Human Resource Management

Application Question 5 a.b.c

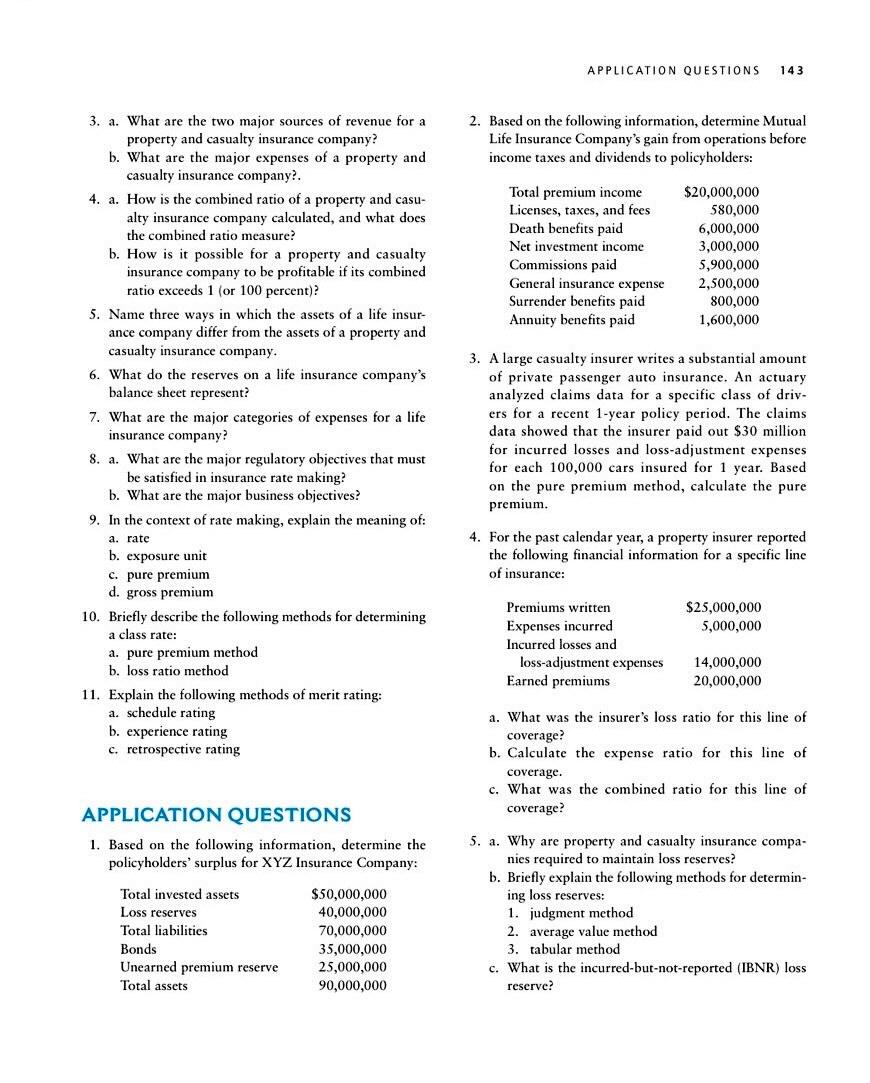

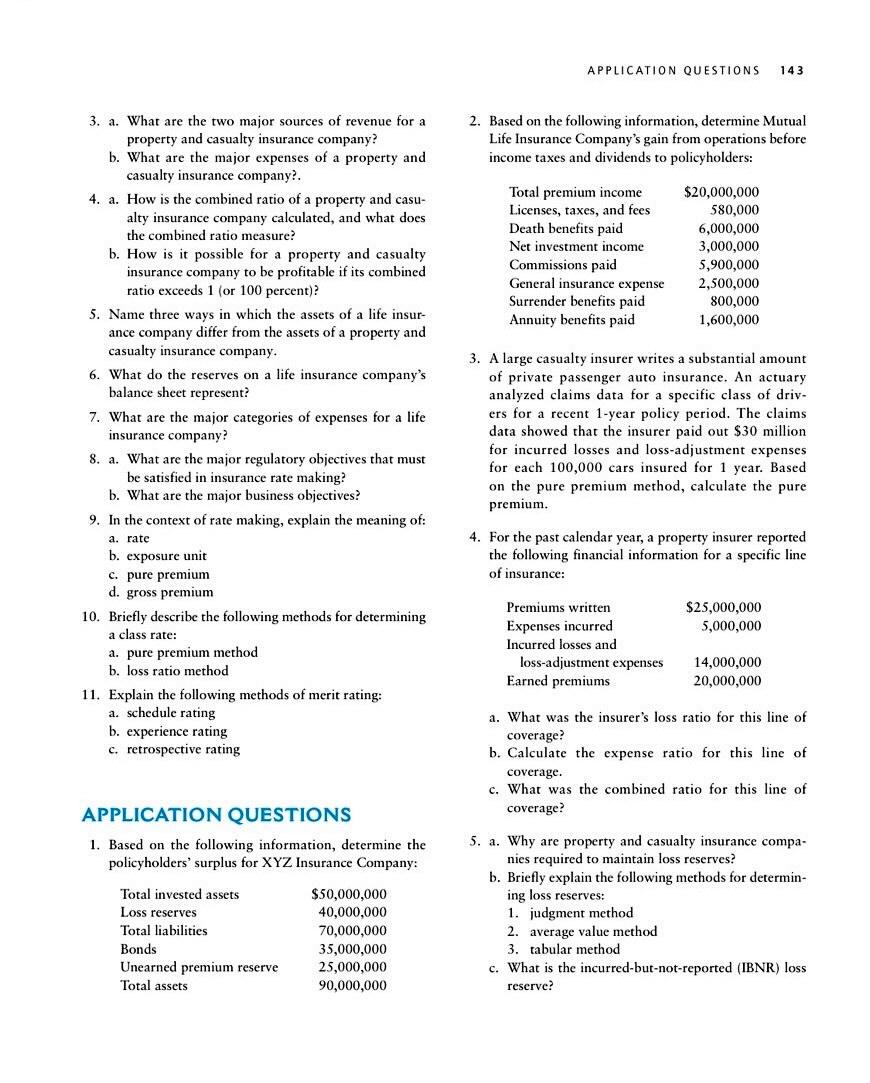

APPLICATION QUESTIONS 143 2. Based on the following information, determine Mutual Life Insurance Company's gain from operations before income taxes and dividends to policyholders: Total premium income Licenses, taxes, and fees Death benefits paid Ner investment income Commissions paid General insurance expense Surrender benefits paid Annuity benefits paid $20,000,000 580,000 6,000,000 3,000,000 5,900,000 2,500,000 800,000 1,600,000 3. a. What are the two major sources of revenue for a property and casualty insurance company? b. What are the major expenses of a property and casualty insurance company?. 4. a. How is the combined ratio of a property and casu- alty insurance company calculated, and what does the combined ratio measure? b. How is it possible for a property and casualty insurance company to be profitable if its combined ratio exceeds 1 (or 100 percent)? 5. Name three ways in which the assets of a life insur- ance company differ from the assets of a property and casualty insurance company. 6. What do the reserves on a life insurance company's balance sheet represent? 7. What are the major categories of expenses for a life insurance company? 8. a. What are the major regulatory objectives that must be satisfied in insurance rate making? b. What are the major business objectives? 