hy

Question 2.1 and Question 2.2 needs to be answered

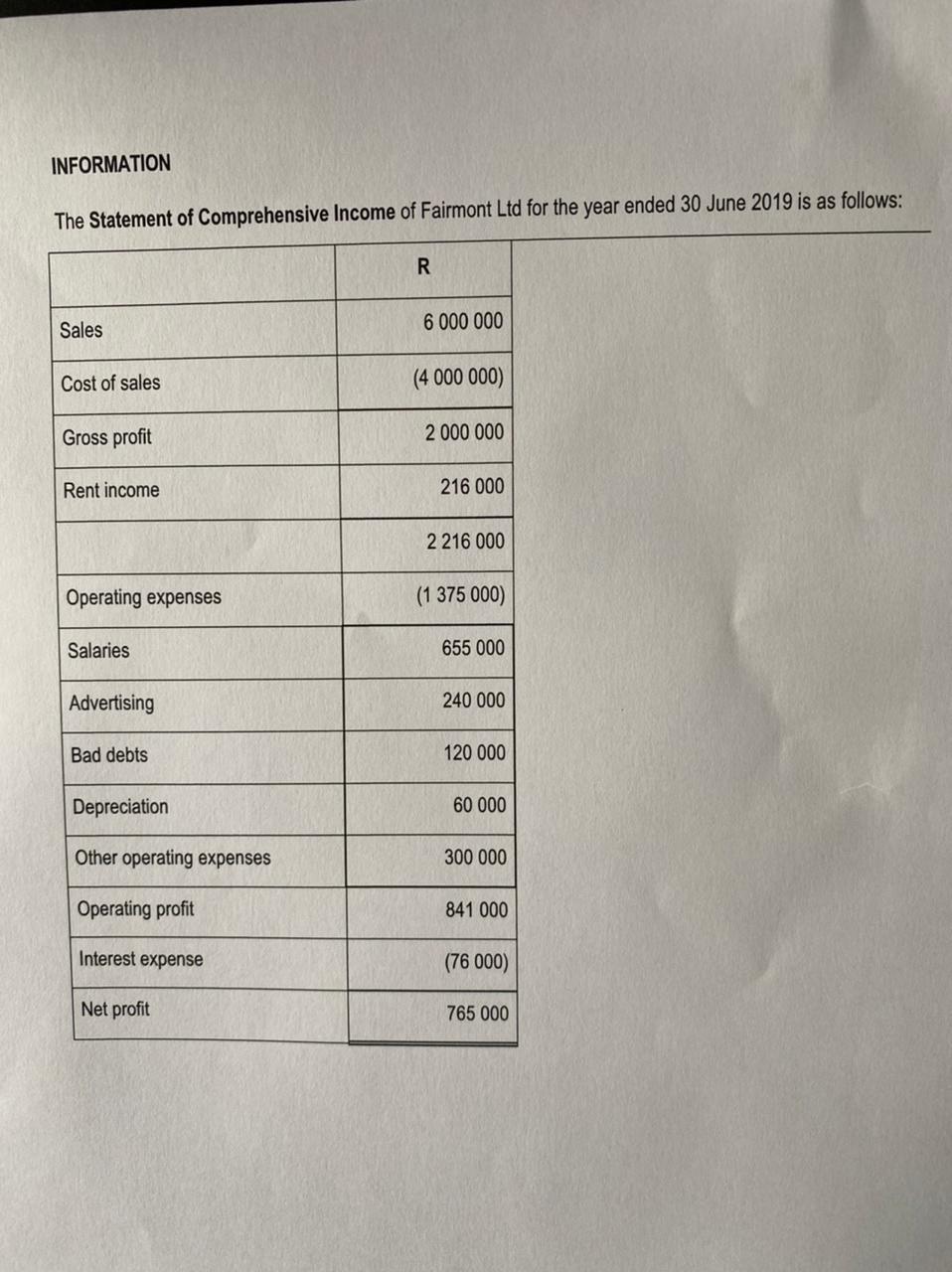

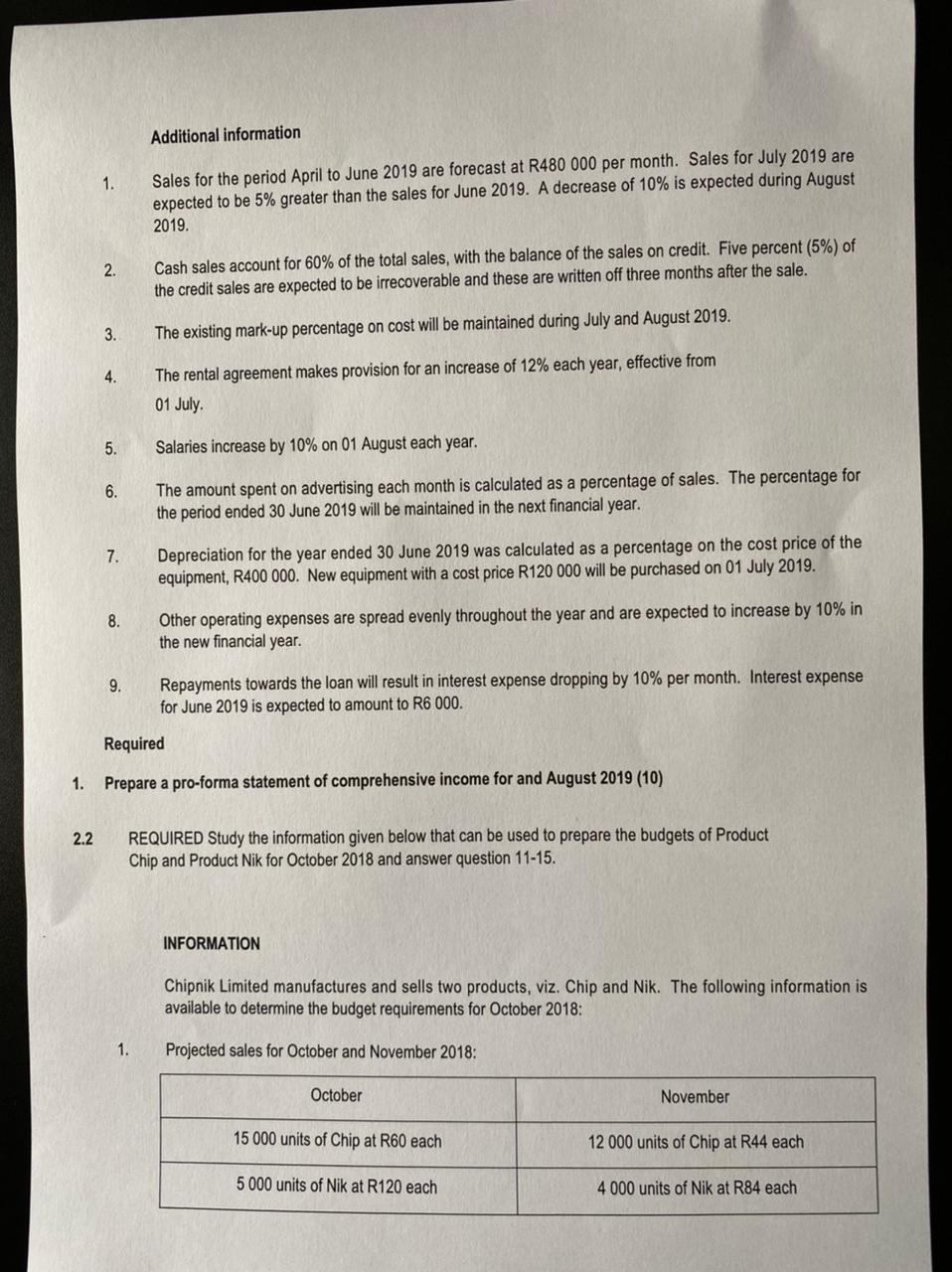

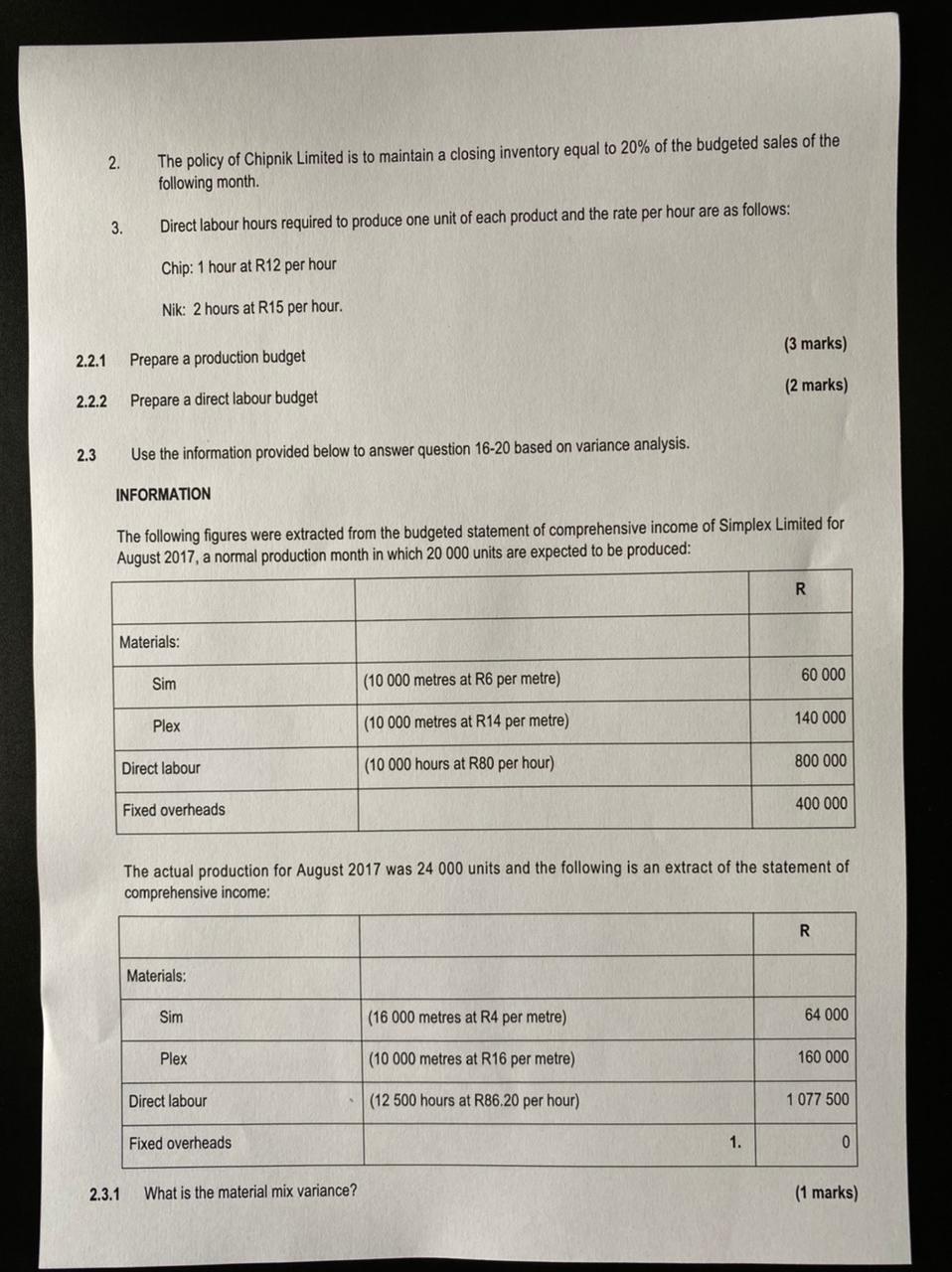

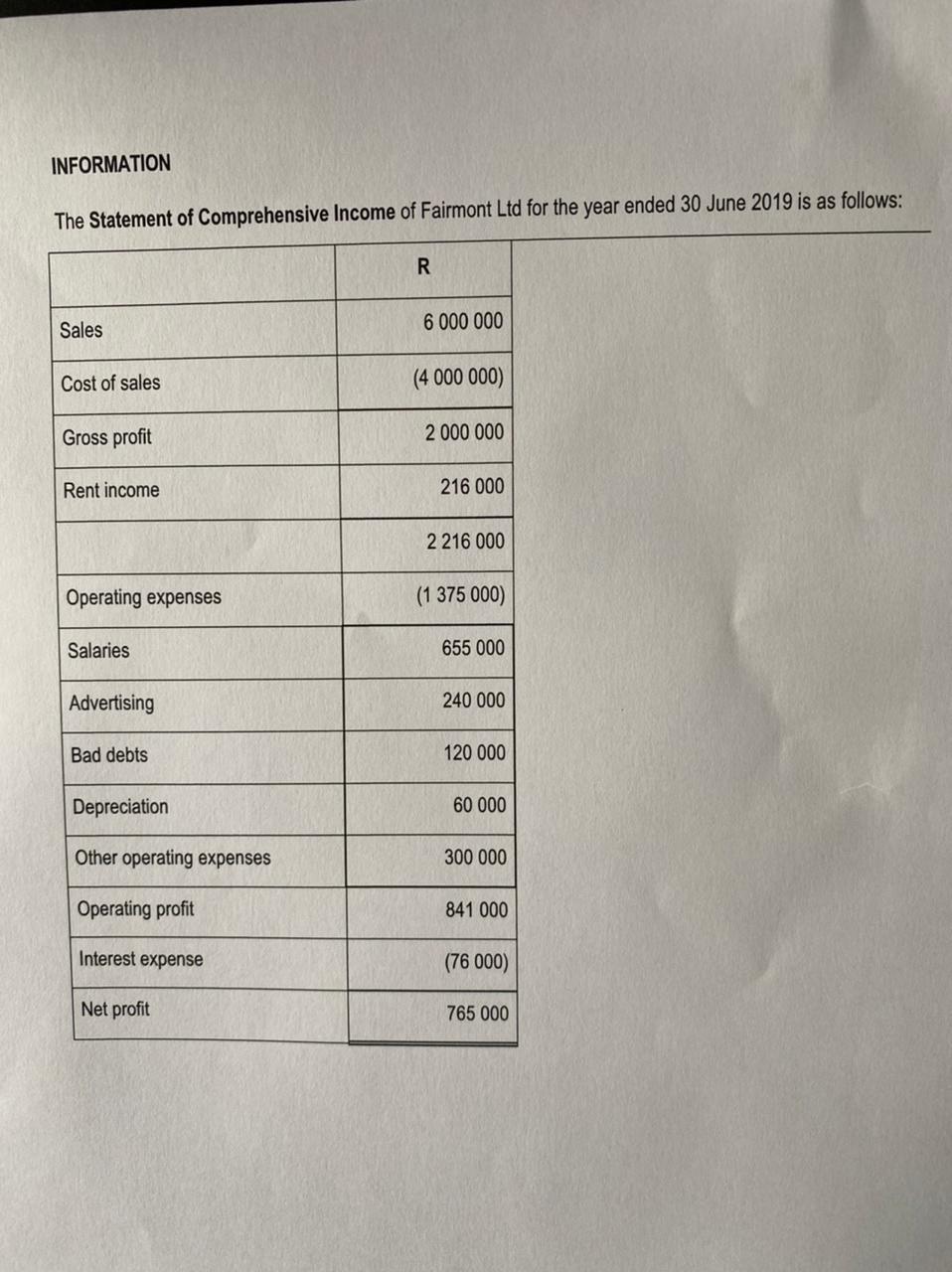

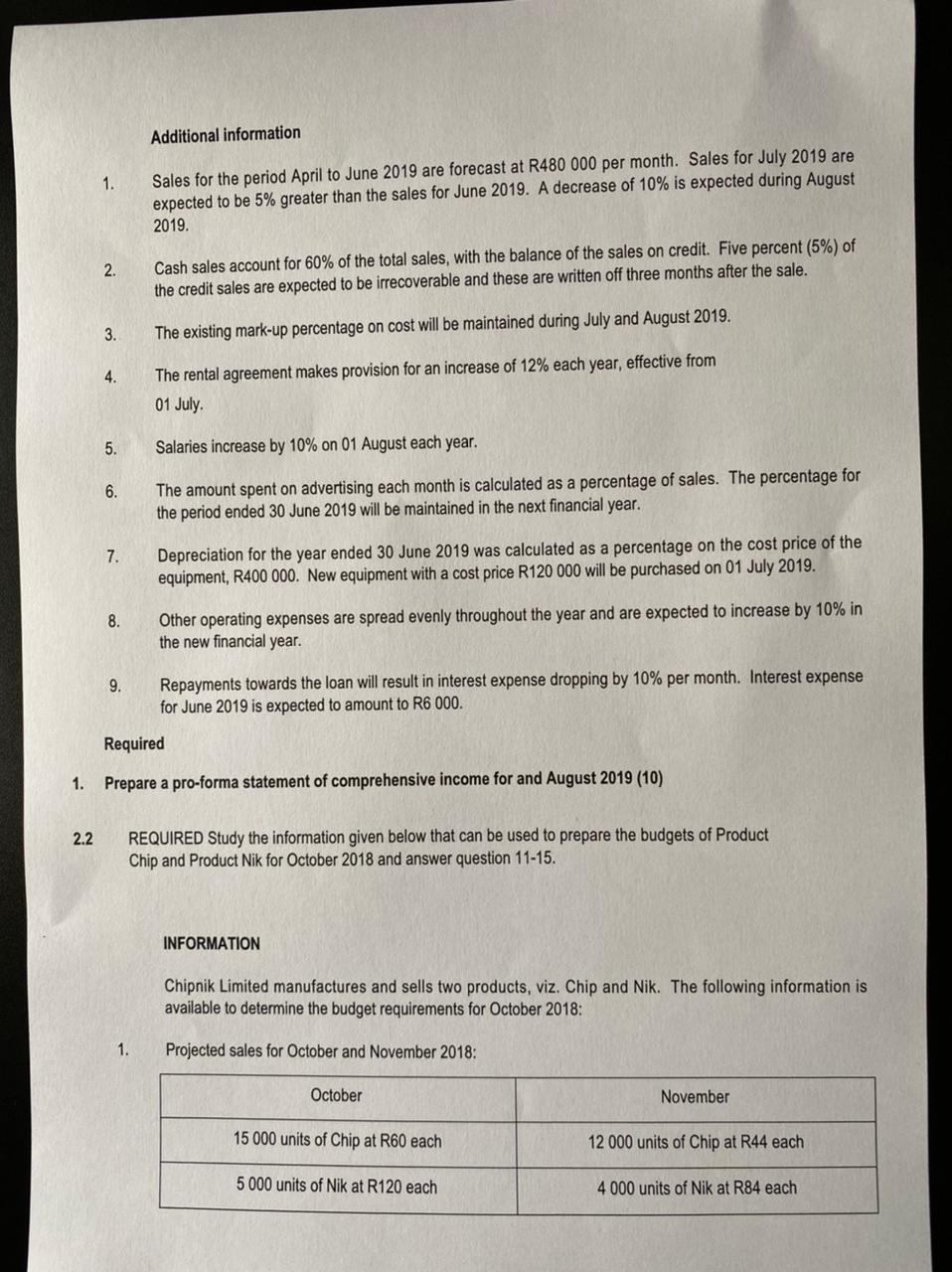

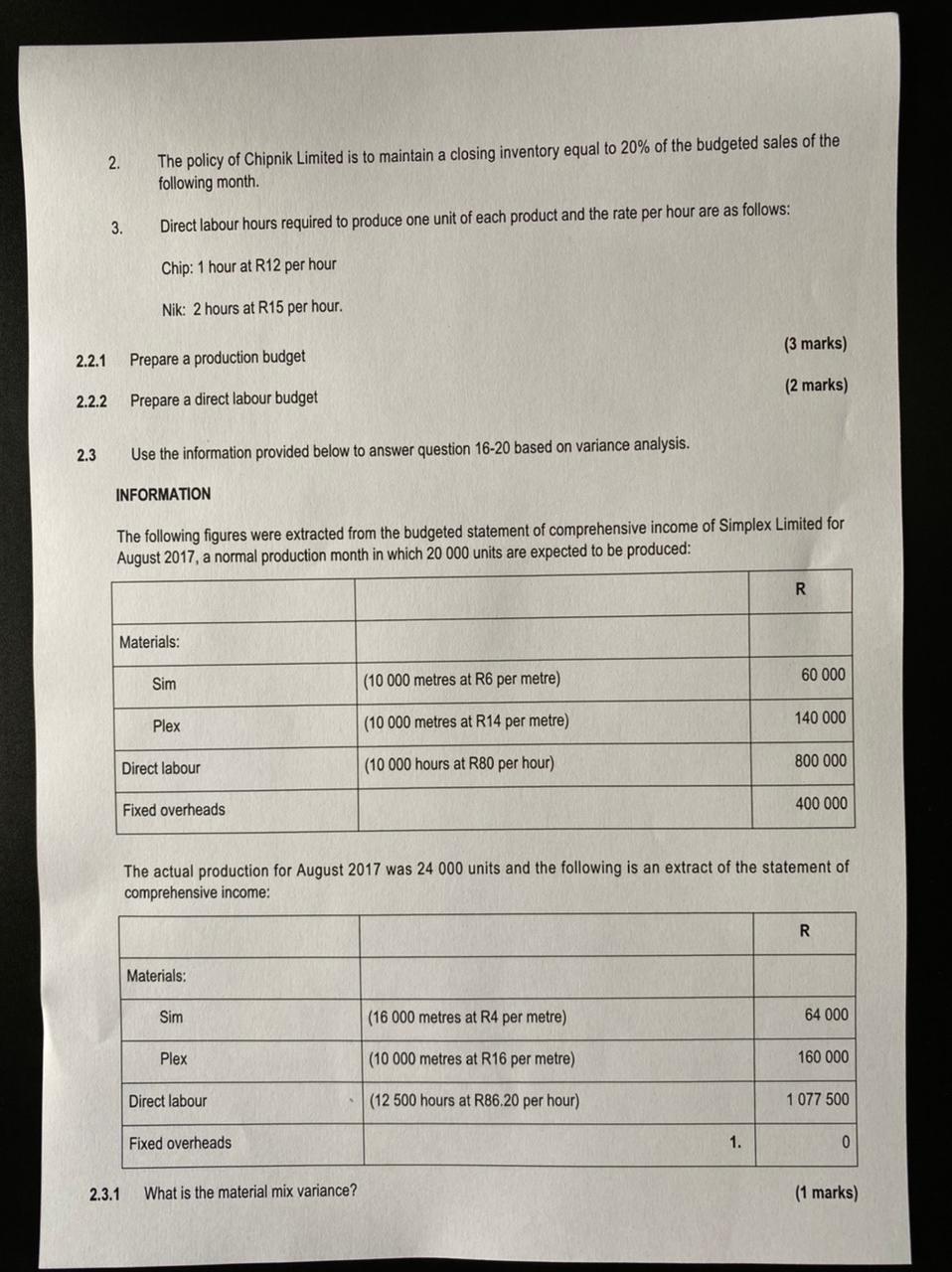

QUESTION 2 2.1 (10 marks) REQUIRED Study the Statement of Comprehensive Income of Fairmont Ltd and additional information below and answer questions below based on the Pro-Forma Statement of Comprehensive Income for July and August 2019. INFORMATION The Statement of Comprehensive Income of Fairmont Ltd for the year ended 30 June 2019 is as follows: R Sales 6 000 000 Cost of sales (4 000 000) Gross profit 2 000 000 Rent income 216 000 2 216 000 Operating expenses (1 375 000) Salaries 655 000 Advertising 240 000 Bad debts 120 000 Depreciation 60 000 Other operating expenses 300 000 Operating profit 841 000 Interest expense (76 000) Net profit 765 000 Additional information 1. Sales for the period April to June 2019 are forecast at R480 000 per month. Sales for July 2019 are expected to be 5% greater than the sales for June 2019. A decrease of 10% is expected during August 2019. 