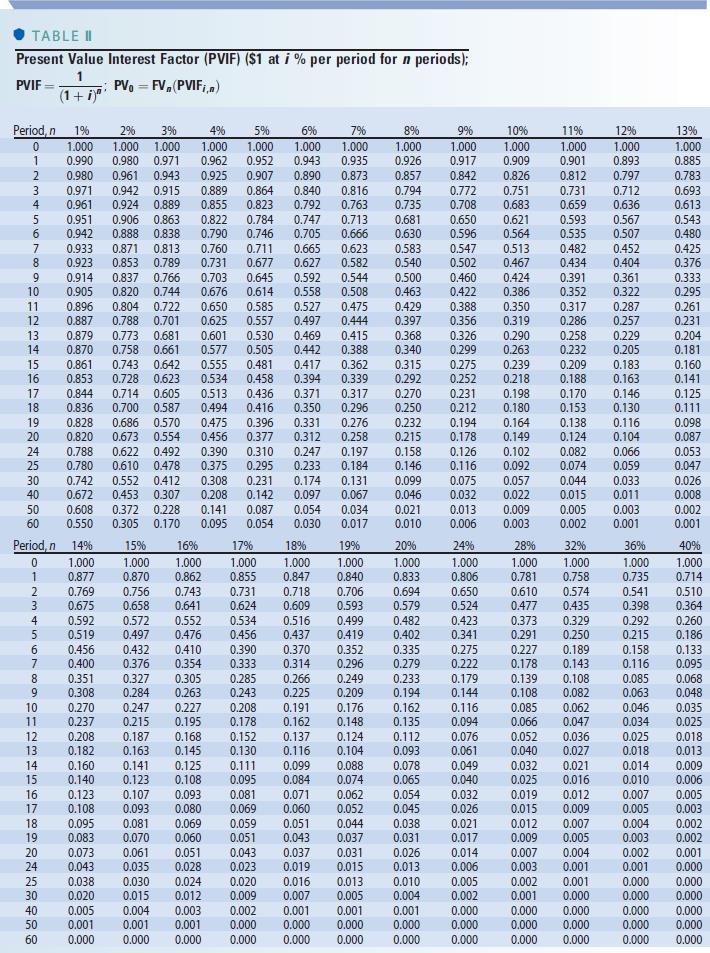

Husky Enterprises recently sold an issue of 11-year maturity bonds. The bonds were sold at a deep discount price of $505 each. After flotation costs, Husky received $494.83 each. The bonds have a $1,000 maturity value and pay $35 interest at the end of each year. Compute the after-tax cost of debt for these bonds if Huskys marginal tax rate is 40 percent. Use Table II and Table IV to answer the question. Round your answer to one decimal place.

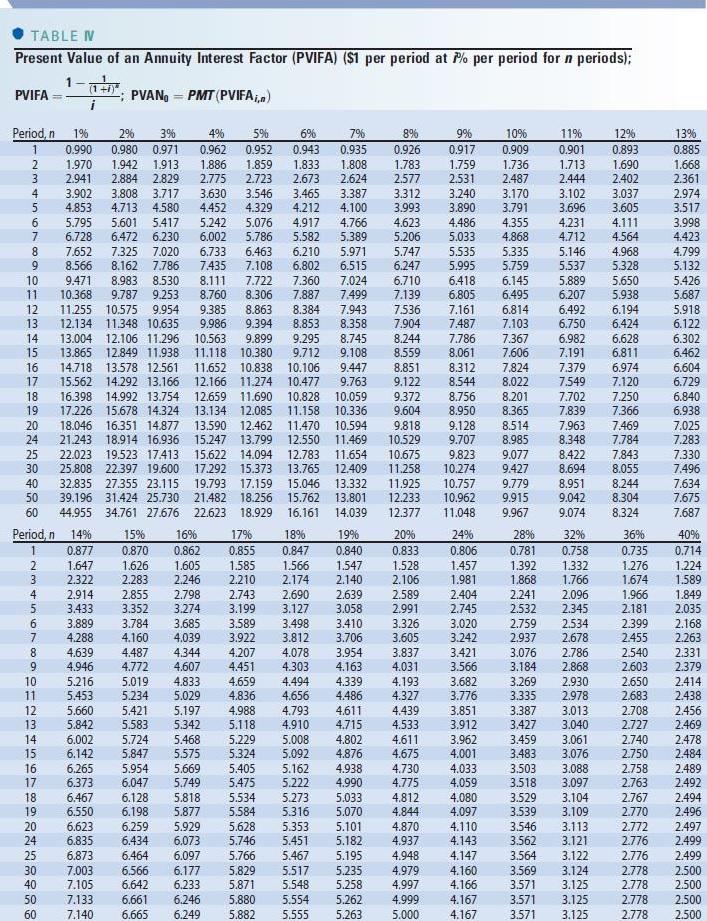

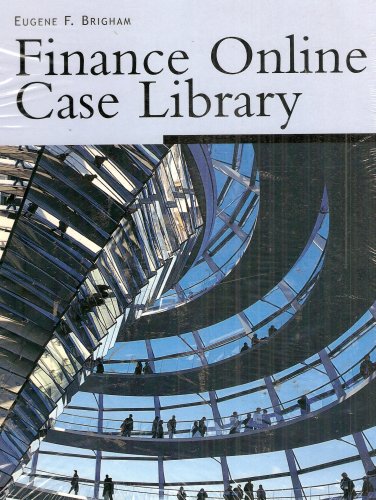

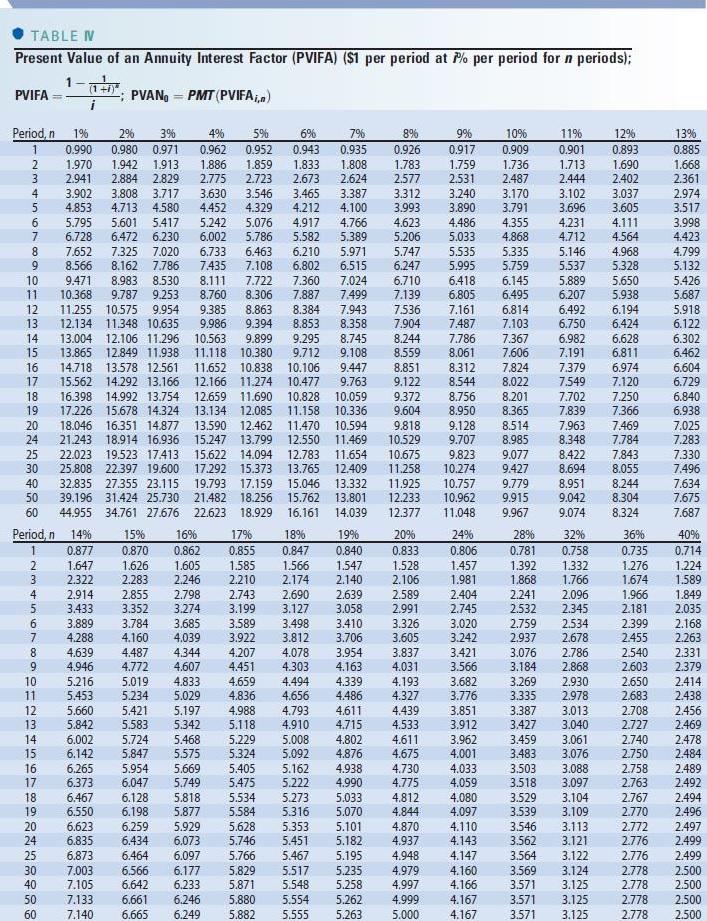

TABLE IV Present Value of an Annuity Interest Factor (PVIFA) ($1 per period at 7% per period for n periods); PVIFA : PVAN, = PMT (PVIFA in) NMNOOOO 6% 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10.828 11.158 11.470 12.550 12.783 13.765 15.046 15.762 16.161 7% 0.935 1.808 2.624 3.387 4.100 4.766 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 9.108 9.447 9.763 10.059 10.336 10.594 11.469 11.654 12.409 13.332 13.801 14.039 8% 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 10.529 10.675 11.258 11.925 12.233 12.377 9% 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 8.312 8.544 8.756 8.950 9.128 9.707 9.823 10.274 10.757 10.962 11.048 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8.022 8.201 8.365 8.514 8.985 9.077 9.427 9.779 9.915 9.967 11% 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 6.750 6.982 7.191 7.379 7.549 7.702 7.839 7.963 8.348 8.422 8.694 8.951 9.042 9.074 8 SUURS Period, 1% 2% 39 4% 5% 1 0.990 0.980 0.971 0.962 0.952 2 1.970 1.942 1.913 1.886 1.859 3 2.941 2.884 2.829 2.775 2.723 4 3.902 3.808 3.717 3.630 3.546 5 4.853 4.713 4.580 4.452 4.329 6 5.795 5.601 5.417 