Answered step by step

Verified Expert Solution

Question

1 Approved Answer

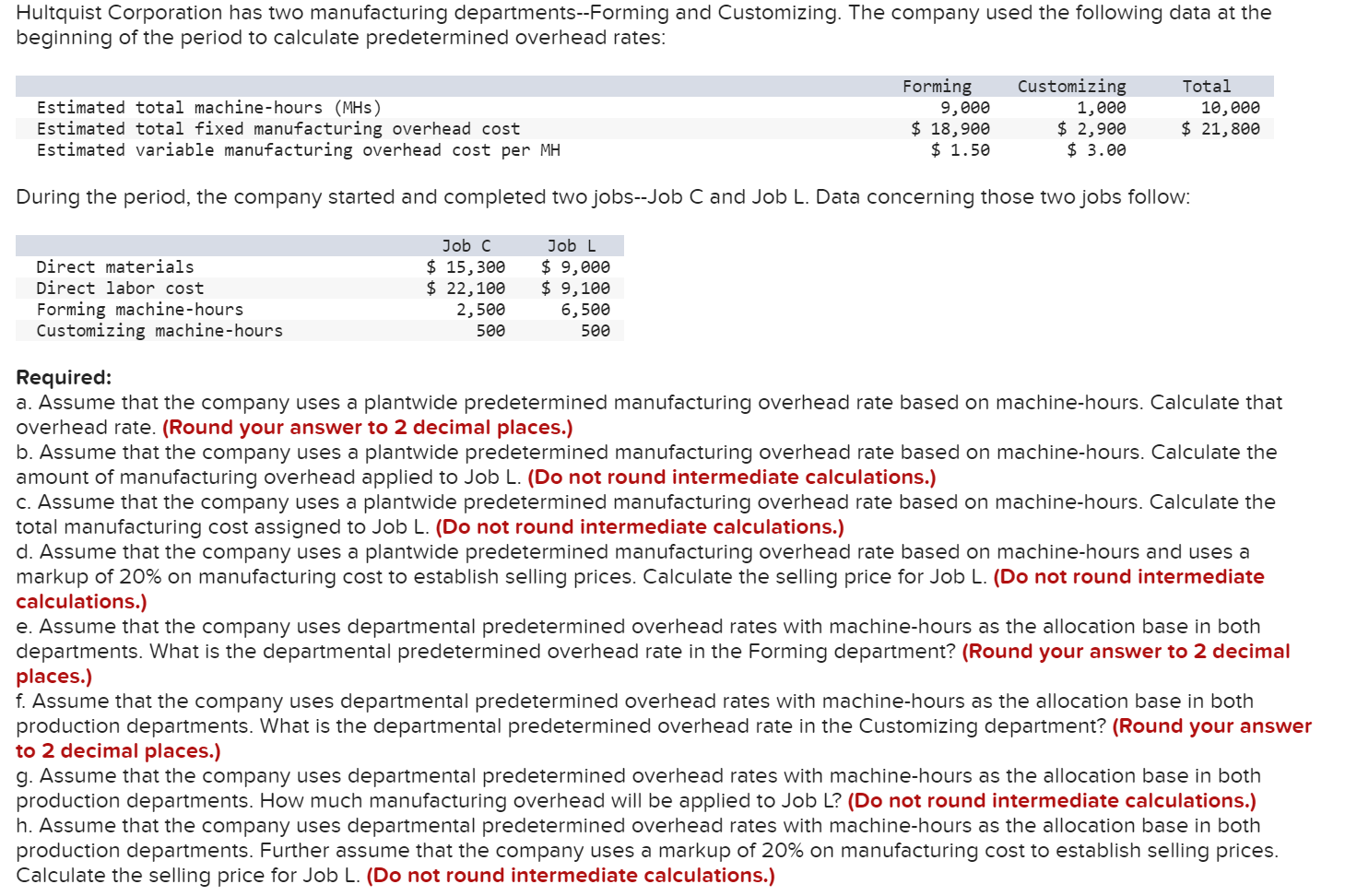

Hultquist Corporation has two manufacturing departments--Forming and Customizing. The company used the following data at the beginning of the period to calculate predetermined overhead

