Answered step by step

Verified Expert Solution

Question

1 Approved Answer

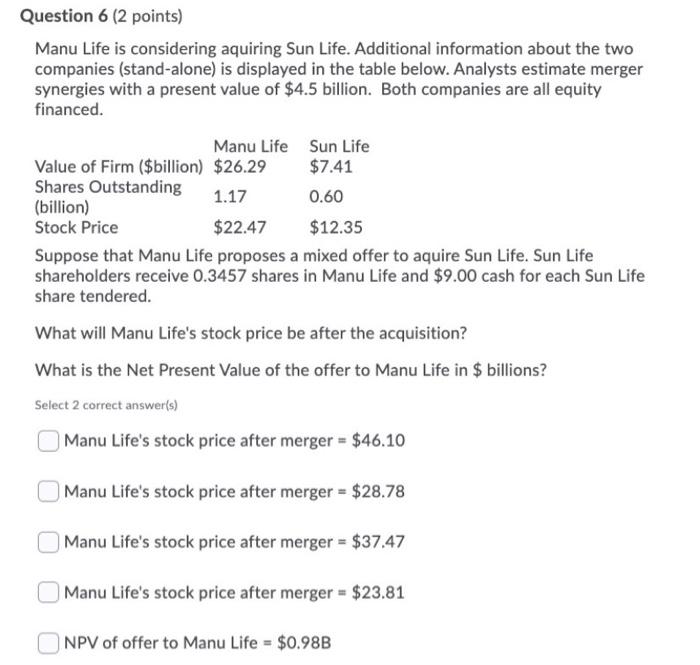

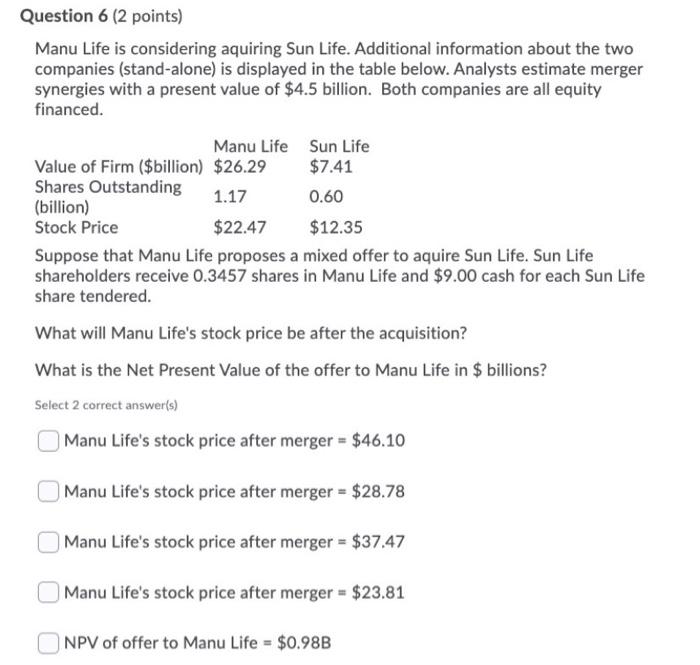

hurry plz Question 6 (2 points) Manu Life is considering aquiring Sun Life. Additional information about the two companies (stand-alone) is displayed in the table

hurry plz

Question 6 (2 points) Manu Life is considering aquiring Sun Life. Additional information about the two companies (stand-alone) is displayed in the table below. Analysts estimate merger synergies with a present value of $4.5 billion. Both companies are all equity financed. Manu Life Sun Life Value of Firm ($billion) $26.29 $7.41 Shares Outstanding 1.17 0.60 (billion) Stock Price $22.47 $12.35 Suppose that Manu Life proposes a mixed offer to aquire Sun Life. Sun Life shareholders receive 0.3457 shares in Manu Life and $9.00 cash for each Sun Life share tendered. What will Manu Life's stock price be after the acquisition? What is the Net Present Value of the offer to Manu Life in $ billions? Select 2 correct answer(s) | Manu Life's stock price after merger = $46.10 Manu Life's stock price after merger = $28.78 Manu Life's stock price after merger = $37.47 Manu Life's stock price after merger = $23.81 NPV of offer to Manu Life = $0.98B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started