Question

Hybe Company distributes rubber tires, automotive oils and lubricants to many transport companies and retailers all over the region. The company offers a contract term

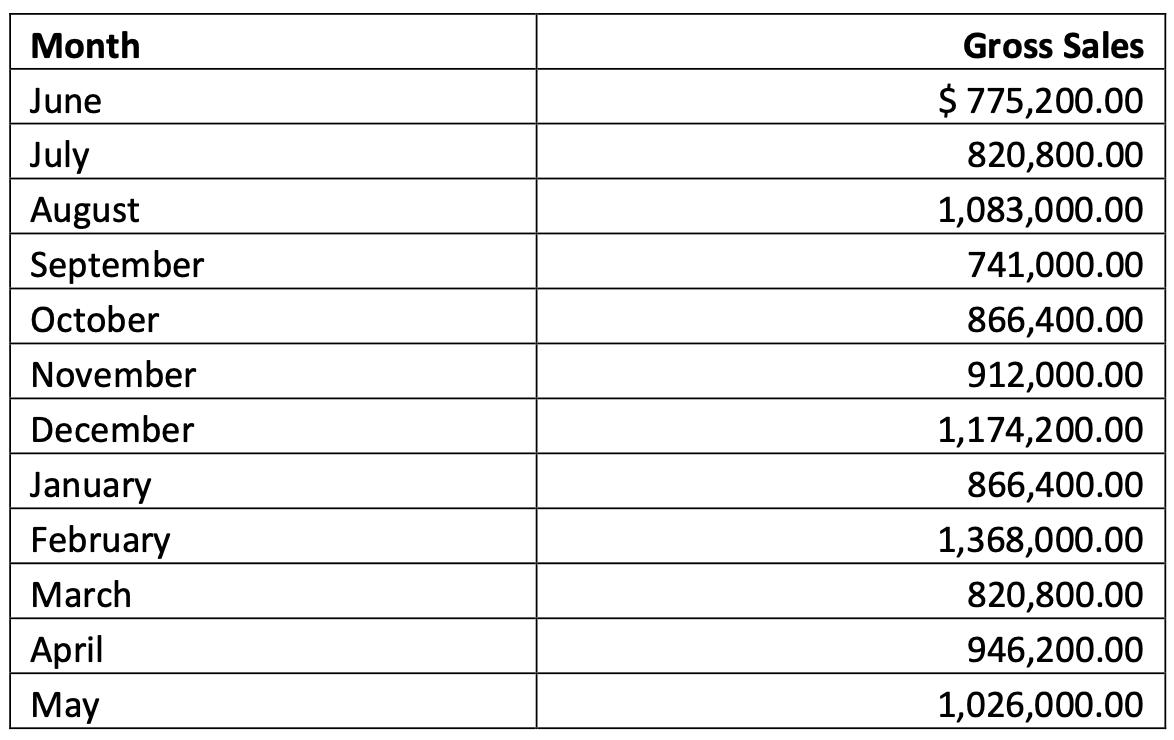

Hybe Company distributes rubber tires, automotive oils and lubricants to many transport companies and retailers all over the region. The company offers a contract term of 2/10, n/30. Currently, sixty (60%) of the credit customers have taken advantage of the discount by paying within ten (10) days of the invoice date. The monthly gross sales, all on credit, for the fiscal year ended May 31, 2022 follow:

The company has provided for a monthly bad debts expenses accrual during the current fiscal year based on the assumption that 5% of gross credit sales will be uncollectible.

