HURRY!!!

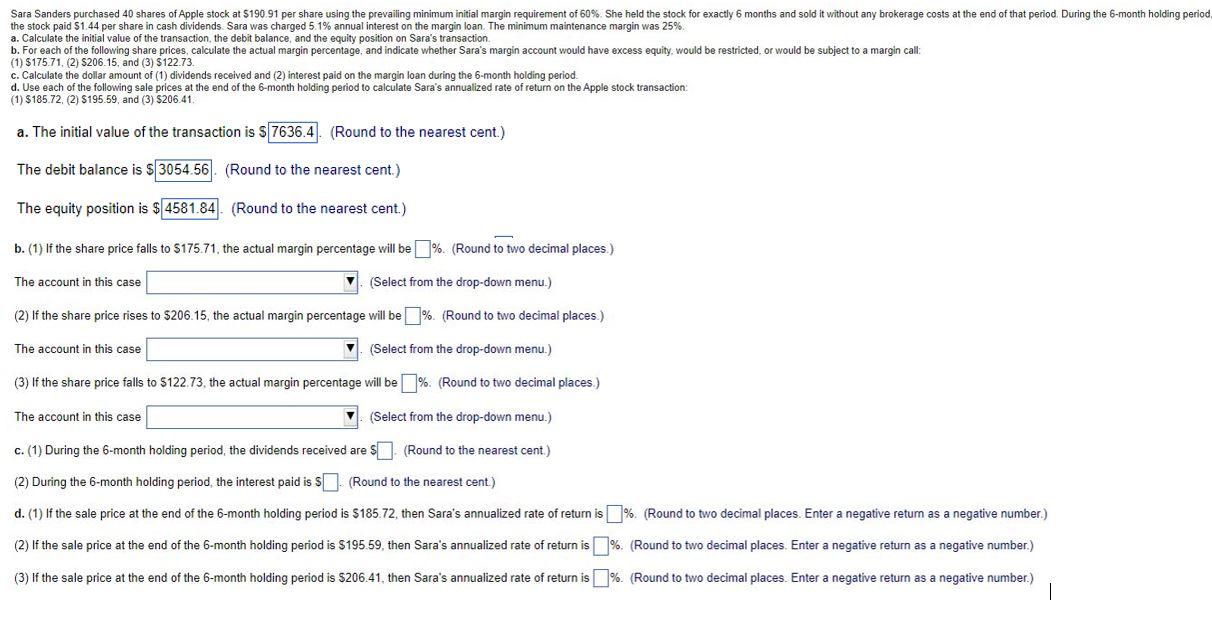

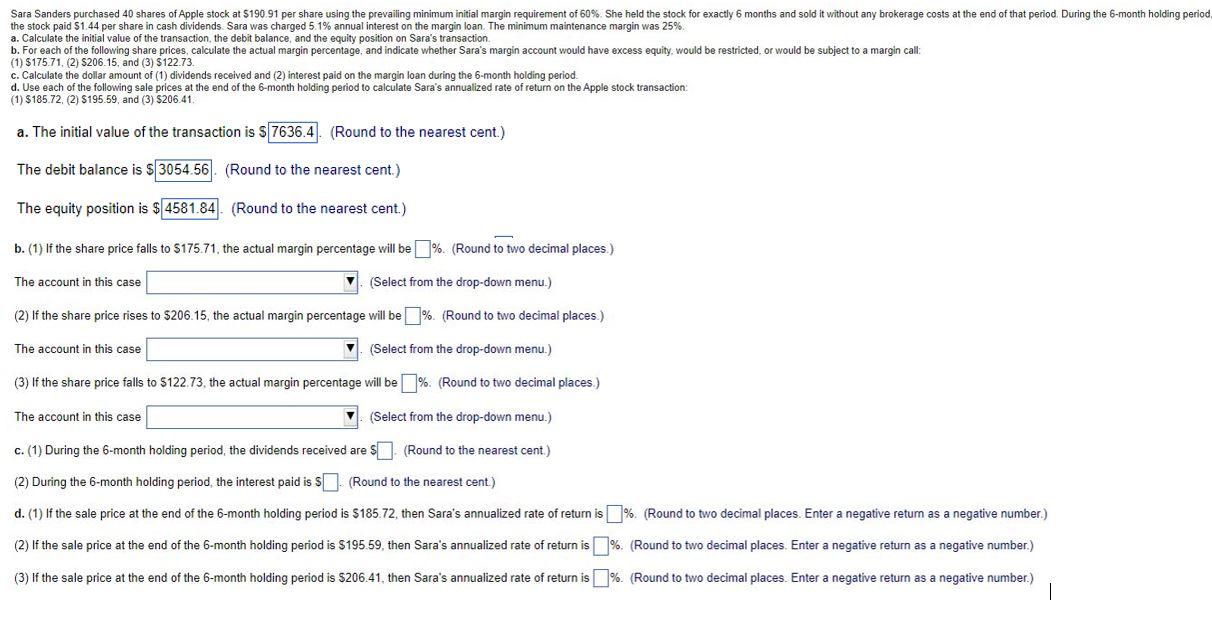

the stock paid $1.44 per share in cash dividends. Sara was charged 5.1% annual interest on the margin loan. The minimum maintenance margin was 25%. a. Calculate the initial value of the transaction, the debit balance, and the equity position on Sara's transaction. (1) \$175.71, (2) \$206.15, and (3) \$122.73. c. Calculate the dollar amount of (1) dividends received and (2) interest paid on the margin loan during the 6 -month holding period. d. Use each of the following sale prices at the end of the 6-month holding period to calculate Sara's annualized rate of return on the Apple stock transaction: (1) \$185.72, (2) \$195.59, and (3) \$206.41. a. The initial value of the transaction is \& (Round to the nearest cent.) The debit balance is 9 (Round to the nearest cent.) The equity position is 9 (Round to the nearest cent.) b. (1) If the share price falls to $175.71, the actual margin percentage will be 6. (Round to two decimal places.) The account in this case (Select from the drop-down menu.) (2) If the share price rises to $206.15, the actual margin percentage will be %. (Round to two decimal places.) The account in this case (Select from the drop-down menu.) (3) If the share price falls to $122.73, the actual margin percentage will be %. (Round to two decimal places.) The account in this case (Select from the drop-down menu.) c. (1) During the 6-month holding period, the dividends received are $ (Round to the nearest cent.) (2) During the 6-month holding period, the interest paid is 9 (Round to the nearest cent) d. (1) If the sale price at the end of the 6-month holding period is $185.72, then Sara's annualized rate of return is \%. (Round to two decimal places. Enter a negative return as a negative number.) (2) If the sale price at the end of the 6-month holding period is $195.59, then Sara's annualized rate of return is 16. (Round to two decimal places. Enter a negative return as a negative number.) (3) If the sale price at the end of the 6-month holding period is $206.41, then Sara's annualized rate of return is 1\%. (Round to two decimal places. Enter