HW 19

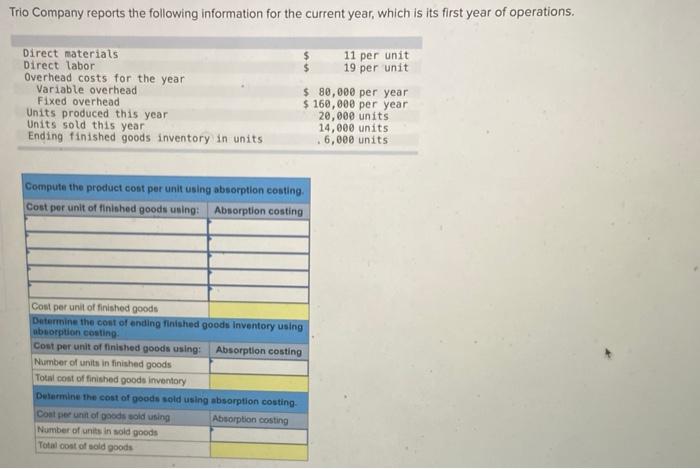

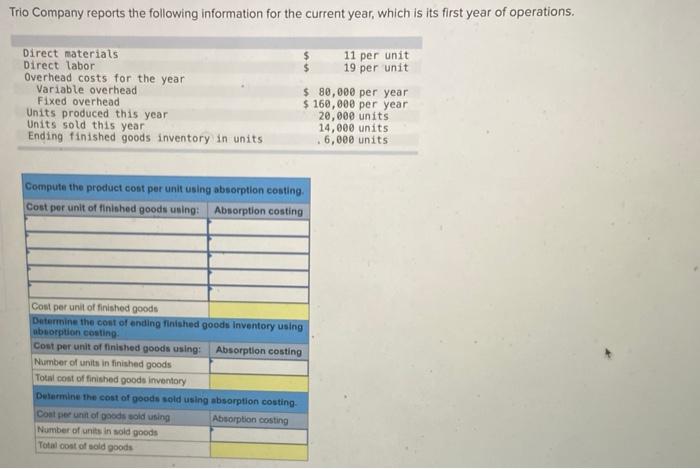

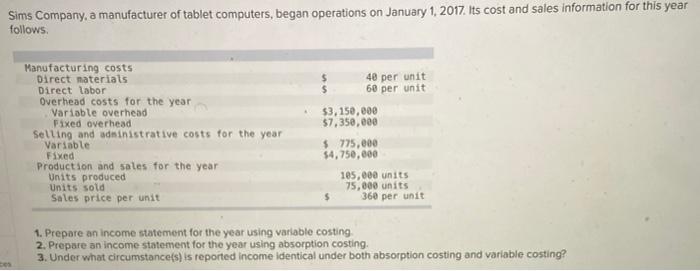

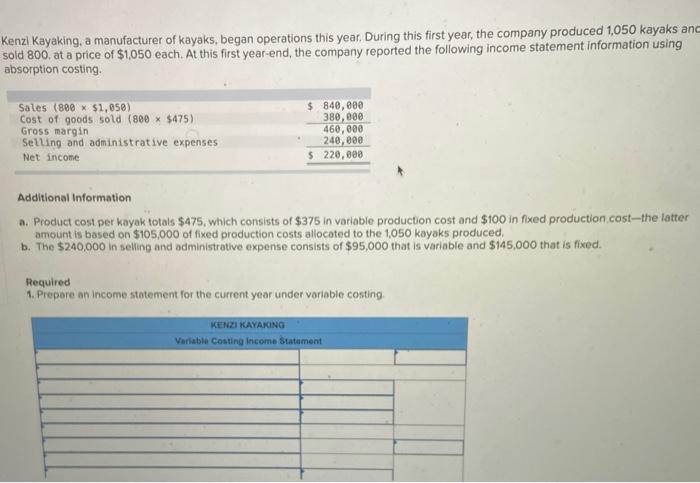

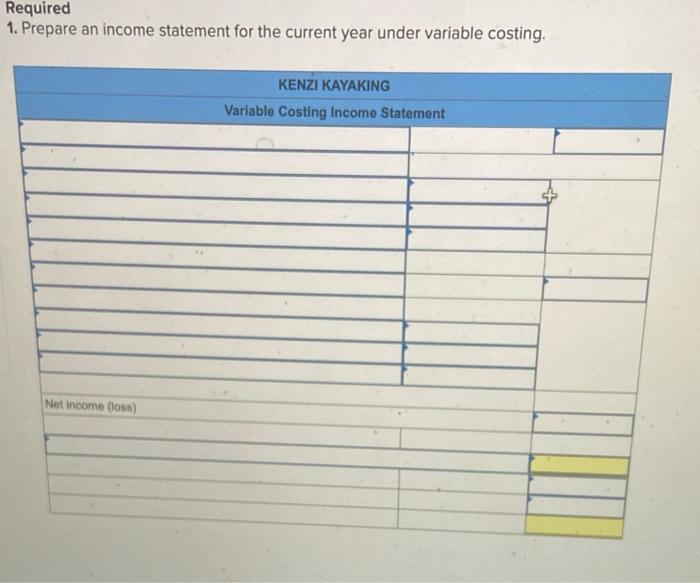

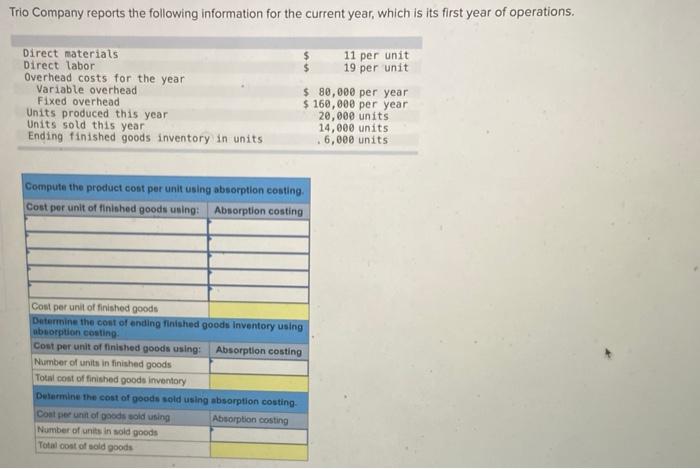

Trio Company reports the following information for the current year, which is its first year of operations. Direct materials Direct labor Overhead costs for the year Variable overhead Fixed overhead Units produced this year Units sold this year Ending finished goods inventory in units 11 per unit 19 per unit $ 80,000 per year $ 160,000 per year 20,000 units 14,000 units .6,000 units Compute the product cont per unit using absorption costing. Cost per unit of finished goods using: Absorption costing Cost per unit of finished goods Determine the cost of ending finished goods Inventory using absorption costing Cost per unit of finished goods using: Absorption costing Number of units in finished goods Total cost of finished goods inventory Determine the cost of goods sold using absorption costing Coat per unit of goods sold using Absorption costing Number of units in sold goods Total cost of sold goods Sims Company, a manufacturer of tablet computers, began operations on January 1, 2017. Its cost and sales information for this year follows Manufacturing costs Direct materials Direct labor Overhead costs for the year Variable overhead Fixed overhead Selling and administrative costs for the year Variable Fixed Production and sales