Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HW2: 1, 3, 6, 8, 9, 24, 33, 42, 48, 54 2.1 Construct the cash-flow diagrams and derive the formulas for the factors listed below

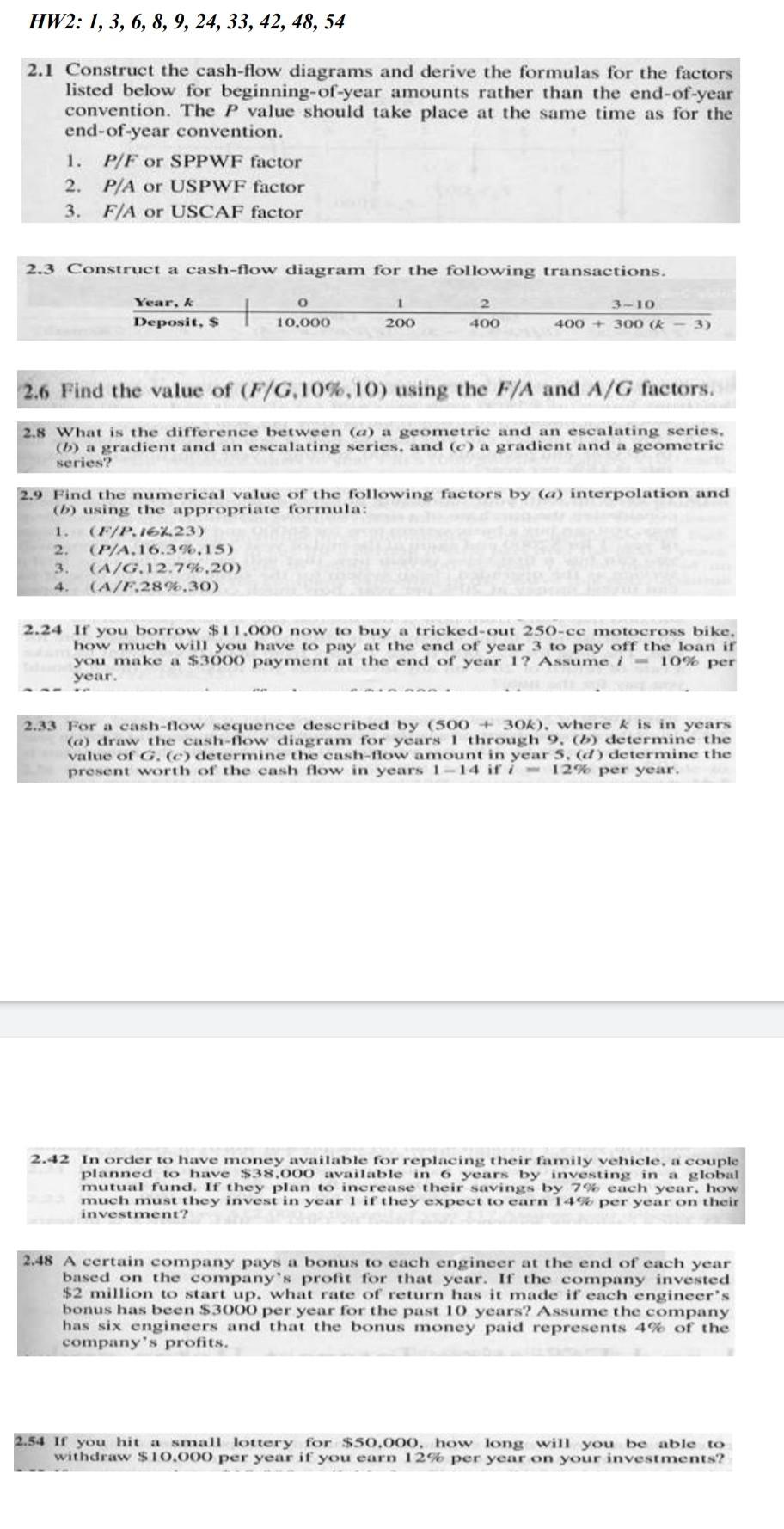

HW2: 1, 3, 6, 8, 9, 24, 33, 42, 48, 54 2.1 Construct the cash-flow diagrams and derive the formulas for the factors listed below for beginning-of-year amounts rather than the end-of-year convention. The P value should take place at the same time as for the end-of-year convention. 1. P/F or SPPWF factor 2. P/A or USPWF factor 3. F/A or USCAF factor 2.3 Construct a cash-flow diagram for the following transactions. Year, k Deposit, s 1 200 10.000 3-10 400 + 300 (k 400 3) 2.6 Find the value of (F/G 10%,10) using the F/A and A/G factors. 2.8 What is the difference between (a) a geometric and an escalating series. (b) a gradient and an escalating series, and (c) a gradient and a geometric series? 2.9 Find the numerical value of the following factors by (a) interpolation and (b) using the appropriate formula: 1. (F/P.16%23) 2. (P/A.16.3%.15) 3. (A/G.12.7%,20) (A/F.28%.30) 2.24 If you borrow $11.000 now to buy a tricked-out 250-cc motocross bike, how much will you have to pay at the end of year 3 to pay off the loan ir you make a $3000 payment at the end of year 12 Assume i = 10% per year. 2.33 For a cash-flow sequence described by (500 + 30k). where k is in years (a) draw the cash-flow diagram for years 1 through 9, (b) determine the value of G. (c) determine the cash-flow amount in year 5. (d) determine the present worth of the cash flow in years 1-14 if i 12% per year. 2.42 In order to have money available for replacing their family vehicle, a couple planned to have $38.000 available in 6 years by investing in a global mutual fund. If they plan to increase their savings by 7% each year, how much must they invest in year 1 if they expect to earn 14% per year on their investment? 2.48 A certain company pays a bonus to each engineer at the end of each year based on the company's profit for that year. If the company invested $2 million to start up. what rate of return has it made if each engineer's bonus has been $3000 per year for the past 10 years? Assume the company has six engineers and that the bonus money paid represents 4% of the company's profits. 