2. Cash sales account for 60% of the total sales, with the balance of the sales on credit. Five percent (5%) of the credit sales are expected to be irrecoverable and these are written off three months after the sale. 3. The existing mark-up percentage on cost will be maintained during July and August 2019. 4. The rental agreement makes provision for an increase of 12% each year, effective from 01 July 5. Salaries increase by 10% on 01 August each year. 6. The amount spent on advertising each month is calculated as a percentage of sales. The percentage for the period ended 30 June 2019 will be maintained in the next financial year. 7. Depreciation for the year ended 30 June 2019 was calculated as a percentage on the cost price of the equipment, R400 000. New equipment with a cost price R120 000 will be purchased on 01 July 2019. 8. Other operating expenses are spread evenly throughout the year and are expected to increase by 10% in the new financial year. 9. Repayments towards the loan will result in interest expense dropping by 10% per month. Interest expense for June 2019 is expected to amount to R6 000. Required 1. Prepare a pro-forma statement of comprehensive income for and August 2019 (10) 2.2 REQUIRED Study the information given below that can be used to prepare the budgets of Product Chip and Product Nik for October 2018 and answer question 11-15. INFORMATION Chipnik Limited manufactures and sells two products, viz. Chip and Nik. The following information is available to determine the budget requirements for October 2018: 1. Projected sales for October and November 2018: October November 15 000 units of Chip at R60 each 12 000 units of Chip at R44 each 5 000 units of Nik at R120 each 4 000 units of Nik at R84 each 2. The policy of Chipnik Limited is to maintain a closing inventory equal to 20% of the budgeted sales of the following month. 