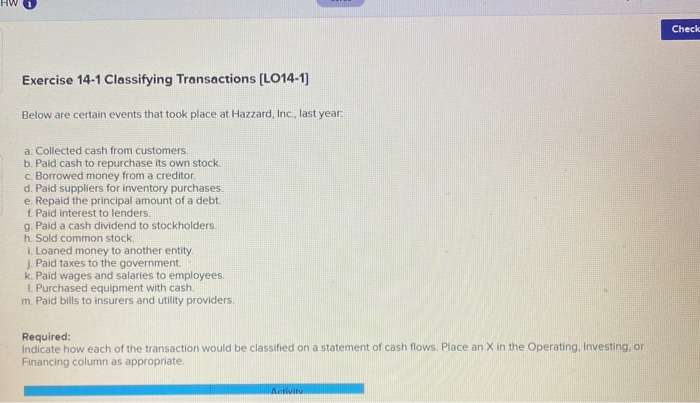

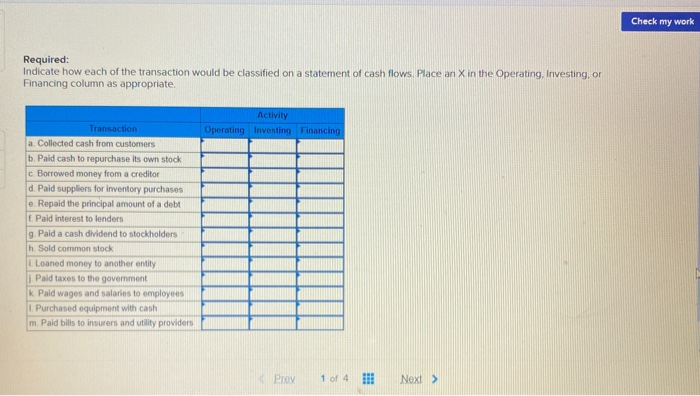

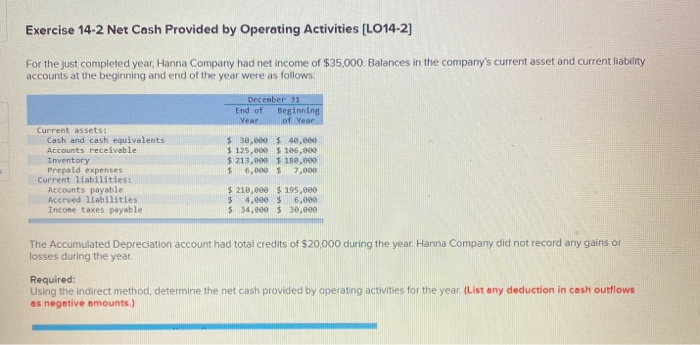

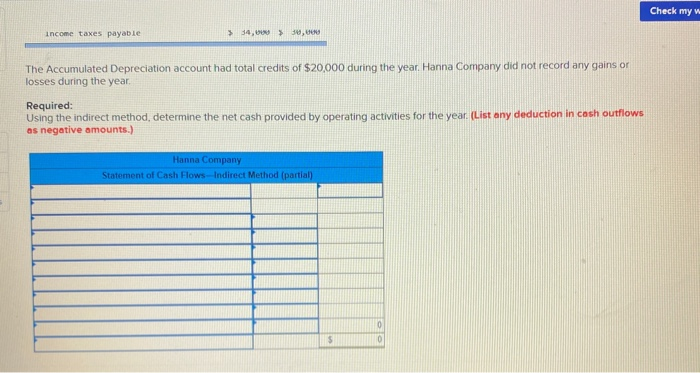

HW Check Exercise 14-1 Classifying Transactions [LO14-1) Below are certain events that took place at Hazzard, Inc., last year. a. Collected cash from customers, b. Paid cash to repurchase its own stock. c. Borrowed money from a creditor. d. Paid suppliers for inventory purchases. e. Repaid the principal amount of a debt. f. Paid interest to lenders. g. Paid a cash dividend to stockholders. h. Sold common stock 1. Loaned money to another entity j. Paid taxes to the government. k. Paid wages and salaries to employees. 1. Purchased equipment with cash. m. Paid bills to insurers and utility providers. Required: Indicate how each of the transaction would be classified on a statement of cash flows. Place an X in the Operating. Investing, or Financing column as appropriate Activity Check my work Required: Indicate how each of the transaction would be classified on a statement of cash flows. Place an X in the Operating, Investing, or Financing column as appropriate Activity Operating Investing Financing Transaction a Collected cash from customers b. Paid cash to repurchase its own stock c Borrowed money from a creditor d. Paid suppliers for inventory purchases e. Repaid the principal amount of a debt Paid interest to lenders g. Paid a cash dividend to stockholders h Sold common stock Loaned money to another entity | Paid taxes to the government k Paid wages and salaries to employees Purchased equipment with cash m. Pald bills to insurers and utility providers Prey 1 of 4 !!! Next > Exercise 14-2 Net Cash Provided by Operating Activities (L014-2] For the just completed year, Hanna Company had net income of $35,000. Balances in the company's current asset and current liability accounts at the beginning and end of the year were as follows: Current assets: Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Current liabilities: Accounts payable Accrued liabilities Incone taxes payable December 31 End of Beginning Year of Year $ 3e.cee $ 40,00 $ 125,000 $ 106,000 $ 213,000 $180,000 $ 7.000 $ 210,000 $ 195,000 $ 4,000 $6,000 $ 34,000 $30,000 The Accumulated Depreciation account had total credits of $20.000 during the year. Hanna Company did not record any gains or losses during the year. Required: Using the indirect method, determine the net cash provided by operating activities for the year. (List any deduction in cash outflows os negative amounts.) Check my w income taxes payable 334, 30,000 The Accumulated Depreciation account had total credits of $20,000 during the year Hanna Company did not record any gains or losses during the year. Required: Using the indirect method, determine the net cash provided by operating activities for the year. (List any deduction in cash outflows as negative amounts.) Hanna Company Statement of Cash Flows-Indirect Method (partial) 0 $ 0