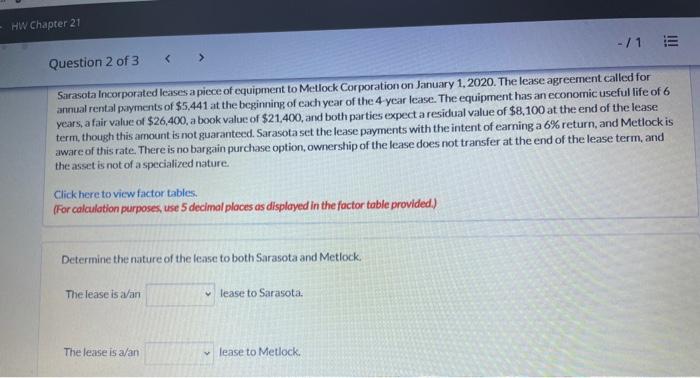

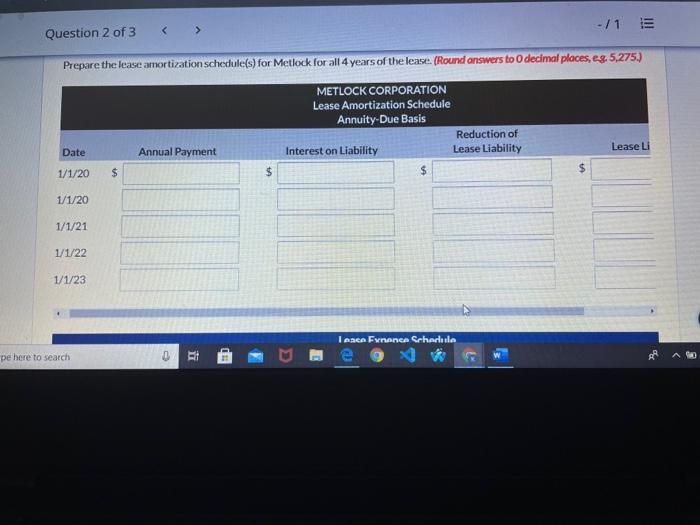

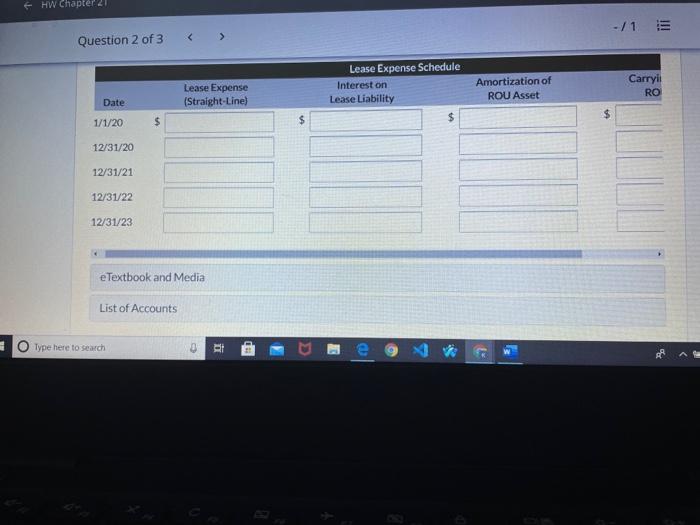

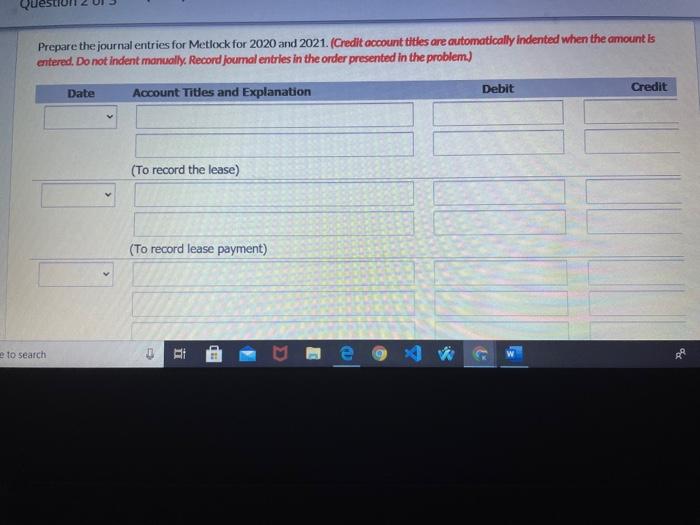

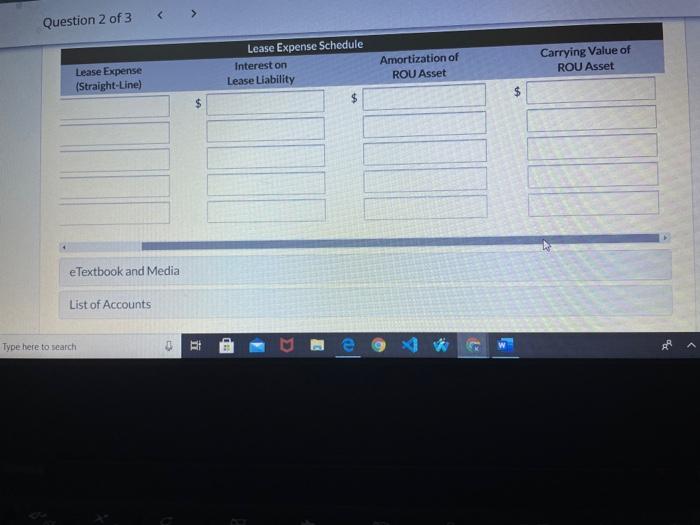

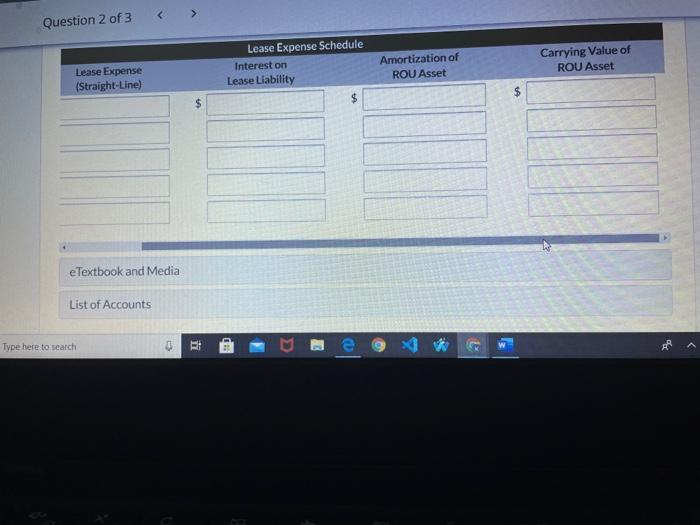

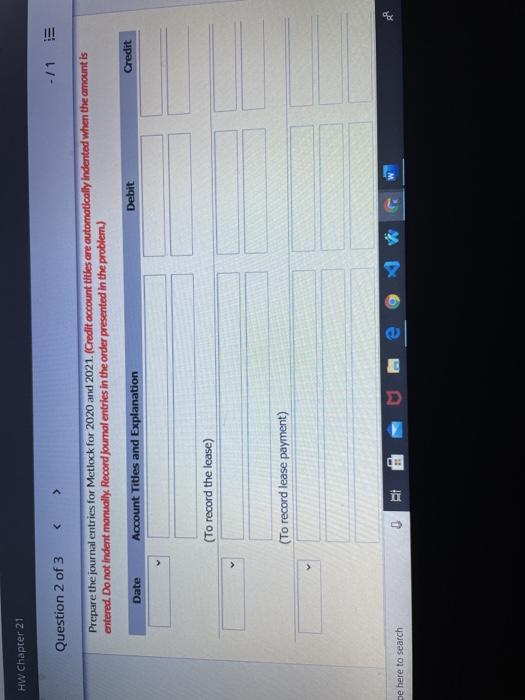

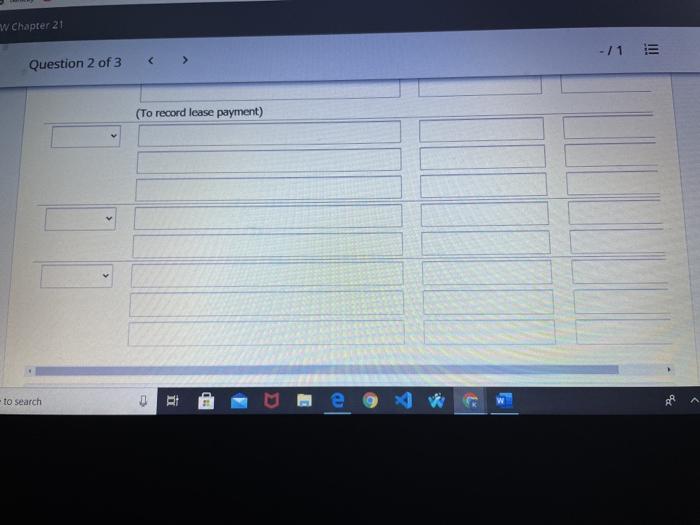

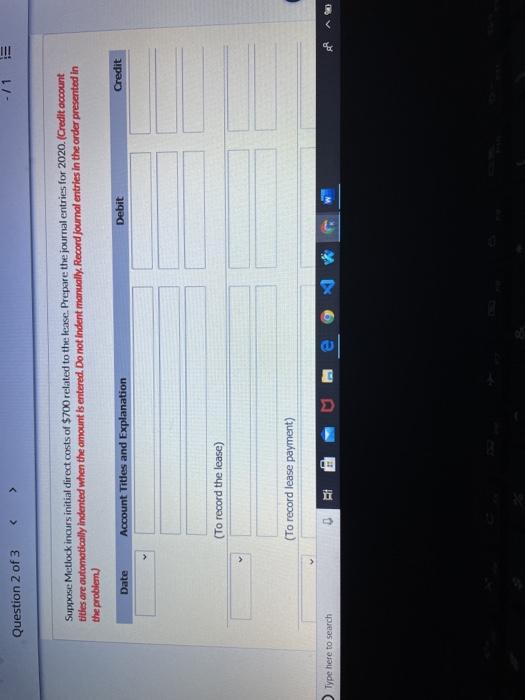

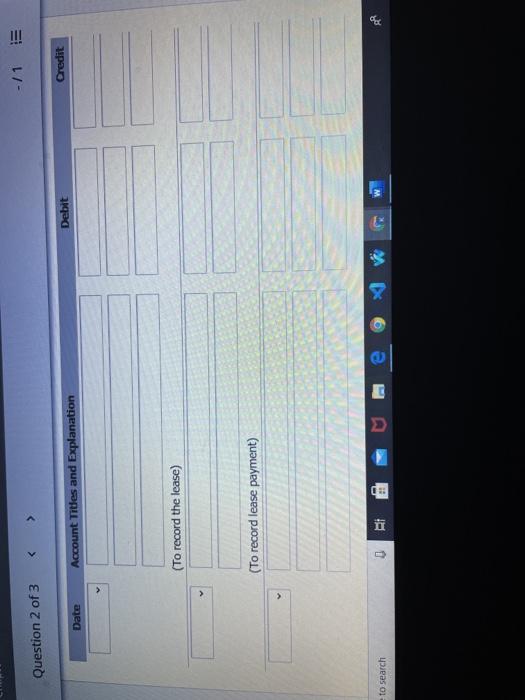

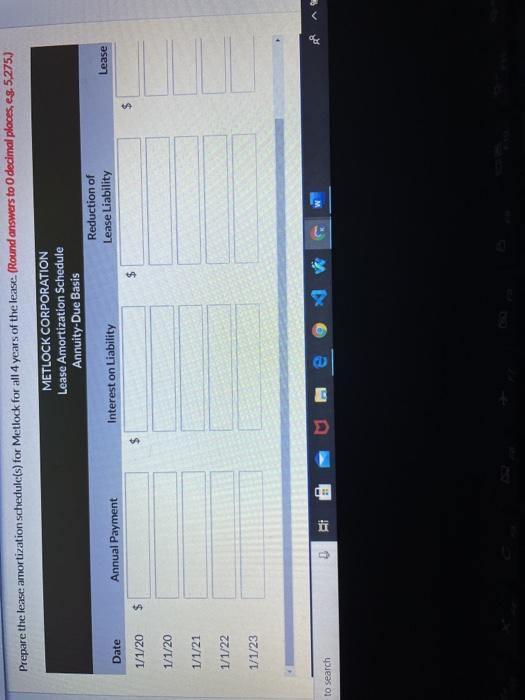

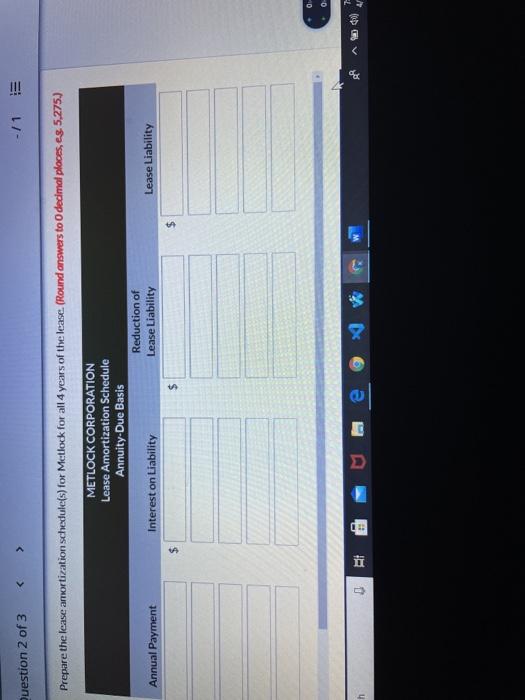

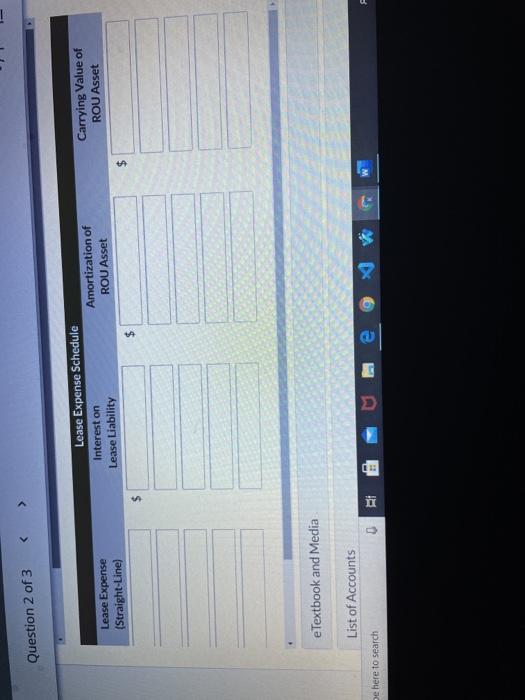

- HW Chapter 21 - / 1 Question 2 of 3 Sarasota Incorporated cases a piece of equipment to Metlock Corporation on January 1, 2020. The lease agreement called for annual rental payments of $5,441 at the beginning of each year of the 4 year lease. The equipment has an economic useful life of 6 years, a fair value of $26,400, a book value of $21.400, and both parties