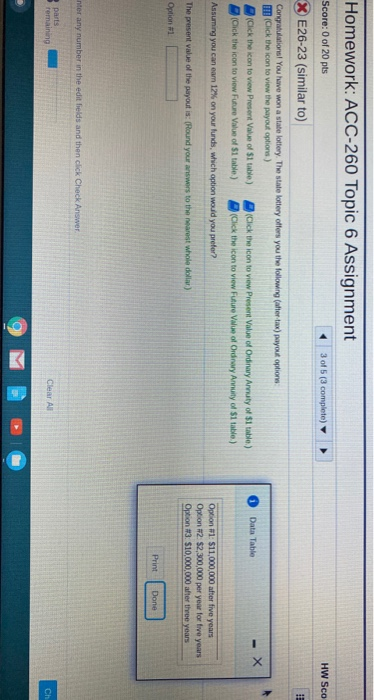

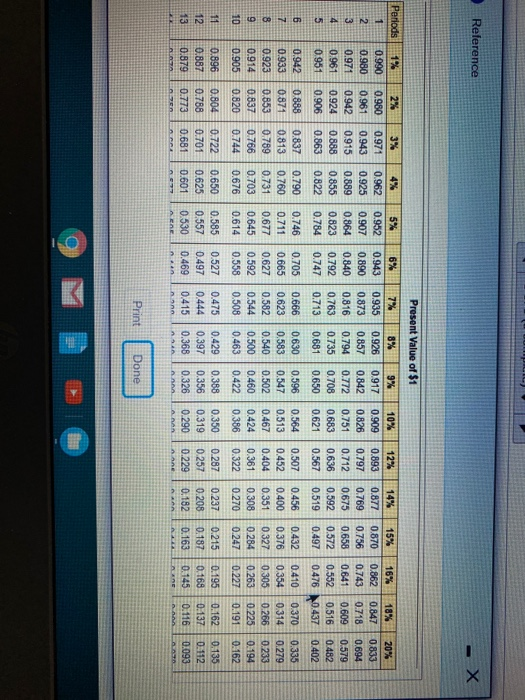

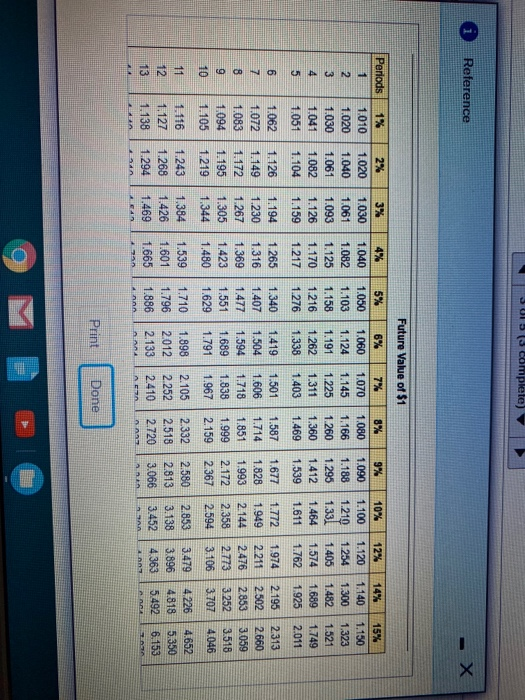

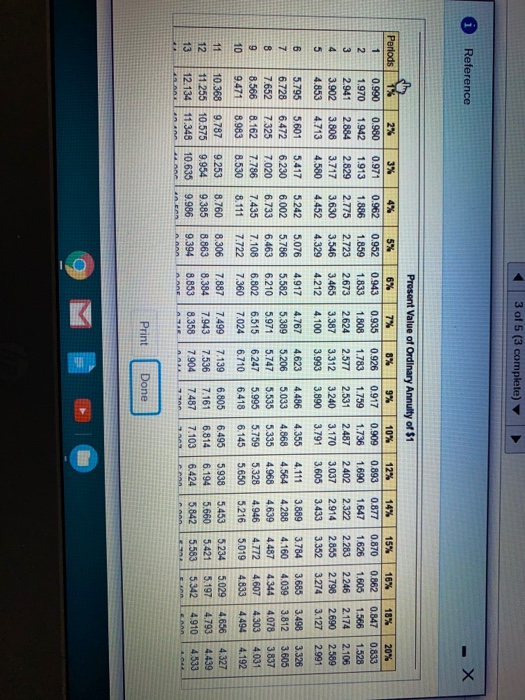

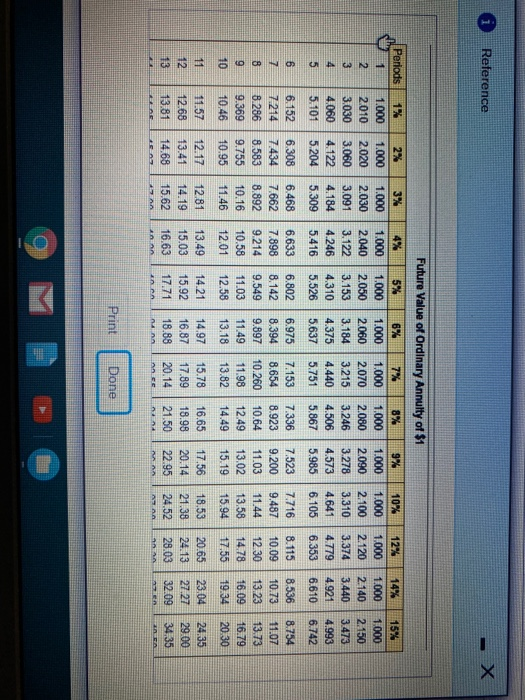

HW Sco F Homework: ACC-260 Topic 6 Assignment Score: 0 of 20 pts 3 of 5 (3 complete) X E26-23 (similar to) Congratulations! You have won a state lottery. The state lottery offers you the following after tax) payout options (Click the icon to view the payout options) (Click the icon to view Present Value of $1 table) (Click the icon to view Present Value of Ordinary Arvuty of $1 table) (Click the icon to view Future Value of $1 table) (Click the icon to view Future Value of Ordinary Annuity of $1 table) Data Table - X Assuming you can earn 12% on your funds, which option would you prefer? Option #1: $11,000,000 after five years Option 2 $2,300,000 per year for five years Option #3: $10,000,000 after three years The present value of the payout is: (Pound your answers to the nearest whole dollar) Option 1 Print Done nter any number in the edit fields and then click Check Answer parts remaining Clear All CH Reference Present Value of $1 Periods 2 1% 0.990 0.980 0.971 0.961 0.951 2% 0.960 0.961 0.942 0.924 0.906 3% 0.971 0.943 0.915 0.888 0.863 0.962 0.925 0.889 0.855 0.822 5% 0.952 0.907 0.864 0.823 0.784 6% 0.943 0.890 0.840 0.792 0.747 7% 0.935 0.873 0.816 0.763 0.713 8% 0.926 0.857 0.794 0.735 0.681 0.917 0.842 0.772 0.708 0.650 10% 0.909 0.826 0.751 0.683 0.621 12% 0.893 0.797 0.712 0.636 0.567 14% 0.877 0.769 0.675 0.592 0.519 15% 0.870 0.756 0.658 0.572 0.497 16% 0.862 0.743 0.641 0.552 0.476 18% 0.847 0.718 0.609 0.516 0.437 20% 0.833 0.694 0.579 0.482 0.402 5 6 7 8 9 10 0.942 0.933 0.923 0.914 0.905 0.888 0.871 0.853 0.837 0.820 0.837 0.813 0.789 0.766 0.744 0.790 0.760 0.731 0.703 0.676 0.746 0.711 0.677 0.645 0.614 0.705 0.665 0.627 0.592 0.558 0.666 0.623 0.582 0.544 0.508 0.630 0.583 0.540 0.500 0.463 0.596 0.547 0.502 0.460 0.422 0.564 0.513 0.467 0.424 0.386 0.507 0.452 0.404 0.361 0.322 0.456 0.400 0.351 0.308 0.270 0.432 0.376 0.327 0.410 0.354 0.305 0.263 