5.242 5.076 7 6.728 6.472 6.230 6.002 5.786 8 7.652 7.325 7.020 6.733 6.463 9 8.566 8.162 7.786 7.435 7.108 10 9.471 8.983 8.530 8.111 7.722 11 10.368 9.787 9.253 8.760 8.306 12 11.255 10.575 9.954 9.385 8.863 13 12.134 11.348 10.635 9.986 9.394 14 13.004 12.106 11.296 10.563 9.899 15 13.865 12.849 11.938 11.118 10.380 16 14.718 13.578 12.561 11.652 10.838 17 15.562 14.292 13.166 12.166 11.274 18 16.398 14.992 13.754 12.659 11.690 19 17.226 15.678 14.324 13.134 12.085 20 18.046 16.351 14.877 13.590 12.462 24 21.243 18.914 16.936 15.247 13.799 25 22.023 19.523 17.413 15.622 14.094 30 25.808 22.397 19.600 17.292 15.373 40 32.835 27.355 23.115 19.793 17.159 50 39.196 31.424 25.730 21.482 18.256 44.955 34.761 27.676 22.623 18.929 Period, 14% 15% 16% 17% 1 0.877 0.870 0.862 0.855 2 1.647 1.626 1.605 1.585 3 2.322 2.283 2.246 2.210 4 2.914 2.855 2.798 2.743 5 3.433 3.352 3.274 3.199 6 3.889 3.784 3.685 3.589 7 4.288 4.160 4.039 3.922 8 4.639 4.487 4.344 4.207 9 4.946 4.772 4.607 4.451 10 5.216 5.019 4.833 4.659 11 5.453 5.234 5.029 4.836 12 5.660 5.421 5.197 4.988 13 5.842 5.583 5.342 5.118 14 6.002 5.724 5.468 5.229 15 6.142 5.847 5.575 5.324 16 6.265 5.954 5.669 5.405 17 6.373 6.047 5.749 5.475 18 6.467 6.128 5.818 5.534 19 6.550 6.198 5.877 5.584 20 6.623 6.259 5.929 5.628 24 6.835 6.434 6.073 5.746 25 6.873 6.464 6.097 5.766 30 7.003 6.566 6.177 5.829 40 7.105 6.642 6.233 5.871 50 7.133 6.661 6.246 5.880 60 7.140 6.665 6.249 5.882 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.784 7.843 8.055 8.244 8.304 8.324 36% 0.735 1.276 1.674 1.966 2.181 2.399 2.455 2.540 2.603 2.650 2.683 2.708 2.727 2.740 2.750 2.758 2.763 2.767 2.770 2.772 2.776 2.776 2.778 2.778 2.778 2.778 13% 0.885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.462 