Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hunt Chemicals is preparing a cash budget for June and July 2023. At the end of July 2023, the company has undertaken to repay

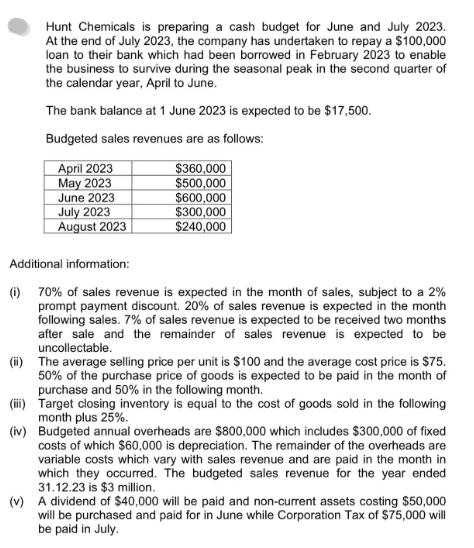

Hunt Chemicals is preparing a cash budget for June and July 2023. At the end of July 2023, the company has undertaken to repay a $100,000 loan to their bank which had been borrowed in February 2023 to enable the business to survive during the seasonal peak in the second quarter of the calendar year, April to June. The bank balance at 1 June 2023 is expected to be $17,500. Budgeted sales revenues are as follows: April 2023 $360,000 May 2023 $500,000 June 2023 $600,000 July 2023 $300,000 August 2023 $240,000 Additional information: (i) 70% of sales revenue is expected in the month of sales, subject to a 2% prompt payment discount. 20% of sales revenue is expected in the month following sales. 7% of sales revenue is expected to be received two months after sale and the remainder of sales revenue is expected to be uncollectable. (ii) The average selling price per unit is $100 and the average cost price is $75. 50% of the purchase price of goods is expected to be paid in the month of purchase and 50% in the following month. (iii) Target closing inventory is equal to the cost of goods sold in the following month plus 25%. (iv) Budgeted annual overheads are $800,000 which includes $300,000 of fixed costs of which $60,000 is depreciation. The remainder of the overheads are variable costs which vary with sales revenue and are paid in the month in which they occurred. The budgeted sales revenue for the year ended 31.12.23 is $3 million. (v) A dividend of $40,000 will be paid and non-current assets costing $50,000 will be purchased and paid for in June while Corporation Tax of $75,000 will be paid in July. Produce a cash budget for each of the months June and July 2023, in columnar form. (15 marks) Present a brief report to the directors of Hunt Chemicals, advising them on steps which could be taken to improve the cash position of the business and how they could seek to avoid a cash crisis when the next seasonal peak arises in April to June 2024.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started