Husky Energy is one of Canada's largest integrated energy companies. Based in Calgary, Alberta, Husky is publicly traded on the Toronto Stock Exchange. The

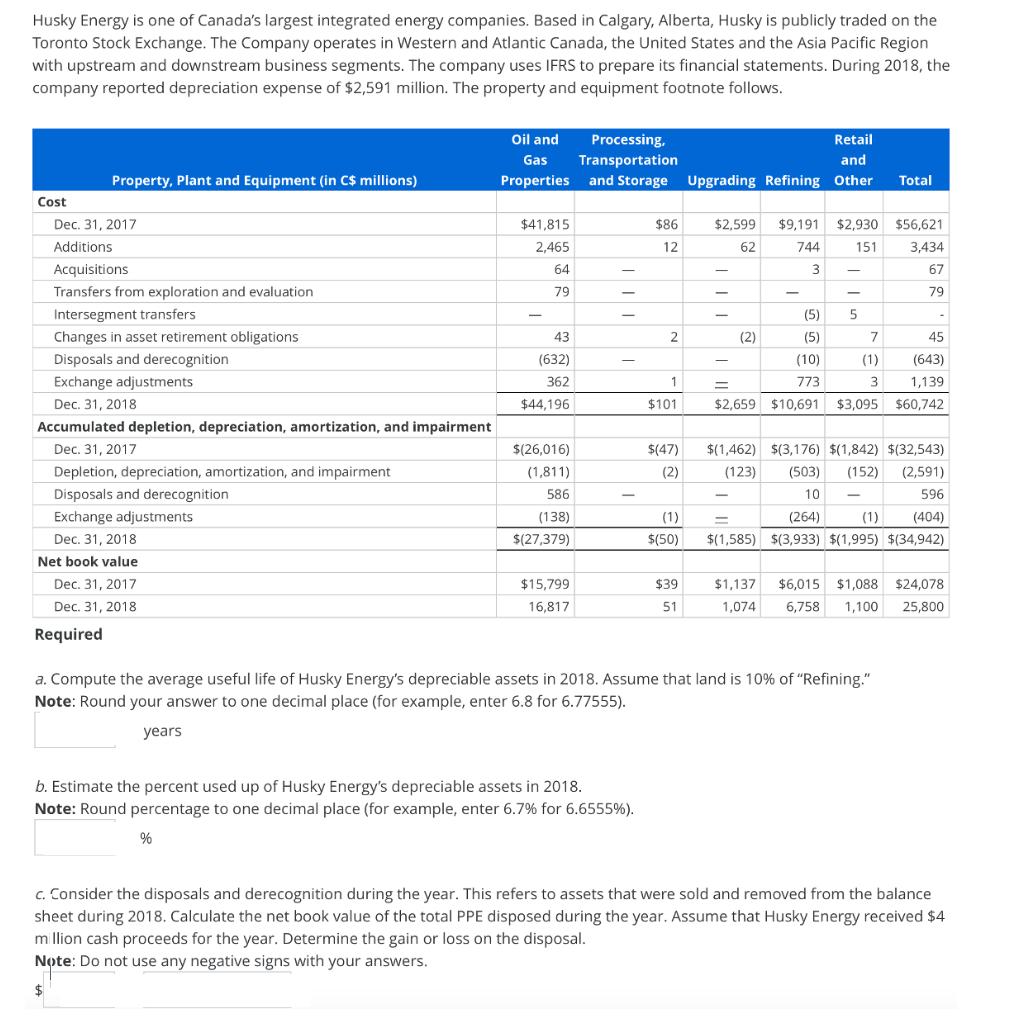

Husky Energy is one of Canada's largest integrated energy companies. Based in Calgary, Alberta, Husky is publicly traded on the Toronto Stock Exchange. The Company operates in Western and Atlantic Canada, the United States and the Asia Pacific Region with upstream and downstream business segments. The company uses IFRS to prepare its financial statements. During 2018, the company reported depreciation expense of $2,591 million. The property and equipment footnote follows. Cost Property, Plant and Equipment (in C$ millions) Dec. 31, 2017 Additions Acquisitions Transfers from exploration and evaluation Intersegment transfers Changes in asset retirement obligations Disposals and derecognition Exchange adjustments Dec. 31, 2018 Accumulated depletion, depreciation, amortization, and impairment Dec. 31, 2017 Depletion, depreciation, amortization, and impairment Disposals and derecognition Exchange adjustments Dec. 31, 2018 Net book value Dec. 31, 2017 Dec. 31, 2018 Required Oil and Gas Properties $41,815 2,465 64 79 % 43 (632) 362 $44,196 $(26,016) (1,811) 586 (138) $(27,379) $15,799 16,817 Processing. Transportation Retail and and Storage Upgrading Refining Other Total b. Estimate the percent used up of Husky Energy's depreciable assets in 2018. Note: Round percentage to one decimal place (for example, enter 6.7% for 6.6555%). $86 12 2 1 $101 (1) $(50) $2,599 $9,191 $2,930 $56,621 62 151 3,434 67 79 $39 51 - 744 3 (2) (5) (5) 7 45 (10) (1) (643) 773 1,139 3 $2,659 $10,691 $3,095 $60,742 - 5 (123) $(47) $(1,462) $(3,176) $(1,842) $(32,543) (2) (503) (152) (2,591) 10 596 (264) (1) (404) $(1,585) $(3,933) $(1,995) $(34,942) a. Compute the average useful life of Husky Energy's depreciable assets in 2018. Assume that land is 10% of "Refining." Note: Round your answer to one decimal place (for example, enter 6.8 for 6.77555). years $1,137 $6,015 $1,088 $24,078 1,074 6,758 1,100 25,800 c. Consider the disposals and derecognition during the year. This refers to assets that were sold and removed from the balance sheet during 2018. Calculate the net book value of the total PPE disposed during the year. Assume that Husky Energy received $4 million cash proceeds for the year. Determine the gain or loss on the disposal. Note: Do not use any negative signs with your answers. $

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Average useful life of Husky Energys depreciable assets in 2018 ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards