hurry up please

thank you so much

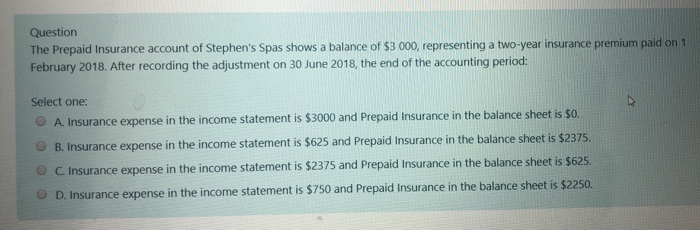

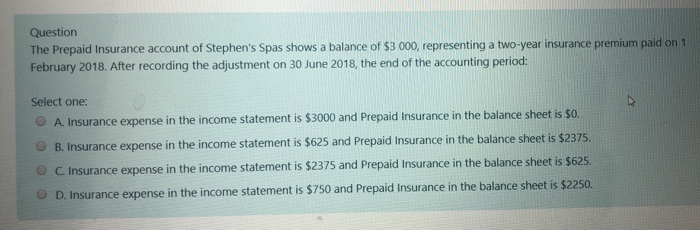

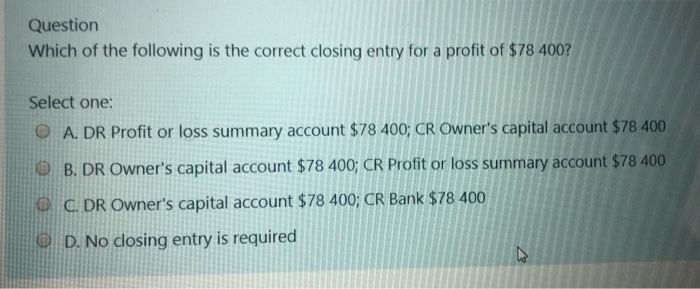

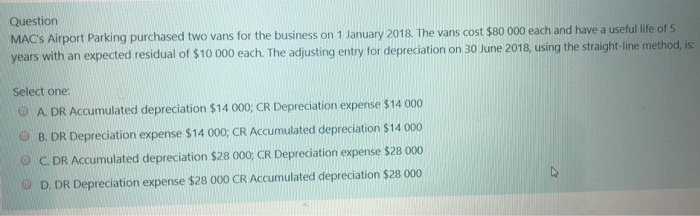

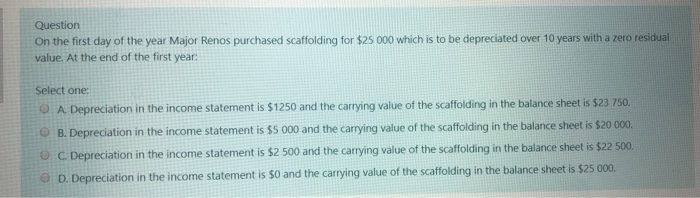

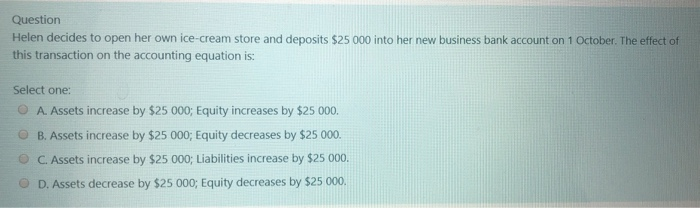

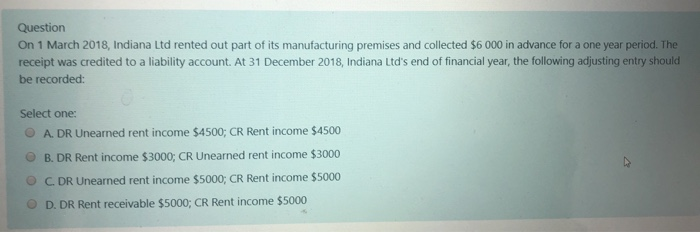

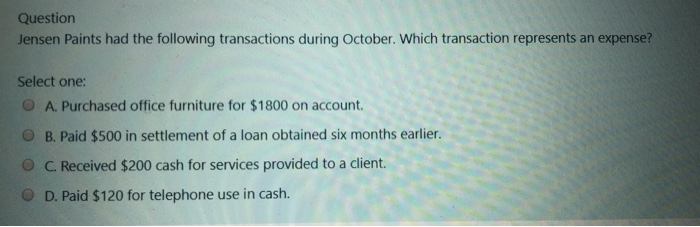

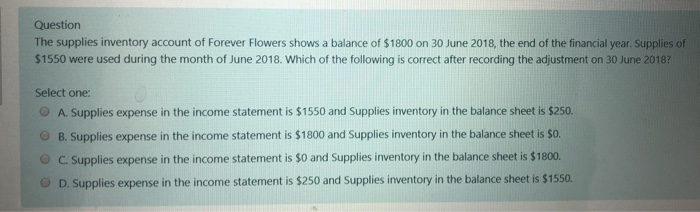

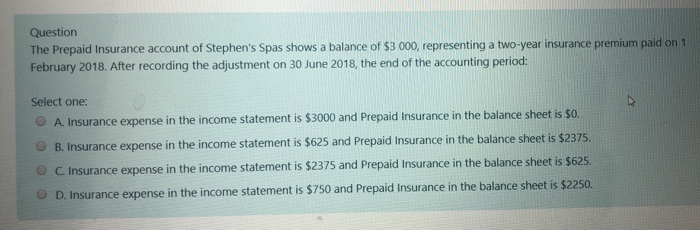

Question The Prepaid Insurance account of Stephen's Spas shows a balance of $3 000, representing a two-year insurance premium paid on 1 February 2018. After recording the adjustment on 30 June 2018, the end of the accounting period: Select one: O A. Insurance expense in the income statement is $3000 and Prepaid Insurance in the balance sheet is $0. B. Insurance expense in the income statement is $625 and Prepaid Insurance in the balance sheet is $2375. O C. Insurance expense in the income statement is $2375 and Prepaid Insurance in the balance sheet is $625. D. Insurance expense in the income statement is $750 and Prepaid Insurance in the balance sheet is $2250. Question Which of the following is the correct closing entry for a profit of $78 400? Select one: O A. DR Profit or loss summary account $78 400; CR Owner's capital account $78 400 O O B. DR Owner's capital account $78 400; CR Profit or loss summary account $78 400 C . DR Owner's capital account $78 400; CR Bank $78 400 0 D. No closing entry is required Question MAC's Airport Parking purchased two vans for the business on 1 January 2018. The vans cost $80 000 each and have a useful life of 5 years with an expected residual of $10 000 each. The adjusting entry for depreciation on 30 June 2018, using the straight-line method, is: Select one: A. DR Accumulated depreciation $14 000; CR Depreciation expense $14 000 B. DR Depreciation expense $14 000; CR Accumulated depreciation $14 000 O C. DR Accumulated depreciation $28 000, CR Depreciation expense $28 000 O D. DR Depreciation expense $28 000 CR Accumulated depreciation $28 000 Question On the first day of the year Major Renos purchased scaffolding for $25 000 which is to be depreciated over 10 years with a zero residual value. At the end of the first year: Select one: A Depreciation in the income statement is $1250 and the carrying value of the scaffolding in the balance sheet is $23 750. B. Depreciation