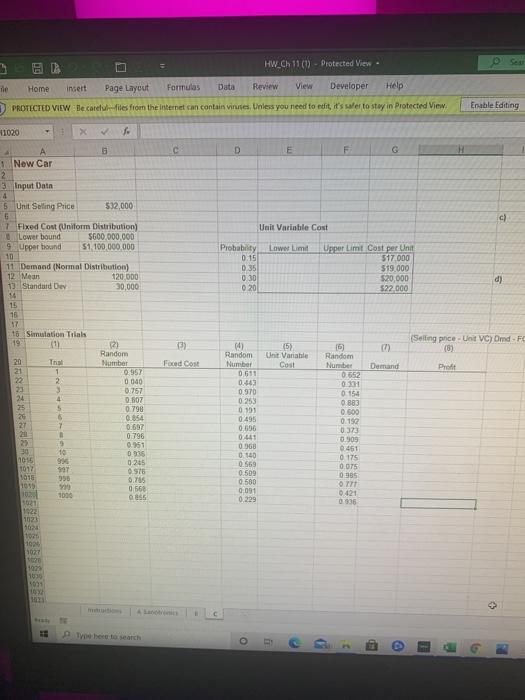

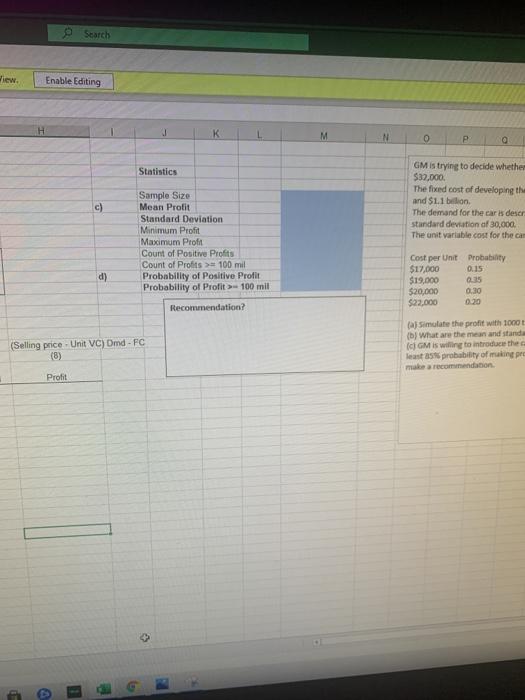

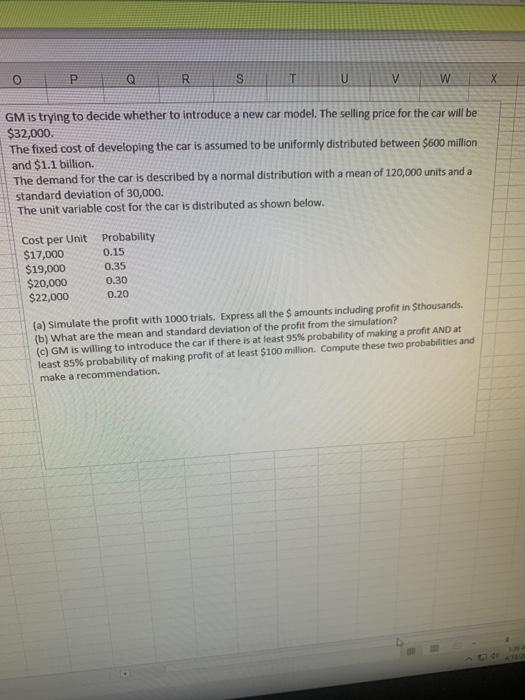

HW_Ch 11 (1) - Protected View - Home Insert Page Layout Formulas Data Review View Developer Help PROTECTED VIEW tle care files from the Internet can contain viruses. Unless you need to edit, it's safe to stay in Protected View The Enable Editing 11020 > D E c) Unit Variable Cost Lower Lima Probability 0.15 0.35 0 30 020 Upper Lim Cost per Unit 517.000 $19.000 $20,000 $22.000 d) 6 1 New Car 2 3 Input Data 4 5 Unit Selling Price $32,000 5 1 Fixed Cost (Uniform Distribution) Lower bound $600.000.000 9 Upper bound 51.100.000.000 10 11 Demand (Normal Distribution) 12 Mean 120.000 13 Standard De 30,000 14 15 16 17 16. Simulation Trials 19 11 123 Random 20 Number 21 1 0957 2 0 040 23 3 0.757 24 4 0507 25 0.798 20 0.854 27 0.632 0.796 25 19 0.951 30 10 0915 1016 994 0.25 1017 997 0.976 1618 956 1019 0.568 102 1000 0855 101 (Selling price - Unt VC) Omd F 13) 0 15) Unit Variable Food Cost Demand Pret 2,rs (4) Random Number 0610 0.643 0.970 0.265 0191 0.495 0696 0 0.368 0.140 0.569 0.509 0.580 0.091 0.299 5) Random Nurmber 0.652 011 0 154 0883 0.000 0.192 0373 0.909 0.461 0-175 0.075 0905 TIT 0421 0936 TUS 1024 1024 1027 o B . Search View. Enable Editing K M P Statistics GM is trying to decide whether $32,000 The fixed cost of developing the and $1.1 billion The demand for the car is deser standard deviation of 30,000 The unit variable cost for the cam c) Sample Size Mean Prolit Standard Deviation Minimum Profit Maximum Profit Count of Positive Profits Count of Profits > 100 mil Probability of Positive Profit Probability of Profit > 100 mil Recommendation? d) Cost per Unit Probability $17,000 0.15 $19,000 0.35 $20,000 0:30 $22.000 0:20 (Selling price - Unit VC) Dmd - FC (8) (aj Simulate the profit with 1000 (b) What are the mean and stand I GM is willing to introduce the least probability of making pre make a recommendation Profit > G P R S T U V w GM is trying to decide whether to introduce a new car model. The selling price for the car will be $32,000. The fixed cost of developing the car is assumed to be uniformly distributed between $600 million and $1.1 billion. The demand for the car is described by a normal distribution with a mean of 120,000 units and a standard deviation of 30,000. The unit variable cost for the car is distributed as shown below. Cost per Unit $17,000 $19,000 $20,000 $22,000 Probability 0.15 0.35 0.30 0.20 (a) Simulate the profit with 1000 trials. Express all the $ amounts including profit in Sthousands. (b) What are the mean and standard deviation of the profit from the simulation? (c) GM is willing to introduce the car if there is at least 95% probability of making a profit AND at least 85% probability of making profit of at least $100 