6.604 6.729 6.840 6.938 7.025 7.283 7.330 7.496 7.634 7.675 7.687 40% 0.714 1.224 1.589 1.849 2.035 2.168 2.263 2.331 2.379 2.414 2.438 2.456 2.469 2.478 2.484 2.489 2.492 2.494 2.496 2.497 2.499 2.499 2.500 2.500 2.500 2.500 VOU AN - 1896 0.847 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 4.793 4.910 5.008 5.092 5.162 5.222 5.273 5.316 5.353 5.451 5.467 5.517 5.548 5.554 5.555 19% 0.840 1.547 2.140 2.639 3.058 3.410 3.706 3.954 4.163 4.339 4.486 4.611 4.715 4.802 4.876 4.938 4.990 5.033 5.070 5.101 5.182 5.195 5.235 5.258 5.262 5.263 20% 0.833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.193 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.844 4.870 4.937 4.948 4.979 4.997 4.999 5.000 2496 0.806 1.457 1.981 2.404 2.745 3.020 3.242 3.421 3.566 3.682 3.776 3.851 3.912 3.962 4.001 4.033 4.059 4.080 4.097 4.110 4.143 4.147 4.160 4.166 4.167 4.167 28% 0.781 1.392 1.868 2.241 2.532 2.759 2.937 3.076 3.184 3.269 3.335 3.387 3.427 3.459 3.483 3.503 3.518 3.529 3.539 3.546 3.562 3.564 3.569 3.571 3.571 3.571 32% 0.758 1.332 1.766 2.096 2.345 2.534 2.678 2.786 2.868 2.930 2.978 3.013 3.040 3.061 3.076 3.088 3.097 3.104 3.109 3.113 3.121 3.122 3.124 3.125 3.125 3.125 TABLE Present Value Interest Factor (PVIF) ($1 at i % per period for n periods); PVIF : PV= FV,(PVIF;,n) (1 + i)" 7% 1.000 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.276 0.258 0.197 0.184 0.131 0.067 0.034 0.017 13% 1.000 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.087 0.053 0.047 0.026 0.008 0.002 0.001 8% WC Period, 1% 2% 3% 4% 5% 6% 0 1.000 1.000 1.000 1.000 1.000 1.000 1 0.990 0.980 0.971 0.962 0.952 0.943 2 0.980 0.961 0.943 0.925 0.907 0.890 3 0.971 0.942 0.915 0.889 0.864 0.840 4 0.961 0.924 0.889 0.855 