Question

Hugh Health Product Corporation is considering purchasing a computer system to control plant packaging for a spectrum of health products. The following data have been

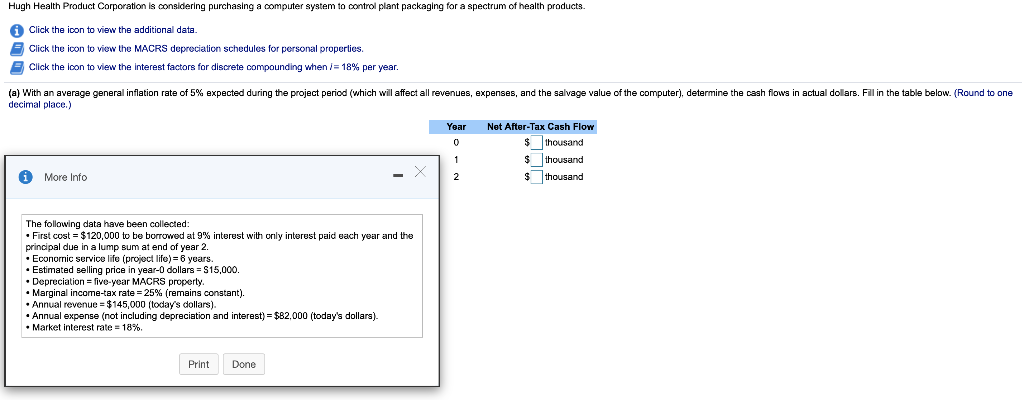

Hugh Health Product Corporation is considering purchasing a computer system to control plant packaging for a spectrum of health products.

The following data have been collected:

1)First cost = $120,000 to be borrowed at 9% interest with only interest paid each year and the principal due in a lump sum at end of year 2.

2)Economic service life (projectlife)equals=6 years.

3)Estimated selling price in year-0 dollars equals=$15,000

4)Depreciationequals=five-year MACRS property.

5)Marginal income-tax rate equals=25% (remains constant)

6)Annual revenueequals=$145,000 (today's dollars).

7) Annual expense (not including depreciation and interest)equals=$82,000 (today's dollars).

8) Market interest rate equals=18%.

(a) With an average general inflation rate of 5% expected during the project period (which will affect all revenues, expenses, and the salvage value of the computer), determine the cash flows in actual dollars. (Round to one decimal place.)

Hugh Health Product Corporation is considering purchasing a computer system to control plant packaging for a spectrum of health products. Click the icon to view the additional data. Click the icon to view the MACRS depreciation schedules for personal properties. Click the icon to view the interest factors for discrete compounding when /= 18% per year. (a) With an average general inflation rate of 5% expected during the project period (which will affect decimal place.) revenues, expenses, and the salvage value of the computer), determine the cash flows in actual dollars. Fill in the table below. (Round to one Year 0 Net After-Tax Cash Flow $ thousand $thousand $ thousand More Info The following data have been collected: First cost = $120,000 to be borrowed at 9% interest with only interest paid each year and the principal due in a lump sum at end of year 2. Economic service life (project life) = 8 years. Estimated selling price in year-0 dollars = $15,000. Depreciation = five-year MACRS property. Marginal income tax rate=25% (remains constant). Annual revenue = $145,000 (today's dollars). Annual expense (not including depreciation and interest) = $82,000 (today's dollars). Market interest rate = 18%. Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started