for the year Units produced Units sold Sales price per unit 40 per unit 60 per unit $3,150,000 $7,350,000 $ 175,000 $4,750,000 105,000 units 75,000 units 368 per unit 1. Prepare an income statement for the year using variable costing 2. Prepare an income statement for the year using absorption costing. 3. Under what circumstance(s) is reported income identical under both absorption costing and variable costing? Kenzi Kayaking, a manufacturer of kayaks, began operations this year, During this first year, the company produced 1,050 kayaks and sold 800, at a price of $1,050 each. At this first year-end, the company reported the following income statement information using absorption costing Sales (896 * $1,650) Cost of goods sold (800 $475) Gross margin Selling and administrative expenses Net income $ 840,000 380,000 460,000 240,000 $ 220,000 Additional Information a. Product cost per kayak totals $475, which consists of $375 in variable production cost and $100 in fixed production cost-the latter amount is based on $105,000 of fixed production costs allocated to the 1,050 kayaks produced, b. The $240,000 in selling and administrative expense consists of $95,000 that is variable and $145,000 that is fixed. Required 1. Prepare an income statement for the current year under variable costing KENZI KAYAKING Variable Costing Income Statement Required 1. Prepare an income statement for the current year under variable costing. KENZI KAYAKING Variable Costing Income Statement Net Income (los)