hurry please

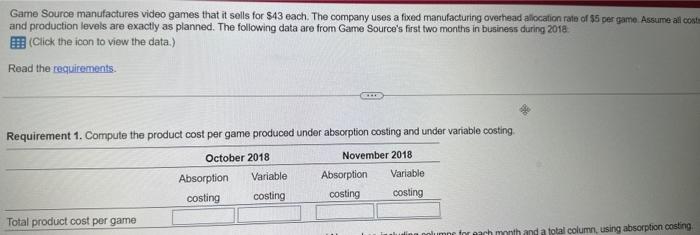

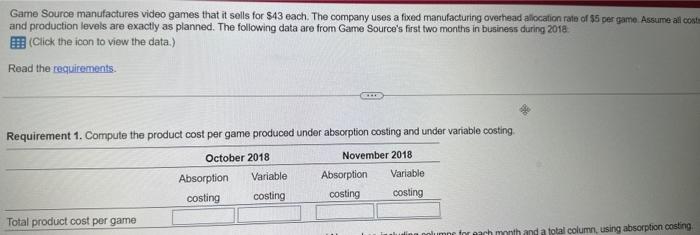

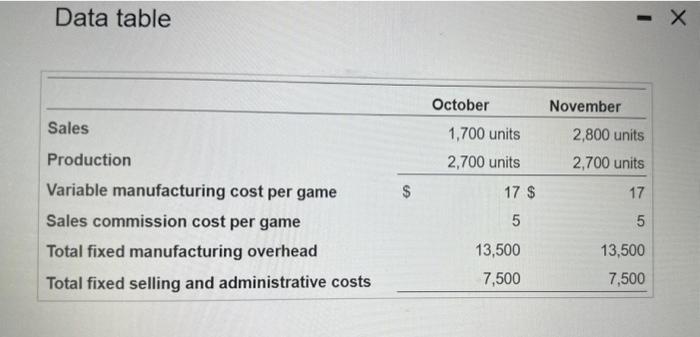

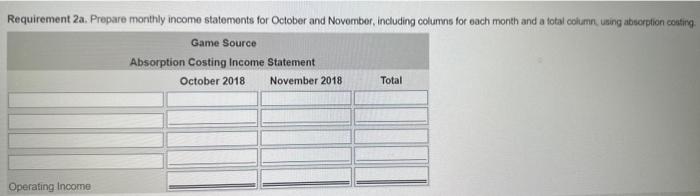

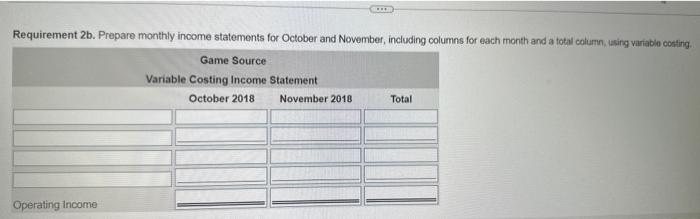

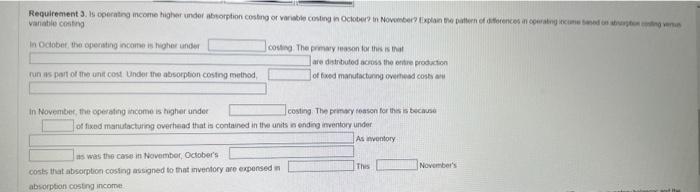

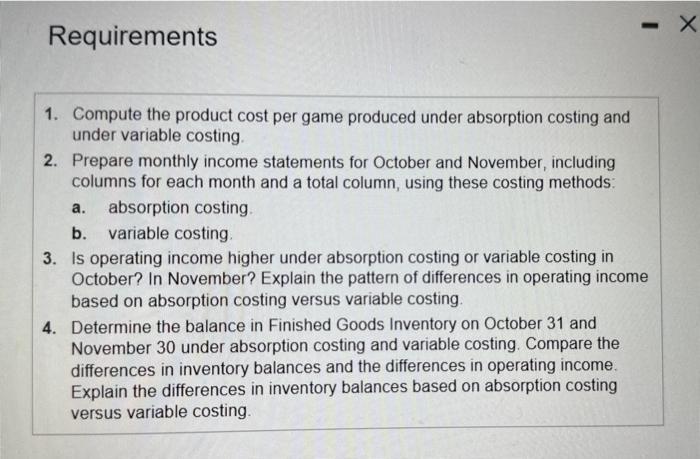

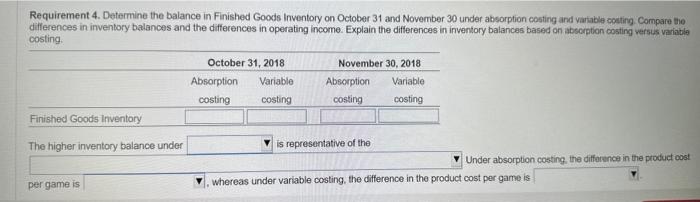

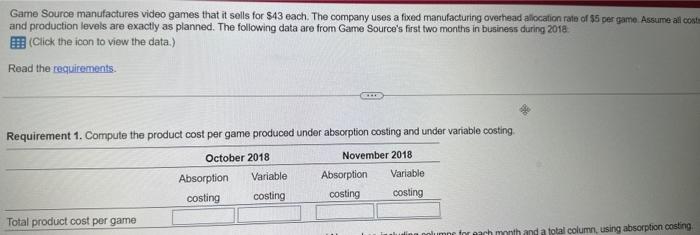

Game Source manufactures video games that it sells for $43 each. The company uses a fixed manufacturing overhead aliocalion rate of \$5 per game Assume ati cost and production levels are exactly as planned. The following data are from Game Source's first two months in business during 201 a (Click the icon to view the data.) Read the reguirements. Requirement 1. Compute the product cost per game produced under absorption costing and under variable costing Data table Requirement 2a. Prepare monthly income statements for October and Novomber, including columns for each month and a fotal column using absorption costing Game Source Absorption Costing Income Statement October 2018 November 2018 Total Requirement 2b. Prepare monthly income statements for October and November, including columns for each month and a total colurrn, using variable costing qanatle consing In Gciobet, the operiting incame is higher under cosing: The prmary ieasen tor the is that lare datribuled across the eritre producton nun is part of the ant cost undor the absorpboin costing method. of foed mansitacturing ovelinesd costs au In Novembet, the cperating income is higher under costing The promyy teasen for the is tevcause of fixed manutacturing overhead that is contained in the units a endirg mventory under: costs that absorption costing assigned to that inventory are expensed an the November's Requirements 1. Compute the product cost per game produced under absorption costing and under variable costing. 2. Prepare monthly income statements for October and November, including columns for each month and a total column, using these costing methods: a. absorption costing. b. variable costing. 3. Is operating income higher under absorption costing or variable costing in October? In November? Explain the pattern of differences in operating income based on absorption costing versus variable costing. 4. Determine the balance in Finished Goods Inventory on October 31 and November 30 under absorption costing and variable costing. Compare the differences in inventory balances and the differences in operating income. Explain the differences in inventory balances based on absorption costing versus variable costing. Requirement 4. Determine the balance in Finished Goods Inventory on October 31 and November 30 under absorption costing and variable costing. Compare the differences in inventory balances and the differences in operating income. Explain the differences in inventory balances based on abserption costing versus variable costing The higher