expect a residual value of $8,100 at the end of the lease term, though this amount is not guaranteed. Sarasota set the lease payments with the intent of earning a 6% return, and Metlock is aware of this rate. There is no bargain purchase option, ownership of the lease does not transfer at the end of the lease term, and the asset is not of a specialized nature. Click here to view factor tables, (For calculation purposes, use 5 decimal places as displayed in the factor toble provided) Determine the nature of the lease to both Sarasota and Metlock, The lease is a/an lease to Sarasota. The lease is a/an lease to Metlock -/1 Prepare the lease amortization schedule(s) for Metlock for all 4 years of the lease. (Round answers to decimal places, eg. 5,275.) METLOCK CORPORATION Lease Amortization Schedule Annuity-Due Basis Reduction of Interest on Liability Lease Liability $ Lease Li Date Annual Payment 1/1/20 $ $ 1/1/20 1/1/21 1/1/22 1/1/23 Ice France Schedule pe here to search ti F HW Chapter 21 -/15 Question 2 of 3 Lease Expense (Straight-Line) Lease Expense Schedule Interest on Lease Liability $ Amortization of ROU Asset Carryi RO Date 1/1/20 $ 12/31/20 12/31/21 12/31/22 12/31/23 e Textbook and Media List of Accounts Type here to search do e Prepare the journal entries for Metlock for 2020 and 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Account Titles and Explanation Debit Credit Date (To record the lease) V (To record lease payment) e to search i > Question 2 of 3 Lease Expense Schedule Interest on Lease Liability Amortization of ROU Asset Carrying Value of ROU Asset Lease Expense (Straight-Line) $ eTextbook and Media List of Accounts Type here to search 1 e > Question 2 of 3 Lease Expense Schedule Interest on Lease Liability Amortization of ROU Asset Carrying Value of ROU Asset Lease Expense (Straight-Line) $ eTextbook and Media List of Accounts Type here to search 1 e HW Chapter 21 -/1 Question 2 of 3 Suppose Metlock incurs initial direct costs of $700 related to the lease. Prepare the journal entries for 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Credit Debit Account Tities and Explanation (To record the lease) (To record lease payment) Type here to search 0 -/1 Question 2 of 3 -/1 Prepare the lease amortization schedule(s) for Metlock for all 4 years of the lease. (Round answers to decimal places, es. 5.275.) METLOCK CORPORATION Lease Amortization Schedule Annuity-Due Basis Reduction of Interest on Liability Lease Liability Annual Payment Lease Liability $ $ . e Question 2 of 3 Lease Expense Schedule Interest on Lease Liability Carrying Value of ROU Asset Amortization of ROU Asset Lease Expense (Straight-Line) $ e Textbook and Media List of Accounts tal F be here to search ORI