3. Direct labour hours required to produce one unit of each product and the rate per hour are as follows: Chip: 1 hour at R12 per hour Nik: 2 hours at R15 per hour. (3 marks) 2.2.1 Prepare a production budget (2 marks) 2.2.2 Prepare a direct labour budget 2.3 Use the information provided below to answer question 16-20 based on variance analysis. INFORMATION The following figures were extracted from the budgeted statement of comprehensive income of Simplex Limited for August 2017, a normal production month in which 20 000 units are expected to be produced: R Materials: Sim 60 000 (10 000 metres at R6 per metre) Plex (10 000 metres at R14 per metre) 140 000 Direct labour (10 000 hours at R80 per hour) 800 000 Fixed overheads 400 000 The actual production for August 2017 was 24 000 units and the following is an extract of the statement of comprehensive income: R Materials: Sim (16 000 metres at R4 per metre) 64 000 Plex (10 000 metres at R16 per metre) 160 000 Direct labour (12 500 hours at R86.20 per hour) 1 077 500 Fixed overheads 1. 0 2.3.1 What is the material mix variance? (1 marks) 2.3.2 What is the material yield variance? (1 marks) 2.3.3 What is the material quantity variance? (1 marks) 2.3.4 What is the fixed manufacturing overheads volume capacity variance? (1 marks 2.3.5 What is the fixed manufacturing overheads volume efficiency variance? (1 marks) QUESTION 2 2.1 (10 marks) REQUIRED Study the Statement of Comprehensive Income of Fairmont Ltd and additional information below and answer questions below based on the Pro-Forma Statement of Comprehensive Income for July and August 2019. INFORMATION The Statement of Comprehensive Income of Fairmont Ltd for the year ended 30 June 2019 is as follows: R Sales 6 000 000 Cost of sales (4 000 000) Gross profit 2 000 000 Rent income 216 000 2 216 000 Operating expenses (1 375 000) Salaries 655 000 Advertising 240 000 Bad debts 120 000 Depreciation 60 000 Other operating expenses 300 000 Operating profit 841 000 Interest expense (76 000) Net profit 765 000 Additional information 1. Sales for the period April to June 2019 are forecast at R480 000 per month. Sales for July 2019 are expected to be 5% greater than the sales for June 2019. A decrease of 10% is expected during August 2019. 