inventory balance under is representative of the Under absorption costing the diffatence in the product cost per game is Whereas under variable costing, the difference in the product cost per game is Game Source manufactures video games that it sells for $43 each. The company uses a fixed manufacturing overhead aliocalion rate of \$5 per game Assume ati cost and production levels are exactly as planned. The following data are from Game Source's first two months in business during 201 a (Click the icon to view the data.) Read the reguirements. Requirement 1. Compute the product cost per game produced under absorption costing and under variable costing Data table Requirement 2a. Prepare monthly income statements for October and Novomber, including columns for each month and a fotal column using absorption costing Game Source Absorption Costing Income Statement October 2018 November 2018 Total Requirement 2b. Prepare monthly income statements for October and November, including columns for each month and a total colurrn, using variable costing qanatle consing In Gciobet, the operiting incame is higher under cosing: The prmary ieasen tor the is that lare datribuled across the eritre producton nun is part of the ant cost undor the absorpboin costing method. of foed mansitacturing ovelinesd costs au In Novembet, the cperating income is higher under costing The promyy teasen for the is tevcause of fixed manutacturing overhead that is contained in the units a endirg mventory under: costs that absorption costing assigned to that inventory are expensed an the November's Requirements 1. Compute the product cost per game produced under absorption costing and under variable costing. 2. Prepare monthly income statements for October and November, including columns for each month and a total column, using these costing methods: a. absorption costing. b. variable costing. 3. Is operating income higher under absorption costing or variable costing in October? In November? Explain the pattern of differences in operating income based on absorption costing versus variable costing. 4. Determine the balance in Finished Goods Inventory on October 31 and November 30 under absorption costing and variable costing. Compare the differences in inventory balances and the differences in operating income. Explain the differences in inventory balances based on absorption costing versus variable costing. Requirement 4. Determine the balance in Finished Goods Inventory on October 31 and November 30 under absorption costing and variable costing. Compare the differences in inventory balances and the differences in operating income. Explain the differences in inventory balances based on abserption costing versus variable costing The higher inventory balance under is representative of the Under absorption costing the diffatence in the product cost per game is Whereas under variable costing, the difference in the product cost per game is