Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hugret Ltd is a company operating in the hotel industry and it owns two hotels, both operating as separate investment centre. The financial information

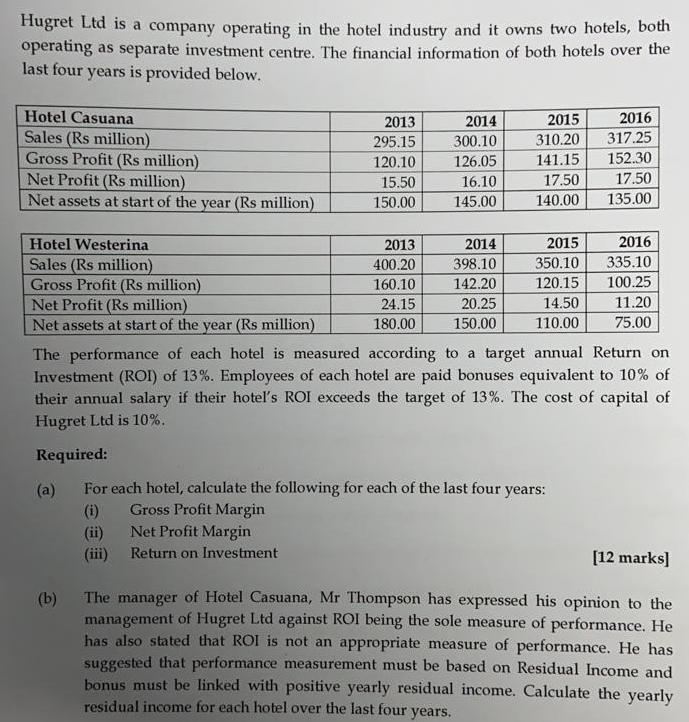

Hugret Ltd is a company operating in the hotel industry and it owns two hotels, both operating as separate investment centre. The financial information of both hotels over the last four years is provided below. Hotel Casuana 2013 2014 2015 2016 Sales (Rs million) Gross Profit (Rs million) Net Profit (Rs million) Net assets at start of the year (Rs million) 295.15 300.10 310.20 317.25 120.10 126.05 141.15 152.30 15.50 16.10 17.50 17.50 150.00 145.00 140.00 135.00 Hotel Westerina 2013 2014 2015 2016 Sales (Rs million) Gross Profit (Rs million) Net Profit (Rs million) Net assets at start of the year (Rs million) 400.20 398.10 350.10 335.10 160.10 142.20 120.15 100.25 24.15 20.25 14.50 11.20 180.00 150.00 110.00 75.00 The performance of each hotel is measured according to a target annual Return on Investment (ROI) of 13%. Employees of each hotel are paid bonuses equivalent to 10% of their annual salary if their hote's ROI exceeds the target of 13%. The cost of capital of Hugret Ltd is 10%. Required: For each hotel, calculate the following for each of the last four years: Gross Profit Margin Net Profit Margin (a) (i) (ii) (ii) Return on Investment [12 marks] The manager of Hotel Casuana, Mr Thompson has expressed his opinion to the (b) management of Hugret Ltd against ROI being the sole measure of performance. He has also stated that ROI is not an appropriate measure of performance. He has suggested that performance measurement must be based on Residual Income and bonus must be linked with positive yearly residual income. Calculate the yearly residual income for each hotel over the last four years,

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 CALCULATION OF GROSS MARGIN NET PROFIT MARGIN AND ROI FOR HOTELS A HOTEL CASUANA PARTICULARS 2013 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e044db2e17_180764.pdf

180 KBs PDF File

635e044db2e17_180764.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started