Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hurry plz Apple Inc., a cell-phone manufacturer, is an all-equity firm. At the end of the current year, the CFO expects EBIT to be $100

hurry plz

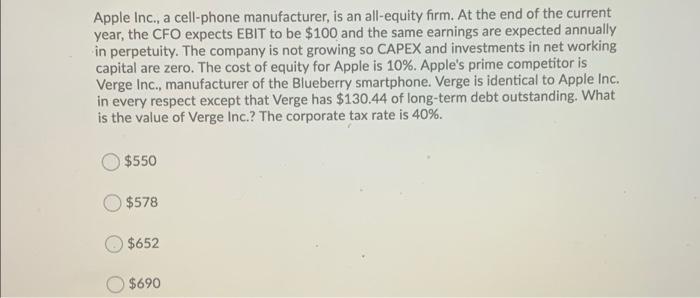

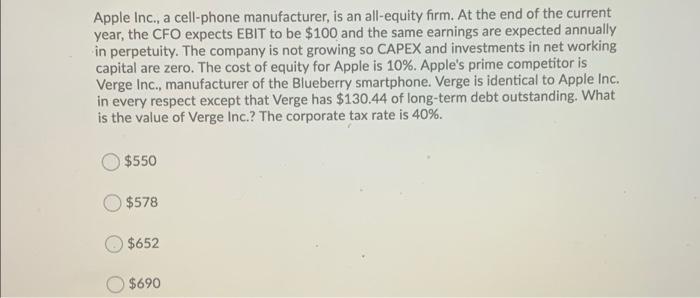

Apple Inc., a cell-phone manufacturer, is an all-equity firm. At the end of the current year, the CFO expects EBIT to be $100 and the same earnings are expected annually in perpetuity. The company is not growing so CAPEX and investments in net working capital are zero. The cost of equity for Apple is 10%. Apple's prime competitor is Verge Inc., manufacturer of the Blueberry smartphone. Verge is identical to Apple Inc. in every respect except that Verge has $130,44 of long-term debt outstanding. What is the value of Verge Inc.? The corporate tax rate is 40%. $550 $578 $652 $690

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started