million. Compute these two probabilities and make a recommendation HW_Ch 11 (1) - Protected View - Home Insert Page Layout Formulas Data Review View Developer Help PROTECTED VIEW tle care files from the Internet can contain viruses. Unless you need to edit, it's safe to stay in Protected View The Enable Editing 11020 > D E c) Unit Variable Cost Lower Lima Probability 0.15 0.35 0 30 020 Upper Lim Cost per Unit 517.000 $19.000 $20,000 $22.000 d) 6 1 New Car 2 3 Input Data 4 5 Unit Selling Price $32,000 5 1 Fixed Cost (Uniform Distribution) Lower bound $600.000.000 9 Upper bound 51.100.000.000 10 11 Demand (Normal Distribution) 12 Mean 120.000 13 Standard De 30,000 14 15 16 17 16. Simulation Trials 19 11 123 Random 20 Number 21 1 0957 2 0 040 23 3 0.757 24 4 0507 25 0.798 20 0.854 27 0.632 0.796 25 19 0.951 30 10 0915 1016 994 0.25 1017 997 0.976 1618 956 1019 0.568 102 1000 0855 101 (Selling price - Unt VC) Omd F 13) 0 15) Unit Variable Food Cost Demand Pret 2,rs (4) Random Number 0610 0.643 0.970 0.265 0191 0.495 0696 0 0.368 0.140 0.569 0.509 0.580 0.091 0.299 5) Random Nurmber 0.652 011 0 154 0883 0.000 0.192 0373 0.909 0.461 0-175 0.075 0905 TIT 0421 0936 TUS 1024 1024 1027 o B . Search View. Enable Editing K M P Statistics GM is trying to decide whether $32,000 The fixed cost of developing the and $1.1 billion The demand for the car is deser standard deviation of 30,000 The unit variable cost for the cam c) Sample Size Mean Prolit Standard Deviation Minimum Profit Maximum Profit Count of Positive Profits Count of Profits > 100 mil Probability of Positive Profit Probability of Profit > 100 mil Recommendation? d) Cost per Unit Probability $17,000 0.15 $19,000 0.35 $20,000 0:30 $22.000 0:20 (Selling price - Unit VC) Dmd - FC (8) (aj Simulate the profit with 1000 (b) What are the mean and stand I GM is willing to introduce the least probability of making pre make a recommendation Profit > G P R S T U V w GM is trying to decide whether to introduce a new car model. The selling price for the car will be $32,000. The fixed cost of developing the car is assumed to be uniformly distributed between $600 million and $1.1 billion. The demand for the car is described by a normal distribution with a mean of 120,000 units and a standard deviation of 30,000. The unit variable cost for the car is distributed as shown below. Cost per Unit $17,000 $19,000 $20,000 $22,000 Probability 0.15 0.35 0.30 0.20 (a) Simulate the profit with 1000 trials. Express all the $ amounts including profit in Sthousands. (b) What are the mean and standard deviation of the profit from the simulation? (c) GM is willing to introduce the car if there is at least 95% probability of making a profit AND at least 85% probability of making profit of at least $100 million. Compute these two probabilities and make a recommendation