0.823 0.792 5 0.951 0.906 0.863 0.822 0.784 0.747 6 0.942 0.888 0.838 0.790 0.746 0.705 7 0.933 0.871 0.813 0.760 0.711 0.665 8 0.923 0.853 0.789 0.731 0.677 0.627 9 0.914 0.837 0.766 0.703 0.645 0.592 10 0.905 0.820 0.744 0.676 0.614 0.558 11 0.896 0.804 0.722 0.650 0.585 0.527 12 0.887 0.788 0.701 0.625 0.557 0.497 13 0.879 0.773 0.681 0.601 0.530 0.469 14 0.870 0.758 0.661 0.577 0.505 0.442 15 0.861 0.743 0.642 0.555 0.481 0.417 16 0.853 0.728 0.623 0.534 0.458 0.394 17 0.844 0.714 0.605 0.513 0.436 0.371 18 0.836 0.700 0.587 0.494 0.416 0.350 19 0.828 0.686 0.570 0.475 0.396 0.331 20 0.820 0.673 0.554 0.456 0.377 0.312 24 0.788 0.622 0.492 0.390 0.310 0.247 25 0.780 0.610 0.478 0.375 0.295 0.233 30 0.742 0.552 0.412 0.308 0.231 0.174 40 0.672 0.453 0.307 0.208 0.142 0.097 50 0.608 0.372 0.228 0.141 0.087 0.054 0.550 0.305 0.170 0.095 0.054 0.030 Period, n 14% 15% 16% 17% 18% 0 1.000 1.000 1.000 1.000 1.000 1 0.877 0.870 0.862 0.855 0.847 2 0.769 0.756 0.743 0.731 0.718 3 0.675 0.658 0.641 0.624 0.609 4 0.592 0.572 0.552 0.534 0.516 5 0.519 0.497 0.476 0.456 0.437 6 0.456 0.432 0.410 0.390 0.370 7 0.400 0.376 0.354 0.333 0.314 8 0.351 0.327 0.305 0.285 0.266 9 0.308 0.284 0.263 0.243 0.225 10 0.270 0.247 0.227 0.208 0.191 11 0.237 0.215 0.195 0.178 0.162 12 0.208 0.187 0.168 0.152 0.137 13 0.182 0.163 0.145 0.130 0.116 14 0.160 0.141 0.125 0.111 0.099 15 0.140 0.123 0.108 0.095 0.084 16 0.123 0.107 0.093 0.081 0.071 17 0.108 0.093 0.080 0.069 0.060 18 0.095 0.081 0.069 0.059 0.051 19 0.083 0.070 0.060 0.051 0.043 20 0.073 0.061 0.051 0.043 0.037 24 0.043 0.035 0.028 0.023 0.019 25 0.038 0.030 0.024 0.020 0.016 30 0.020 0.015 0.012 0.009 0.007 40 0.005 0.004 0.003 0.002 0.001 50 0.001 0.001 0.001 0.000 0.000 60 0.000 