9. In the context of rate making, explain the meaning of: a. rate b. exposure unit c. pure premium d. gross premium 10. Briefly describe the following methods for determining a class rate: a. pure premium method b. loss ratio method 11. Explain the following methods of merit rating: a. schedule rating b. experience rating c. retrospective rating 3. A large casualty insurer writes a substantial amount of private passenger auto insurance. An actuary analyzed claims data for a specific class of driv- ers for recent 1-year policy period. The claims data showed that the insurer paid out $30 million for incurred losses and loss-adjustment expenses for each 100,000 cars insured for 1 year. Based on the pure premium method, calculate the pure premium. 4. For the past calendar year, a property insurer reported the following financial information for a specific line of insurance: $25,000,000 5,000,000 Premiums written Expenses incurred Incurred losses and loss-adjustment expenses Earned premiums 14,000,000 20,000,000 a. What was the insurer's loss ratio for this line of coverage? b. Calculate the expense ratio for this line of coverage. c. What was the combined ratio for this line of coverage? APPLICATION QUESTIONS 1. Based on the following information, determine the policyholders' surplus for XYZ Insurance Company: Total invested assets Loss reserves Total liabilities Bonds Unearned premium reserve Total assets $50,000,000 40,000,000 70,000,000 35,000,000 25,000,000 90,000,000 5. a. Why are property and casualty insurance compa- nies required to maintain loss reserves? b. Briefly explain the following methods for determin- ing loss reserves: 1. judgment method 2. average value method 3. tabular method c. What is the incurred-but-not-reported (IBNR) loss reserve