Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[HW Problem 02] - Present Worth You supervise an aging production line that constantly needs maintenance and new parts. Last month you spent $25,000

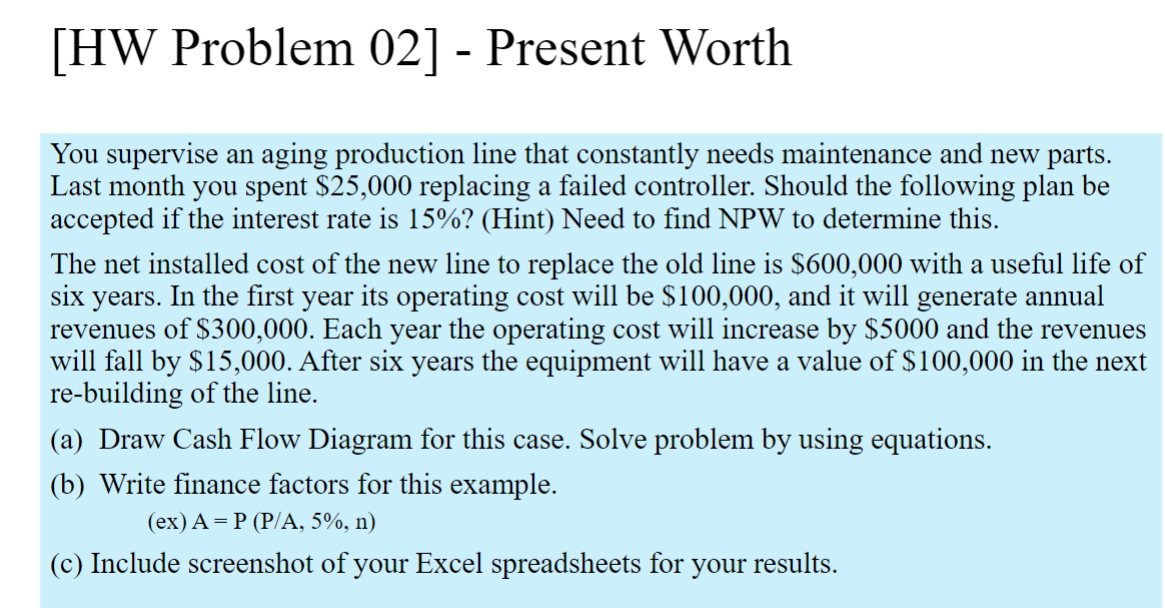

[HW Problem 02] - Present Worth You supervise an aging production line that constantly needs maintenance and new parts. Last month you spent $25,000 replacing a failed controller. Should the following plan be accepted if the interest rate is 15%? (Hint) Need to find NPW to determine this. The net installed cost of the new line to replace the old line is $600,000 with a useful life of six years. In the first year its operating cost will be $100,000, and it will generate annual revenues of $300,000. Each year the operating cost will increase by $5000 and the revenues will fall by $15,000. After six years the equipment will have a value of $100,000 in the next re-building of the line. (a) Draw Cash Flow Diagram for this case. Solve problem by using equations. (b) Write finance factors for this example. (ex) AP (P/A, 5%, n) (c) Include screenshot of your Excel spreadsheets for your results.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started