2. Cash sales account for 60% of the total sales, with the balance of the sales on credit. Five percent (5%) of the credit sales are expected to be irrecoverable and these are written off three months after the sale. 3. The existing mark-up percentage on cost will be maintained during July and August 2019. 4. The rental agreement makes provision for an increase of 12% each year, effective from 01 July 5. Salaries increase by 10% on 01 August each year. 6. The amount spent on advertising each month is calculated as a percentage of sales. The percentage for the period ended 30 June 2019 will be maintained in the next financial year. 7. Depreciation for the year ended 30 June 2019 was calculated as a percentage on the cost price of the equipment, R400 000. New equipment with a cost price R120 000 will be purchased on 01 July 2019. 8. Other operating expenses are spread evenly throughout the year and are expected to increase by 10% in the new financial year. 9. Repayments towards the loan will result in interest expense dropping by 10% per month. Interest expense for June 2019 is expected to amount to R6 000. Required 1. Prepare a pro-forma statement of comprehensive income for and August 2019 (10) 2.2 REQUIRED Study the information given below that can be used to prepare the budgets of Product Chip and Product Nik for October 2018 and answer question 11-15. INFORMATION Chipnik Limited manufactures and sells two products, viz. Chip and Nik. The following information is available to determine the budget requirements for October 2018: 1. Projected sales for October and November 2018: October November 15 000 units of Chip at R60 each 12 000 units of Chip at R44 each 5 000 units of Nik at R120 each 4 000 units of Nik at R84 each 2. The policy of Chipnik Limited is to maintain a closing inventory equal to 20% of the budgeted sales of the following month. 3. Direct labour hours required to produce one unit of each product and the rate per hour are as follows: Chip: 1 hour at R12 per hour Nik: 2 hours at R15 per hour. (3 marks) 2.2.1 Prepare a production budget (2 marks) 2.2.2 Prepare a direct labour budget 2.3 Use the information provided below to answer question 16-20 based on variance analysis. INFORMATION The following figures were extracted from the budgeted statement of comprehensive income of Simplex Limited for August 2017, a normal production month in which 20 000 units are expected to be produced: R Materials: Sim 60 000 (10 000 metres at R6 per metre) Plex (10 000 metres at R14 per metre) 140 000 Direct labour (10 000 hours at R80 per hour) 800 000 Fixed overheads 400 000 The actual production for August 2017 was 24 000 units and the following is an extract of the statement of comprehensive income: R Materials: Sim (16 000 metres at R4 per metre) 64 000 Plex (10 000 metres at R16 per metre) 160 000 Direct labour (12 500 hours at R86.20 per hour) 1 077 500 Fixed overheads 1. 0 2.3.1 What is the material mix variance? (1 marks) 2.3.2 What is the material yield variance? (1 marks) 2.3.3 What is the material quantity variance? (1 marks) 2.3.4 What is the fixed manufacturing overheads volume capacity variance? (1 marks 2.3.5 What is the fixed manufacturing overheads volume efficiency variance? (1 marks)