Question

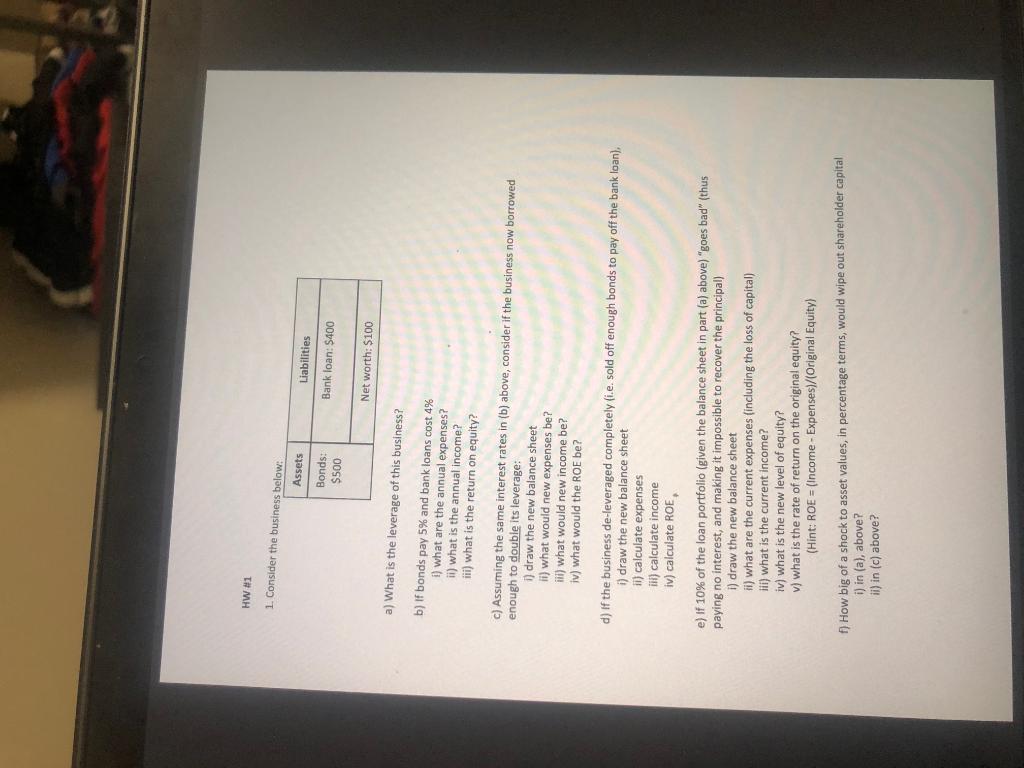

HW #11. Con Consider the business below:AssetsLiabilitiesBonds: $500B ank loan: $400Net worth: $100a) What is the leverage of this business? b) If bonds pay 5%

HW #11. Con

Consider the business below:AssetsLiabilitiesBonds: $500B ank loan: $400Net worth: $100a) What is the leverage of this business? b) If bonds pay 5% and bank loans cost 4%i) what are the annual expenses?ii) what is the annual income?iii) what is the return on equity?c) Assuming the same interest rates in (b) above, consider if the business now borrowed enough to double its leverage:i) draw the new balance sheetii) what would new expenses be?iii) what would new income be?iv) what would the ROE be?d) If the business de-leveraged completely (i.e. sold off enough bonds to pay off the bank loan), i) draw the new balance sheetii) calculate expensesiii) calculate incomeiv) calculate ROEe) If 10% of the loan portfolio (given the balance sheet in part (a) above) goes bad (thus paying no interest, and making it impossible to recover the principal)i) draw the new balance sheetii) what are the current expenses (including the loss of capital)iii) what is the current income?iv) what is the new level of equity?v) what is the rate of return on the original equity? (Hint: ROE = (Income - Expenses)/(Original Equity)f) How big of a shock to asset values, in percentage terms, would wipe out shareholder capitali) in (a), above? ii) in (c) above?

ank loan: $400Net worth: $100a) What is the leverage of this business? b) If bonds pay 5% and bank loans cost 4%i) what are the annual expenses?ii) what is the annual income?iii) what is the return on equity?c) Assuming the same interest rates in (b) above, consider if the business now borrowed enough to double its leverage:i) draw the new balance sheetii) what would new expenses be?iii) what would new income be?iv) what would the ROE be?d) If the business de-leveraged completely (i.e. sold off enough bonds to pay off the bank loan), i) draw the new balance sheetii) calculate expensesiii) calculate incomeiv) calculate ROEe) If 10% of the loan portfolio (given the balance sheet in part (a) above) goes bad (thus paying no interest, and making it impossible to recover the principal)i) draw the new balance sheetii) what are the current expenses (including the loss of capital)iii) what is the current income?iv) what is the new level of equity?v) what is the rate of return on the original equity? (Hint: ROE = (Income - Expenses)/(Original Equity)f) How big of a shock to asset values, in percentage terms, would wipe out shareholder capitali) in (a), above? ii) in (c) above?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started