0.227 0.370 0.314 0.266 0.225 0.191 0.335 0.279 0.233 0.194 0.162 0 284 0.247 11 12 13 0.896 0.887 0.879 0.804 0.788 0.773 0.722 0.701 0.681 0.650 0.625 0.601 0.585 0.557 0.530 ANE 0.527 0.497 0.469 0.475 0.444 0.415 0.429 0.397 0.368 0.388 0.356 0.326 0.350 0.319 0290 0.287 0.257 0.229 0.237 0.208 0.182 0.215 0.187 0.163 0.195 0.168 0.145 0.162 0.137 0.116 0.135 0.112 0.093 ACT dan An e Print Done O SUI 55 complete) i Reference X Future Value of $1 6% 7% 1.070 8% 10% 1.100 1.219 Periods 1 2 3 4 5 1% 1.010 1.020 1.030 1.041 1051 2% 1.020 1.040 1.061 1.082 1.104 3% 1.030 1,061 1.093 1.126 1.159 4% 1.040 1.082 1.125 1.170 1217 5% 1.050 1.103 1.158 1.216 1.276 1.060 1.124 1.191 1.262 1.338 1.145 1.225 1.080 1.166 1.260 1.360 1.469 9% 1.090 1.188 1.295 1.412 1.539 1.33 12% 1.120 1.254 1.405 1.574 1.762 14% 1.140 1.300 1.482 1.689 1.925 15% 1.150 1.323 1.521 1.749 2.011 1.311 1.464 1.611 1.403 6 7 8 9 10 1.062 1.072 1.083 1.094 1.105 1.126 1.149 1.172 1.195 1.219 1.194 1.230 1 267 1.305 1.344 1.265 1.316 1.369 1.423 1.480 1.340 1.407 1.477 1.551 1.629 1.419 1.504 1.594 1.689 1.791 1.501 1.606 1.718 1.838 1.967 1.587 1.714 1.851 1.999 2.159 1.677 1.828 1.993 2.172 2 367 1.772 1.949 2.144 2.358 2.594 1.974 2.211 2.476 2.773 3.106 2. 195 2502 2.853 3.252 3.707 2.313 2.660 3.059 3.518 4.046 11 12 13 1.116 1.127 1.138 1 243 1.268 1.294 1,384 1.426 1.469 1.539 1.601 1.665 1.710 1.796 1.886 1.898 2012 2.133 ANA 2.105 2.252 2.410 2.332 2.518 2.720 2.580 2.813 3.066 2.853 3.138 3.452 3.479 3.896 4.363 4.226 4.818 5.492 4.652 5.350 6.153 TATA TA An Print Done C 3 of 5 (3 complete) Reference - X 5% 1 0.952 1.859 2.723 3.546 4.329 Present Value of Ordinary Annulty of $1 6% 7% 9% 10% 0943 0.935 0.926 0.917 0.909 1.833 1.808 1.783 1.759 1.736 2673 2.624 2.577 2.531 2487 3.465 3.387 3.312 3.240 3.170 4.212 4.100 3.993 3.890 3.791 12% 0.893 1.690 2402 3,037 3.605 14% 0.877 1.647 2.322 2.914 3.433 15% 0.870 1.626 2.283 2.855 3.352 16% 0.862 1.605 2.246 2.798 3.274 18% 0.847 1.566 2.174 2.690 3.127 20% 0.833 1.528 2.106 2.589 2.991 Periods 1% 2% 4% 0.990 0.980 0.971 0.962 2 1.970 1.942 1.913 