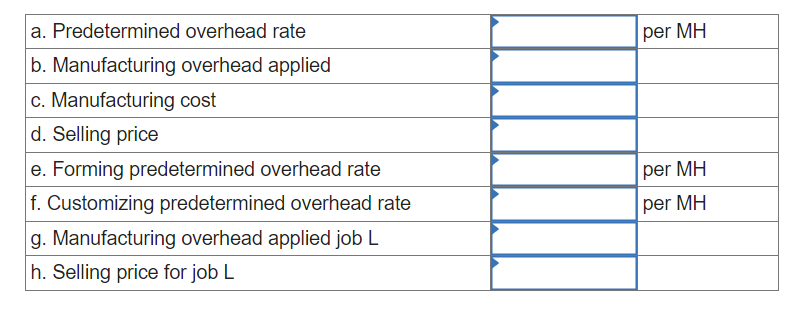

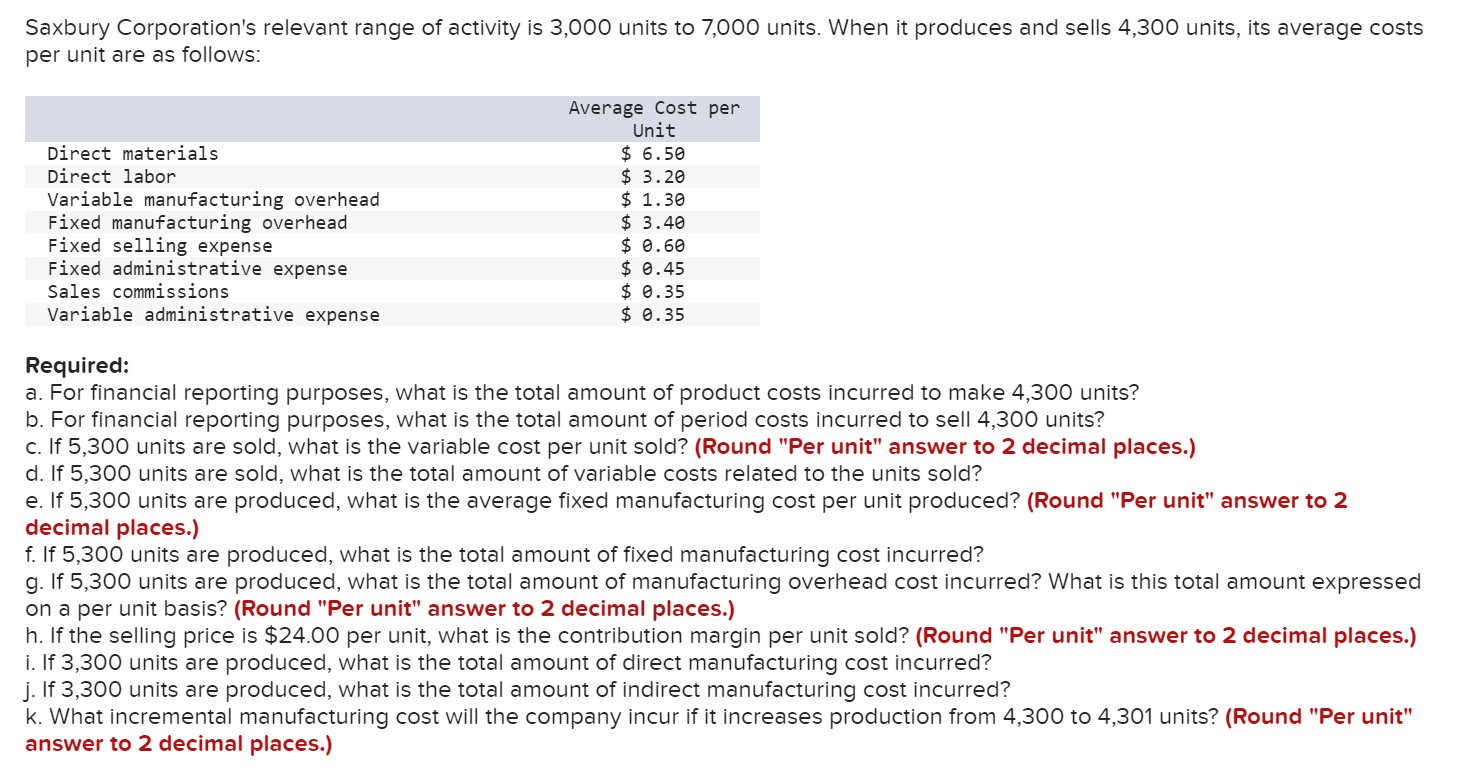

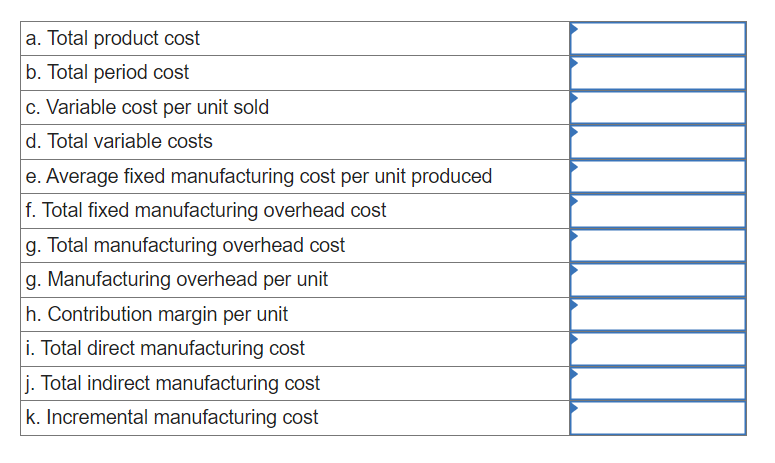

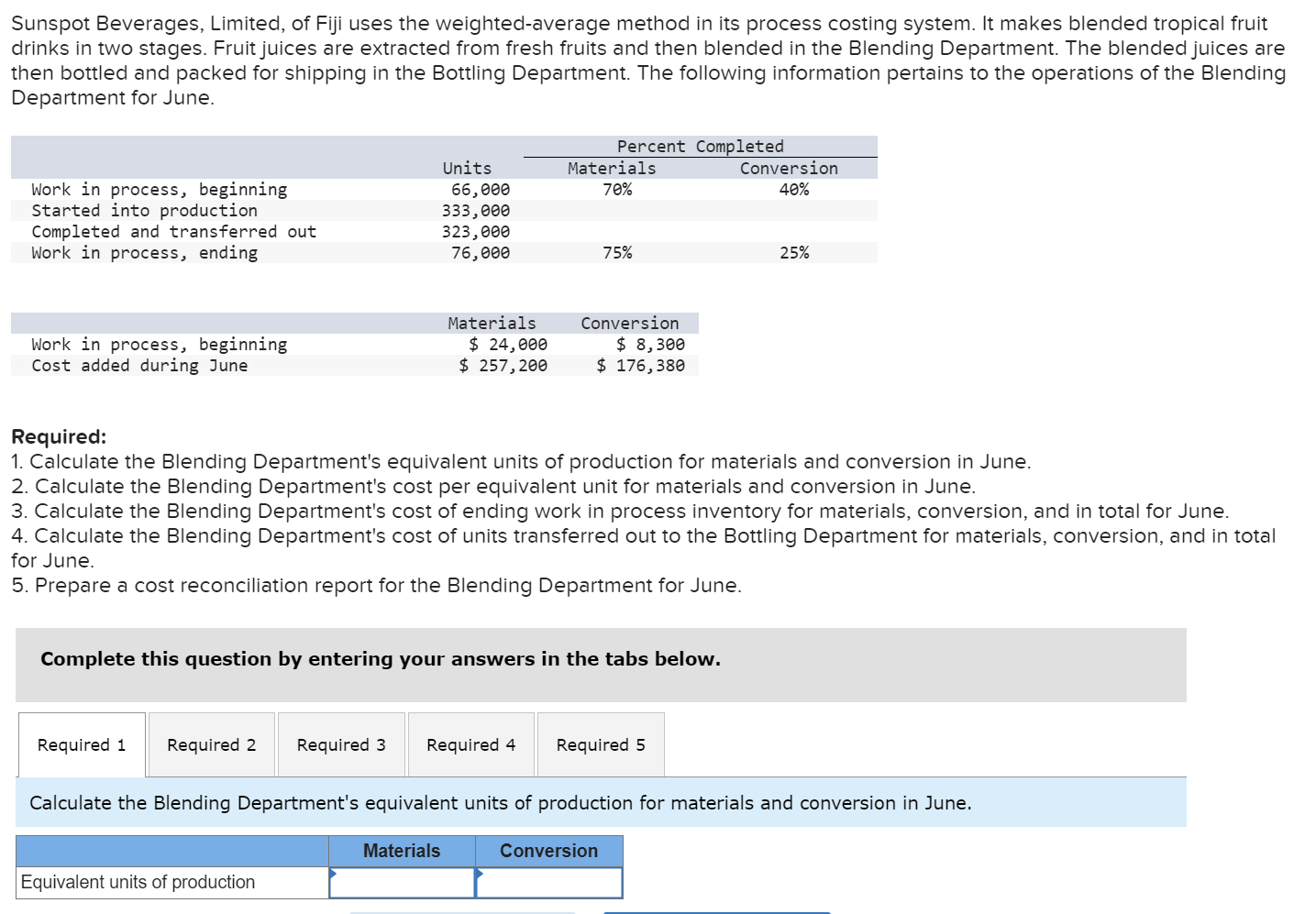

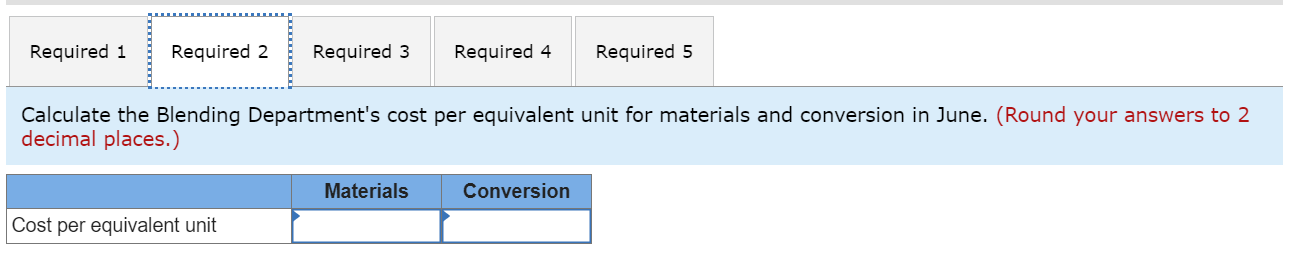

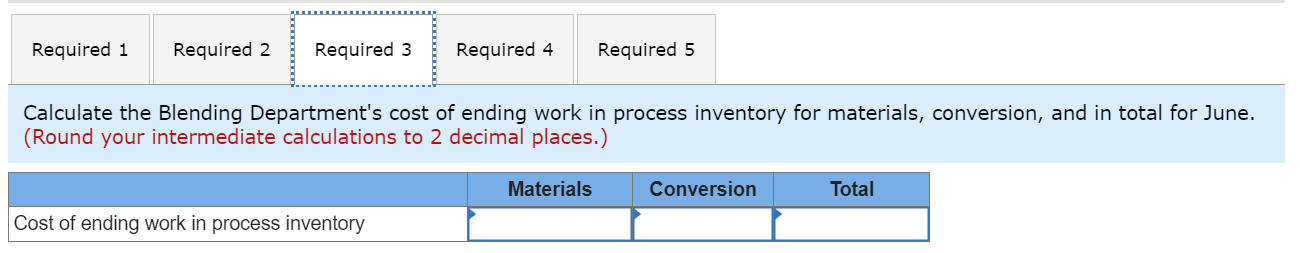

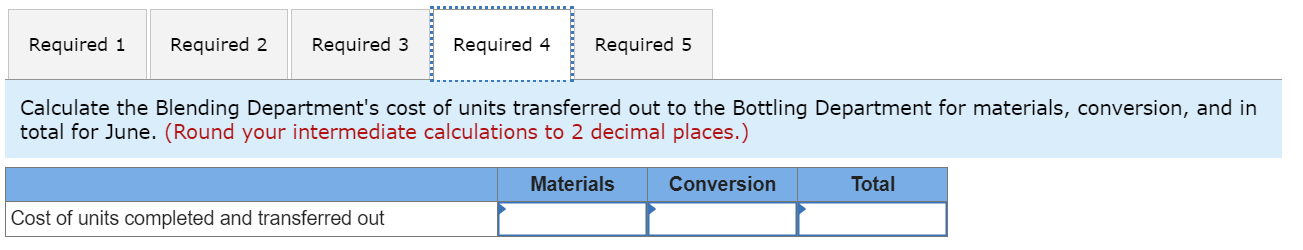

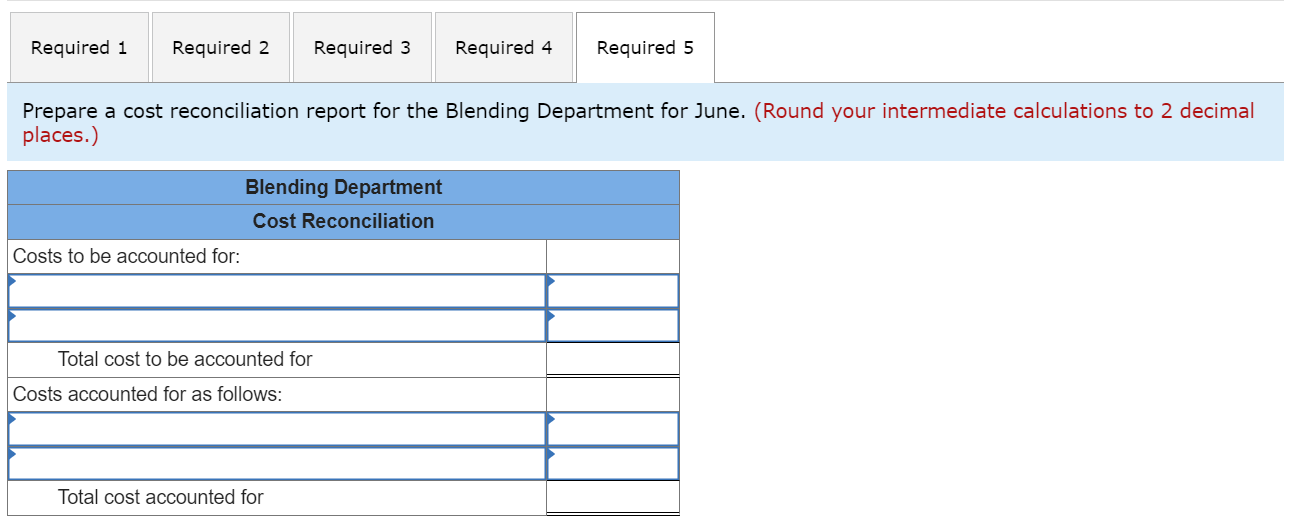

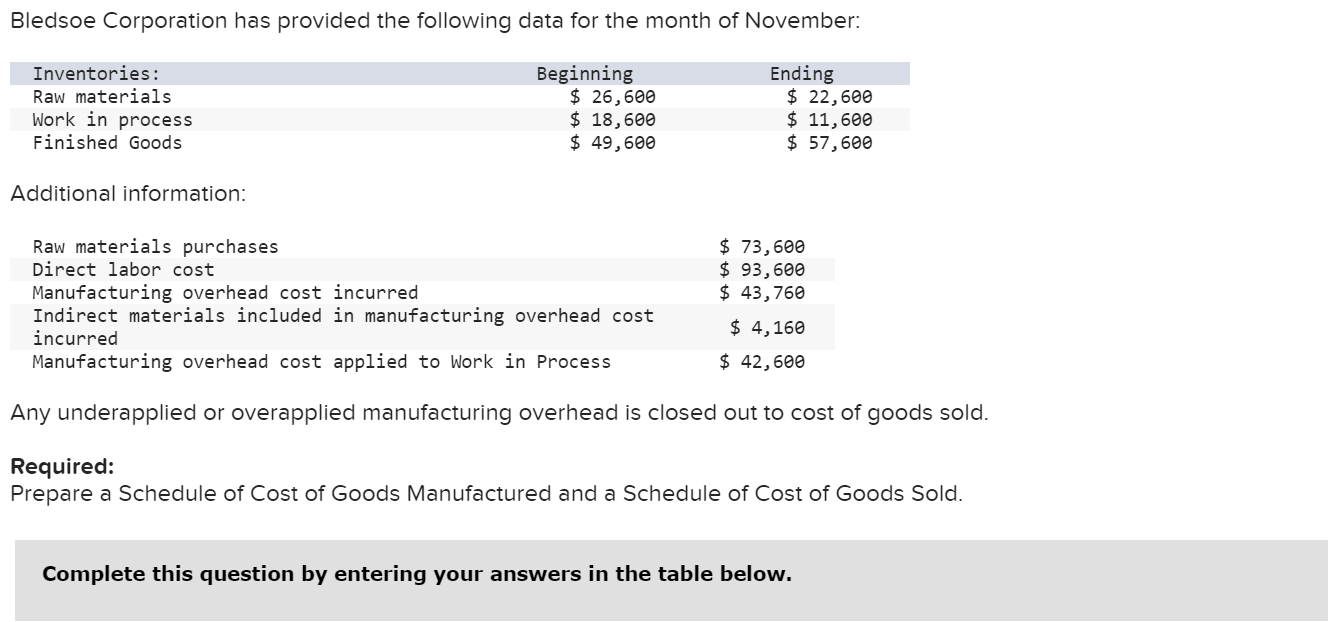

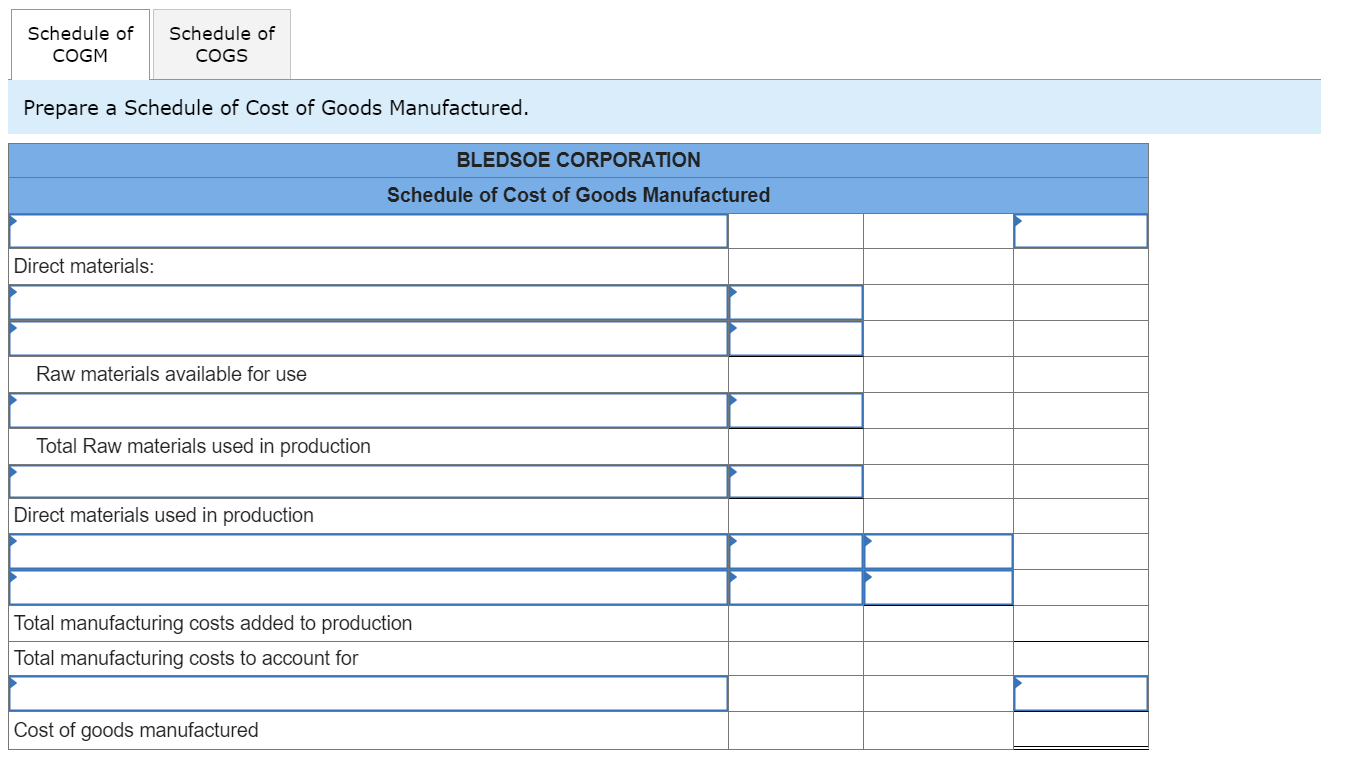

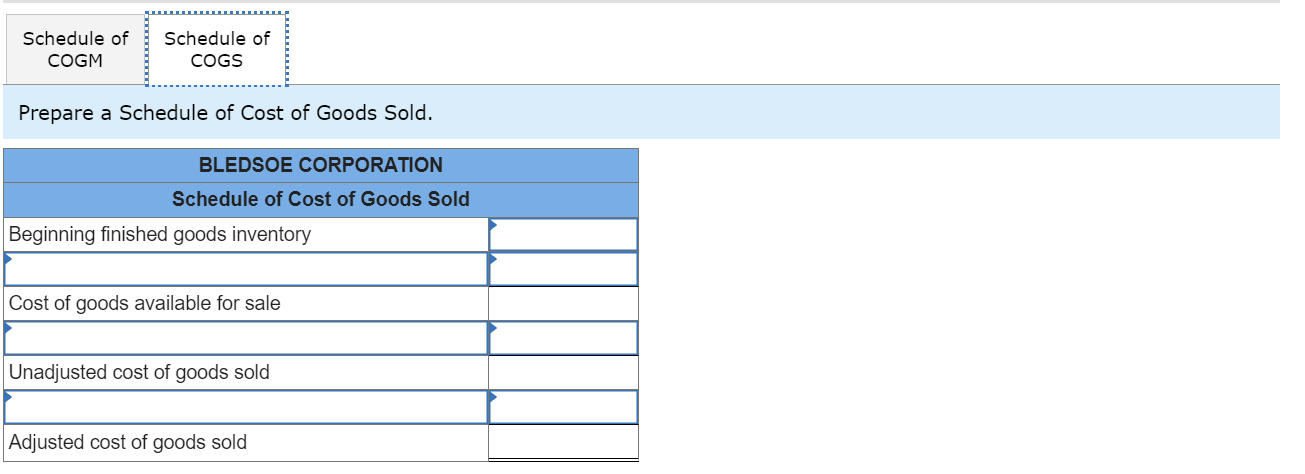

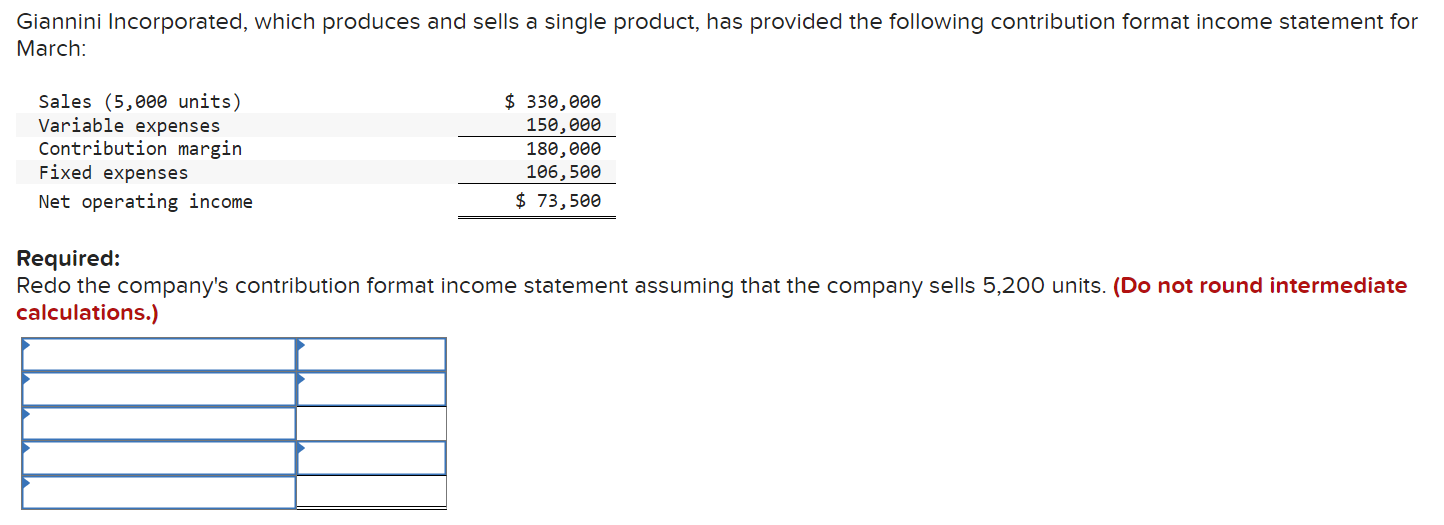

Hultquist Corporation has two manufacturing departments--Forming and Customizing. The company used the following data at the beginning of the period to calculate predetermined overhead rates: Estimated total machine-hours (MHS) Estimated total fixed manufacturing overhead cost Estimated variable manufacturing overhead cost per MH Forming Customizing 9,000 $ 18,900 $ 1.50 1,000 $ 2,900 $ 3.00 Total 10,000 $ 21,800 During the period, the company started and completed two jobs--Job C and Job L. Data concerning those two jobs follow: Direct materials Direct labor cost Forming machine-hours Customizing machine-hours Required: Job C $ 15,300 Job L $ 9,000 $ 22,100 2,500 500 $ 9,100 6,500 500 a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that overhead rate. (Round your answer to 2 decimal places.) b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job L. (Do not round intermediate calculations.) c. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the total manufacturing cost assigned to Job L. (Do not round intermediate calculations.) d. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 20% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.) e. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. What is the departmental predetermined overhead rate in the Forming department? (Round your answer to 2 decimal places.) f. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. What is the departmental predetermined overhead rate in the Customizing department? (Round your answer to 2 decimal places.) g. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job L? (Do not round intermediate calculations.) h. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 20% on manufacturing cost to establish selling prices. Calculate the selling price for Job L. (Do not round intermediate calculations.) a. Predetermined overhead rate b. Manufacturing overhead applied c. Manufacturing cost d. Selling price e. Forming predetermined overhead rate f. Customizing predetermined overhead rate g. Manufacturing overhead applied job L h. Selling price for job L per MH per MH per MH Saxbury Corporation's relevant range of activity is 3,000 units to 7,000 units. When it produces and sells 4,300 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 6.50 Direct labor $ 3.20 Variable manufacturing overhead $ 1.30 Fixed manufacturing overhead $ 3.40 Fixed selling expense $ 0.60 Fixed administrative expense $ 0.45 $ 0.35 $ 0.35 Sales commissions Variable administrative expense Required: a. For financial reporting purposes, what is the total amount of product costs incurred to make 4,300 units? b. For financial reporting purposes, what is the total amount of period costs incurred to sell 4,300 units? c. If 5,300 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.) d. If 5,300 units are sold, what is the total amount of variable costs related to the units sold? e. If 5,300 units are produced, what is the average fixed manufacturing cost per unit produced? (Round "Per unit" answer to 2 decimal places.) f. If 5,300 units are produced, what is the total amount of fixed manufacturing cost incurred? g. If 5,300 units are produced, what is the total amount of manufacturing overhead cost incurred? What is this total amount expressed on a per unit basis? (Round "Per unit" answer to 2 decimal places.) h. If the selling price is $24.00 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.) I. If 3,300 units