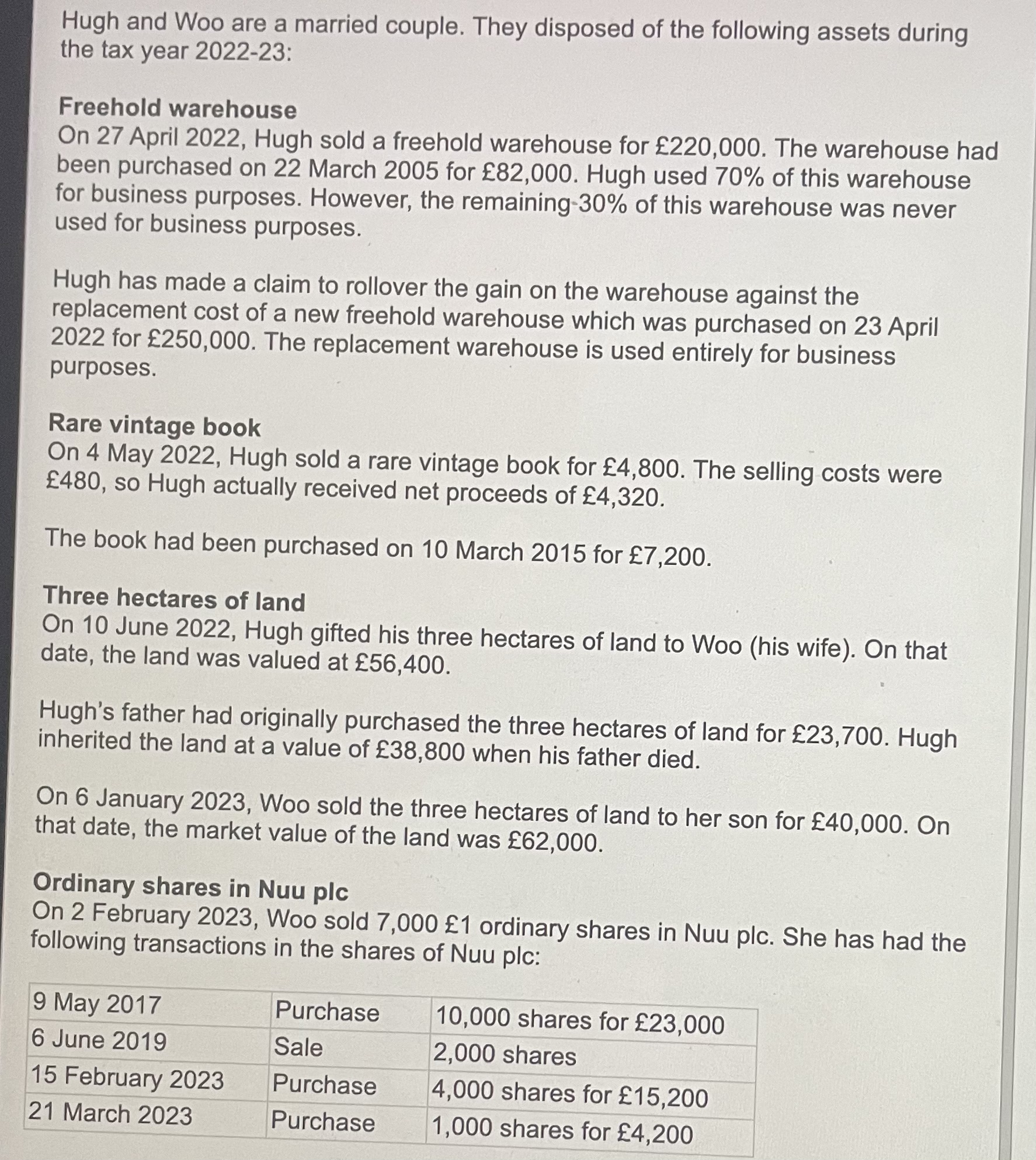

Hugh and Woo are a married couple. They disposed of the following assets during the tax year 2022-23: Freehold warehouse On 27 April 2022, Hugh sold a freehold warehouse for 220,000. The warehouse had been purchased on 22 March 2005 for 82,000. Hugh used 70% of this warehouse for business purposes. However, the remaining 30% of this warehouse was never used for business purposes. Hugh has made a claim to rollover the gain on the warehouse against the replacement cost of a new freehold warehouse which was purchased on 23 April 2022 for 250,000. The replacement warehouse is used entirely for business purposes. Rare vintage book On 4 May 2022, Hugh sold a rare vintage book for 4,800. The selling costs were 480, so Hugh actually received net proceeds of 4,320. The book had been purchased on 10 March 2015 for 7,200. Three hectares of land On 10 June 2022, Hugh gifted his three hectares of land to Woo (his wife). On that date, the land was valued at 56,400. Hugh's father had originally purchased the three hectares of land for 23,700. Hugh inherited the land at a value of 38,800 when his father died. On 6 January 2023, Woo sold the three hectares of land to her son for 40,000. On that date, the market value of the land was 62,000. Ordinary shares in Nuu plc On 2 February 2023 , Woo sold 7,000 11 ordinary shares in Nuu plc. She has had the following transactions in the shares of Nuu plc: What is Woo's chargeable gain in respect of the sale of the three hectares of land to her son? 23,200 1,200 38,300 5,600

Hugh and Woo are a married couple. They disposed of the following assets during the tax year 2022-23: Freehold warehouse On 27 April 2022, Hugh sold a freehold warehouse for 220,000. The warehouse had been purchased on 22 March 2005 for 82,000. Hugh used 70% of this warehouse for business purposes. However, the remaining 30% of this warehouse was never used for business purposes. Hugh has made a claim to rollover the gain on the warehouse against the replacement cost of a new freehold warehouse which was purchased on 23 April 2022 for 250,000. The replacement warehouse is used entirely for business purposes. Rare vintage book On 4 May 2022, Hugh sold a rare vintage book for 4,800. The selling costs were 480, so Hugh actually received net proceeds of 4,320. The book had been purchased on 10 March 2015 for 7,200. Three hectares of land On 10 June 2022, Hugh gifted his three hectares of land to Woo (his wife). On that date, the land was valued at 56,400. Hugh's father had originally purchased the three hectares of land for 23,700. Hugh inherited the land at a value of 38,800 when his father died. On 6 January 2023, Woo sold the three hectares of land to her son for 40,000. On that date, the market value of the land was 62,000. Ordinary shares in Nuu plc On 2 February 2023 , Woo sold 7,000 11 ordinary shares in Nuu plc. She has had the following transactions in the shares of Nuu plc: What is Woo's chargeable gain in respect of the sale of the three hectares of land to her son? 23,200 1,200 38,300 5,600 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started