1.886 3 2.941 2884 2.829 2.775 4 3.902 3.808 3.717 3.630 5 4.853 4.713 4.580 4.452 6 5.795 5.601 5.417 5.242 7 6.728 6.472 6.230 6.002 8 7.652 7.325 7,020 6.733 9 8.566 8.162 7.786 7.435 10 9.471 8.983 8.530 8.111 11 10.368 9.787 9.253 8.760 12 11.255 10.575 9.954 9.385 13 12.134 11.348 10.6359.986 ARA In EAN 5.076 5.786 6.463 7.108 7.722 4.917 5.582 6.210 6.802 7.360 4.767 5.389 5.971 6.515 7.024 4.623 5.206 5.747 6.247 6.710 4.486 5.033 5.535 5.995 6.418 4.355 4.868 5.335 5.759 6.145 4.111 4.564 4.968 5.328 5.650 3.889 4.288 4.639 4.946 5.216 3.784 4.160 4.487 4.772 5.019 3.685 4.039 4.344 4.607 4.833 3.498 3.812 4.078 4.303 4.494 3.326 3.605 3.837 4.031 4.192 8.306 8.863 9.394 7.887 8.384 8.853 ARE 7.499 7.943 8.358 7.139 7.536 7.904 AAA 6.805 7.161 7.487 6.495 6.814 7.103 5.938 6.194 6.424 5.453 5.660 5.842 5.234 5.421 5.583 5.029 5.197 5.342 4.656 4.793 4.910 4.327 4.439 4.533 ATE AAAA AL Print Done Reference - X Periods 1 2 3 4 5 1% 1.000 2.010 3.030 4.060 5.101 2% 1.000 2020 3.060 4.122 5.204 3% 1.000 2.030 3.091 4.184 5,309 Future Value of Ordinary Annulty of $1 5% 6% 7% 8% 9% 1.000 1.000 1.000 1.000 1.000 1.000 2.040 2.050 2.060 2.070 2.080 2.090 3.122 3.153 3.184 3.215 3.246 3.278 4.246 4.310 4.375 4.440 4.506 4.573 5.416 5.526 5.637 5.751 5.867 5.985 10% 1.000 2.100 3.310 4.641 6.105 12% 1.000 2.120 3.374 4.779 6.353 14% 1.000 2.140 3.440 4.921 6.610 15% 1000 2.150 3.473 4.993 6.742 6 7 8 6.152 7.214 8.286 9.369 10.46 6.308 7.434 8.583 9.755 10.95 6.468 7.662 8,892 10.16 11.46 6.633 7.898 9.214 10.58 12.01 6.802 8.142 9.549 11.03 12.58 6.975 8.394 9.897 11.49 13.18 7.153 8.654 10.260 11.98 13.82 7.336 8.923 10.64 12.49 14.49 7.523 9.200 11.03 13.02 15.19 7.716 9.487 11.44 13.58 15.94 8.115 10.09 12.30 14.78 17.55 8.536 10.73 13.23 16.09 1934 8.754 11.07 13.73 16.79 20.30 9 10 11 12 13 11.57 12.68 13.81 12.17 13.41 14.68 12.81 14.19 15.62 13.49 15.03 16.63 14.21 15.92 17.71 14.97 16.87 18.88 15.78 17.89 20.14 16.65 18.98 21.50 17.56 20.14 22.95 18.53 21.38 24.52 20.65 24.13 28.03 23.04 27.27 32.09 24:35 29.00 34 35 2 Once EEA MAA AN A ELAS inn Inn LEO Print Done