are produced, what is the total amount of direct manufacturing cost incurred? j. If 3,300 units are produced, what is the total amount of indirect manufacturing cost incurred? k. What incremental manufacturing cost will the company incur if it increases production from 4,300 to 4,301 units? (Round "Per unit" answer to 2 decimal places.) a. Total product cost b. Total period cost c. Variable cost per unit sold d. Total variable costs e. Average fixed manufacturing cost per unit produced f. Total fixed manufacturing overhead cost g. Total manufacturing overhead cost g. Manufacturing overhead per unit h. Contribution margin per unit i. Total direct manufacturing cost j. Total indirect manufacturing cost k. Incremental manufacturing cost Sunspot Beverages, Limited, of Fiji uses the weighted-average method in its process costing system. It makes blended tropical fruit drinks in two stages. Fruit juices are extracted from fresh fruits and then blended in the Blending Department. The blended juices are then bottled and packed for shipping in the Bottling Department. The following information pertains to the operations of the Blending Department for June. Percent Completed Work in process, beginning Started into production Units 66,000 Materials Conversion 70% 40% 333,000 Completed and transferred out 323,000 Work in process, ending 76,000 75% 25% Work in process, beginning Materials $ 24,000 Conversion $ 8,300 Cost added during June $ 257,200 $ 176,380 Required: 1. Calculate the Blending Department's equivalent units of production for materials and conversion in June. 2. Calculate the Blending Department's cost per equivalent unit for materials and conversion in June. 3. Calculate the Blending Department's cost of ending work in process inventory for materials, conversion, and in total for June. 4. Calculate the Blending Department's cost of units transferred out to the Bottling Department for materials, conversion, and in total for June. 5. Prepare a cost reconciliation report for the Blending Department for June. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Calculate the Blending Department's equivalent units of production for materials and conversion in June. Equivalent units of production Materials Conversion Required 1 Required 2 Required 3 Required 4 Required 5 Calculate the Blending Department's cost per equivalent unit for materials and conversion in June. (Round your answers to 2 decimal places.) Materials Conversion Cost per equivalent unit Required 1 Required 2 Required 3 Required 4 Required 5 Calculate the Blending Department's cost of ending work in process inventory