2.54 If you hit a small lottery for $50,000, how long will you be able to withdraw $10.000 per year if you earn 12% per year on your investments? HW2: 1, 3, 6, 8, 9, 24, 33, 42, 48, 54 2.1 Construct the cash-flow diagrams and derive the formulas for the factors listed below for beginning-of-year amounts rather than the end-of-year convention. The P value should take place at the same time as for the end-of-year convention. 1. P/F or SPPWF factor 2. P/A or USPWF factor 3. F/A or USCAF factor 2.3 Construct a cash-flow diagram for the following transactions. Year, k Deposit, s 1 200 10.000 3-10 400 + 300 (k 400 3) 2.6 Find the value of (F/G 10%,10) using the F/A and A/G factors. 2.8 What is the difference between (a) a geometric and an escalating series. (b) a gradient and an escalating series, and (c) a gradient and a geometric series? 2.9 Find the numerical value of the following factors by (a) interpolation and (b) using the appropriate formula: 1. (F/P.16%23) 2. (P/A.16.3%.15) 3. (A/G.12.7%,20) (A/F.28%.30) 2.24 If you borrow $11.000 now to buy a tricked-out 250-cc motocross bike, how much will you have to pay at the end of year 3 to pay off the loan ir you make a $3000 payment at the end of year 12 Assume i = 10% per year. 2.33 For a cash-flow sequence described by (500 + 30k). where k is in years (a) draw the cash-flow diagram for years 1 through 9, (b) determine the value of G. (c) determine the cash-flow amount in year 5. (d) determine the present worth of the cash flow in years 1-14 if i 12% per year. 2.42 In order to have money available for replacing their family vehicle, a couple planned to have $38.000 available in 6 years by investing in a global mutual fund. If they plan to increase their savings by 7% each year, how much must they invest in year 1 if they expect to earn 14% per year on their investment? 2.48 A certain company pays a bonus to each engineer at the end of each year based on the company's profit for that year. If the company invested $2 million to start up. what rate of return has it made if each engineer's bonus has been $3000 per year for the past 10 years? Assume the company has six engineers and that the bonus money paid represents 4% of the company's profits. 2.54 If you hit a small lottery for $50,000, how long will you be able to withdraw $10.000 per year if you earn 12% per year on your investments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started