0.000 0.000 0.000 0.000 8% 1.000 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.158 0.146 0.099 0.046 0.021 0.010 20% 1.000 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 0.013 0.010 0.004 0.001 0.000 0.000 9% 10% 1.000 1.000 0.917 0.909 0.842 0.826 0.772 0.751 0.708 0.683 0.650 0.621 0.596 0.564 0.547 0.513 0.502 0.467 0.460 0.424 0.422 0.386 0.388 0.350 0.356 0.319 0.326 0.290 0.299 0.263 0.275 0.239 0.252 0.218 0.231 0.198 0.212 0.180 0.194 0.164 0.178 0.149 0.126 0.102 0.116 0.092 0.075 0.057 0.032 0.022 0.013 0.009 0.006 0.003 24% 28% 1.000 1.000 0.806 0.781 0.650 0.610 0.524 0.477 0.423 0.373 0.341 0.291 0.275 0.227 0.222 0.178 0.179 0.139 0.144 0.108 0.116 0.085 0.094 0.066 0.076 0.052 0.061 0.040 0.049 0.032 0.040 0.025 0.032 0.019 0.026 0.015 0.021 0.012 0.017 0.009 0.014 0.007 0.006 0.003 0.005 0.002 0.002 0.001 0.000 0.000 0.000 0.000 0.000 0.000 11% 1.000 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.082 0.074 0.044 0.015 0.005 0.002 32% 1.000 0.758 0.574 0.435 0.329 0.250 0.189 0.143 0.108 0.082 0.062 0.047 0.036 0.027 0.021 0.016 0.012 0.009 0.007 0.005 0.004 0.001 0.001 0.000 0.000 0.000 0.000 12% 1.000 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.066 0.059 0.033 0.011 0.003 0.001 36% 1.000 0.735 0.541 0.398 0.292 0.215 0.158 0.116 0.085 0.063 0.046 0.034 0.025 0.018 0.014 0.010 0.007 0.005 0.004 0.003 0.002 0.001 0.000 0.000 0.000 0.000 0.000 ONMONDO O 19% 1.000 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 0.176 0.148 0.124 0.104 0.088 0.074 0.062 0.052 0.044 0.037 0.031 0.015 0.013 0.005 0.001 0.000 0.000 40% 1.000 0.714 0.510 0.364 0.260 0.186 0.133 0.095 0.068 0.048 0.035 0.025 0.018 0.013 0.009 0.006 0.005 0.003 0.002 0.002 0.001 0.000 0.000 0.000 0.000 0.000 0.000