for materials, conversion, and in total for June. (Round your intermediate calculations to 2 decimal places.) Cost of ending work in process inventory Materials Conversion Total Required 1 Required 2 Required 3 Required 4 Required 5 Calculate the Blending Department's cost of units transferred out to the Bottling Department for materials, conversion, and in total for June. (Round your intermediate calculations to 2 decimal places.) Cost of units completed and transferred out Materials Conversion Total Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a cost reconciliation report for the Blending Department for June. (Round your intermediate calculations to 2 decimal places.) Costs to be accounted for: Blending Department Cost Reconciliation Total cost to be accounted for Costs accounted for as follows: Total cost accounted for Bledsoe Corporation has provided the following data for the month of November: Inventories: Raw materials Work in process Beginning Ending $ 26,600 $ 22,600 $ 18,600 $ 11,600 $ 49,600 $ 57,600 Finished Goods Additional information: Raw materials purchases Direct labor cost Manufacturing overhead cost incurred Indirect materials included in manufacturing overhead cost incurred Manufacturing overhead cost applied to Work in Process $ 73,600 $ 93,600 $ 43,760 $ 4,160 $ 42,600 Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold. Required: Prepare a Schedule of Cost of Goods Manufactured and a Schedule of Cost of Goods Sold. Complete this question by entering your answers in the table below. Schedule of Schedule of COGM COGS Prepare a Schedule of Cost of Goods Manufactured. BLEDSOE CORPORATION Schedule of Cost of Goods Manufactured Direct materials: Raw materials available for use Total Raw materials used in production Direct materials used in production Total manufacturing costs added to production Total manufacturing costs to account for Cost of goods manufactured Schedule of Schedule of COGM COGS Prepare a Schedule of Cost of Goods Sold. BLEDSOE CORPORATION Schedule of Cost of Goods Sold Beginning finished goods inventory Cost of goods available for sale Unadjusted cost of goods sold Adjusted cost of goods sold Giannini Incorporated, which produces and sells a single product, has provided the following contribution format income statement for March: Sales (5,000 units) Variable expenses Contribution margin Fixed expenses $ 330,000 150,000 180,000 106,500 Net operating income Required: $ 73,500 Redo the company's contribution format income statement assuming that the company sells 5,200 units. (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started