a negative return as a negative number.) the stock paid $1.44 per share in cash dividends. Sara was charged 5.1% annual interest on the margin loan. The minimum maintenance margin was 25%. a. Calculate the initial value of the transaction, the debit balance, and the equity position on Sara's transaction. (1) \$175.71, (2) \$206.15, and (3) \$122.73. c. Calculate the dollar amount of (1) dividends received and (2) interest paid on the margin loan during the 6 -month holding period. d. Use each of the following sale prices at the end of the 6-month holding period to calculate Sara's annualized rate of return on the Apple stock transaction: (1) \$185.72, (2) \$195.59, and (3) \$206.41. a. The initial value of the transaction is \& (Round to the nearest cent.) The debit balance is 9 (Round to the nearest cent.) The equity position is 9 (Round to the nearest cent.) b. (1) If the share price falls to $175.71, the actual margin percentage will be 6. (Round to two decimal places.) The account in this case (Select from the drop-down menu.) (2) If the share price rises to $206.15, the actual margin percentage will be %. (Round to two decimal places.) The account in this case (Select from the drop-down menu.) (3) If the share price falls to $122.73, the actual margin percentage will be %. (Round to two decimal places.) The account in this case (Select from the drop-down menu.) c. (1) During the 6-month holding period, the dividends received are $ (Round to the nearest cent.) (2) During the 6-month holding period, the interest paid is 9 (Round to the nearest cent) d. (1) If the sale price at the end of the 6-month holding period is $185.72, then Sara's annualized rate of return is \%. (Round to two decimal places. Enter a negative return as a negative number.) (2) If the sale price at the end of the 6-month holding period is $195.59, then Sara's annualized rate of return is 16. (Round to two decimal places. Enter a negative return as a negative number.) (3) If the sale price at the end of the 6-month holding period is $206.41, then Sara's annualized rate of return is 1\%. (Round to two decimal places. Enter a negative return as a negative number.)