Answered step by step

Verified Expert Solution

Question

1 Approved Answer

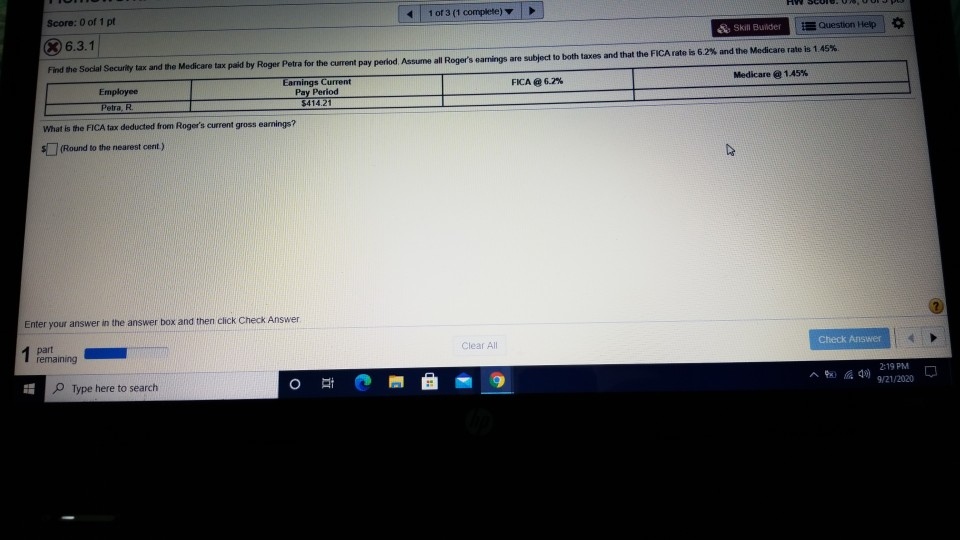

HV Score: 0 of 1 pt 1 of 3 (1 complete) 6.3.1 Skill Builder Question Help Find the Social Security tax and the Medicare tax

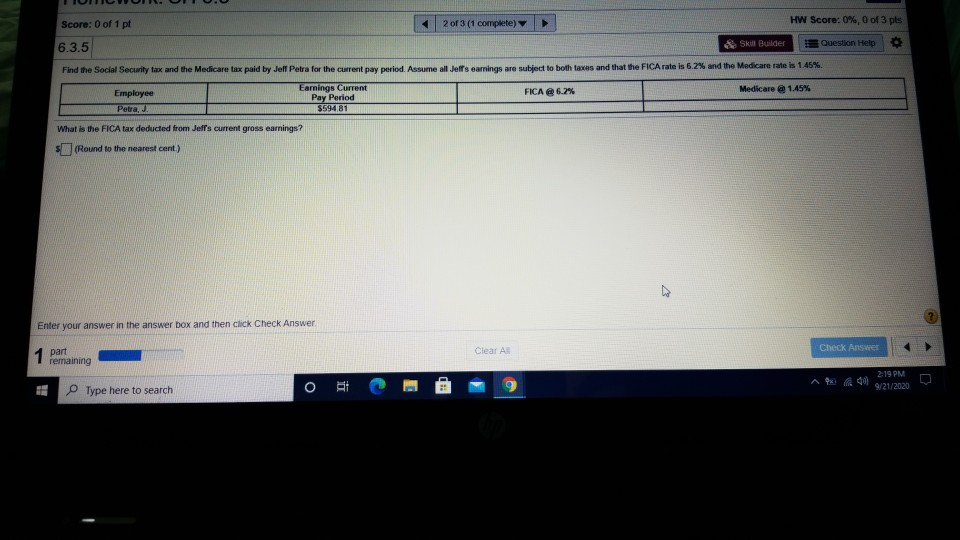

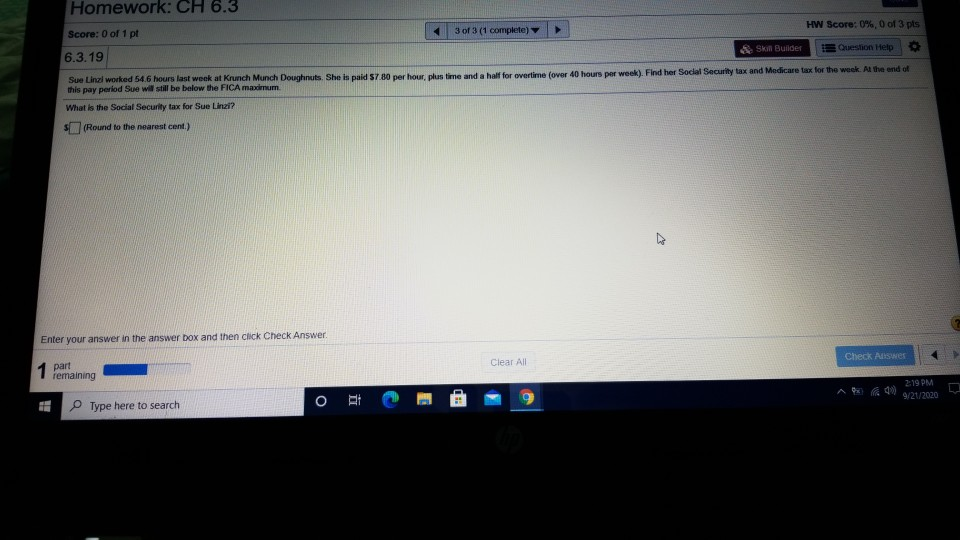

HV Score: 0 of 1 pt 1 of 3 (1 complete) 6.3.1 Skill Builder Question Help Find the Social Security tax and the Medicare tax paid by Roger Petra for the current pay period. Assume all Roger's earnings are subject to both taxes and that the FICA rate is 6.2% and the Medicare rate is 1.45% Employee Earnings Current Pay Period FICA @ 6.2% Medicare @ 1.45% Petra R $414.21 What is the FICA tax deducted from Roger's current gross earnings? (Round to the nearest cent) Enter your answer in the answer box and then click Check Answer Check Answer Clear All 1 part remaining at 3 2:19 PM 9/21/2020 E BD Type here to search Score: 0 of 1 pt 2 or 3 (1 complete) HW Score: 0% 0 of 3 pts 6.3.5 Skill Builder Question Help Find the Social Security tax and the Medicare tax paid by Jell Petra for the current pay period. Assume all Jeff's earnings are subject to both taxes and that the FICA rate is 6.2% and the Medicare rate is 145%. Employee Earnings Current Pay Period FICA @ 6.2% Medicare @ 1.45% Petra, $59481 What is the FICA tax deducted from Jeffs current gross earnings? (Round to the nearest cent) 7 Enter your answer in the answer box and then click Check Answer Clear A Check Answer 1 part remaining 2:19 PM 9/21/2020 Type here to search O it Homework: CH 6.3 Score: 0 of 1 pt HW Score: 0%, 0 of 3 pts 3 of 3 (1 complete Skill Builder Chestion Help 6.3.19 Sue Ling worked 54.6 hours last week at Krunch Munch Doughnuts. She is paid 57 80 per hour, plus time and a half for overtime (over 40 hours per week). Find her Social Security tax and Medicare tax for the week. At the end of this pay period Sue will still be below the FICA maximum What is the Social Security tax for Sue Linzi? (Round to the nearest cent.) Enter your answer in the answer box and then click Check Answer. Check Answer Clear All 1 part remaining 2:19 PM 9/21/2020 i Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started