in the income statement is $5 000 and the carrying value of the scaffolding in the balance sheet is $20 000 O C. Depreciation in the income statement is $2 500 and the carrying value of the scaffolding in the balance sheet is $22 500, D. Depreciation in the income statement is $0 and the carrying value of the scaffolding in the balance sheet is $25 000 Question Helen decides to open her own ice-cream store and deposits $25 000 into her new business bank account on 1 October. The effect of this transaction on the accounting equation is: Select one: O A. Assets increase by $25 000; Equity increases by $25 000. B. Assets increase by $25 000; Equity decreases by $25 000. C. Assets increase by $25 000; Liabilities increase by $25 000. O D. Assets decrease by $25 000; Equity decreases by $25 000. Question On 1 March 2018, Indiana Ltd rented out part of its manufacturing premises and collected $6 000 in advance for a one year period. The receipt was credited to a liability account. At 31 December 2018, Indiana Ltd's end of financial year, the following adjusting entry should be recorded: Select one: O A. DR Unearned rent income $4500; CR Rent income $4500 B. DR Rent income $3000; CR Unearned rent income $3000 O C. DR Unearned rent income $5000; CR Rent income $5000 O D. DR Rent receivable $5000; CR Rent income $5000 Question Jensen Paints had the following transactions during October. Which transaction represents an expense? Select one: O A. Purchased office furniture for $1800 on account. O B. Paid $500 in settlement of a loan obtained six months earlier. O C. Received $200 cash for services provided to a client. O D. Paid $120 for telephone use in cash. Question The supplies inventory account of Forever Flowers shows a balance of $1800 on 30 June 2018, the end of the financial year. Supplies of $1550 were used during the month of June 2018. Which of the following is correct after recording the adjustment on 30 June 2018? Select one: O A. Supplies expense in the income statement is $1550 and Supplies inventory in the balance sheet is $250. O O B. Supplies expense in the income statement is $1800 and Supplies inventory in the balance sheet is so. C. Supplies expense in the income statement is $0 and Supplies inventory in the balance sheet is $1800. D. Supplies expense in the income statement is $250 and Supplies inventory in the balance sheet is $1550