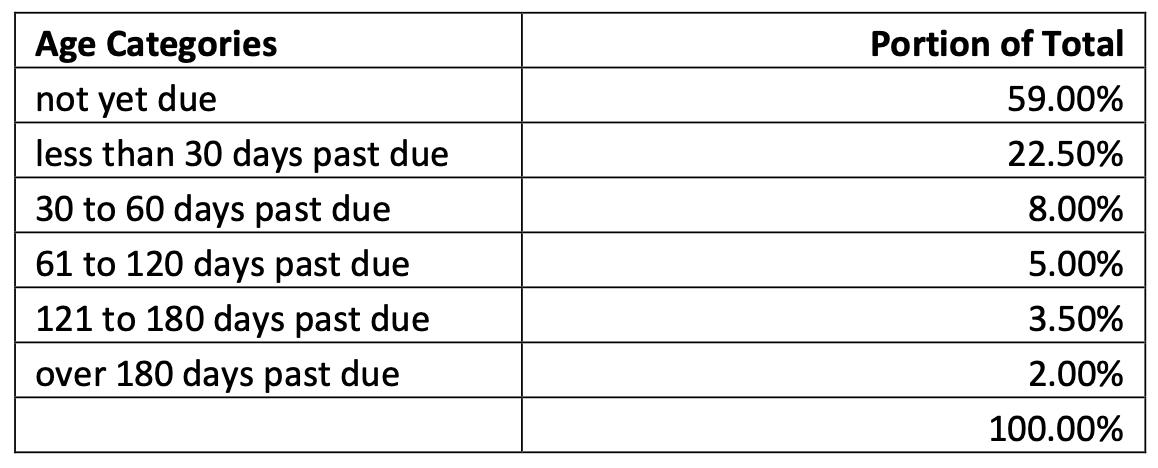

The current Accounts Receivable Balance at May 31, 2022 is $4,560,000. The composition of this amount in terms of age, as provided by the Accounting Department follows:

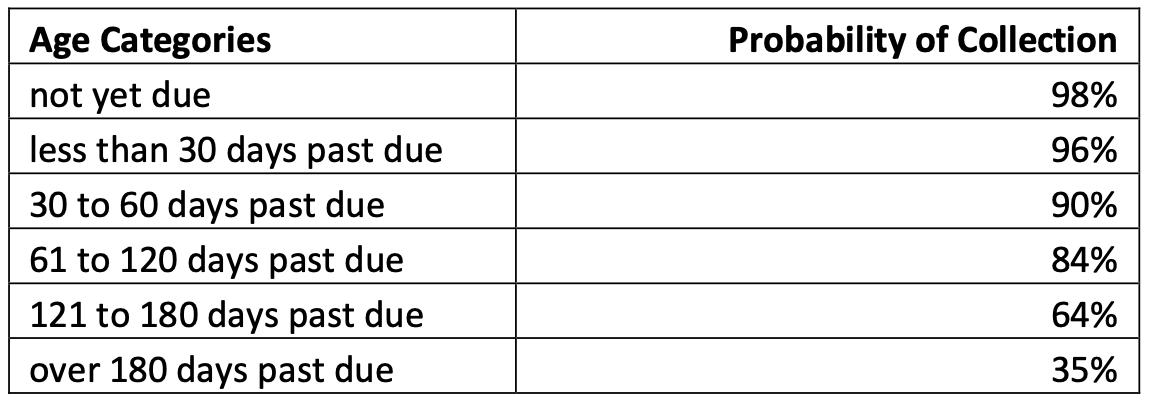

The company's collection department supervisor also provided the conditions of this balance in terms of probability of collection:

The company's collection department supervisor also provided the conditions of this balance in terms of probability of collection:

Accounting records show that the Allowance for Doubtful Accounts had a credit balance of $118,000. A total $490,000 of bad accounts have been written off or the fiscal year.

The pandemic has decreased the number of customers availing of the discount. The current sixty (60%) percent of the customers taking advantage discount is a great decrease from previous years’ experience of seventy-five (75%) of them paying within 10 days of the invoice date. Further, the current five (5%) percent monthly provision for bad debts was already adjusted from the previous provision of three (3%) percent prior to the pandemic.

Instructions:

a. Determine the amount accrued for bad debts based on the monthly schedule of gross sales.

b. Prepare an accounts receivable aging schedule for the company based on the age categories provided by the Accounting Department.

c. Determine the amount that is uncollectible for each category and in total.

d. Calculate the amount of fiscal-year adjustment necessary to bring the Allowance for Doubtful Accounts to the balance computed in the age analysis.

e. Prepare the necessary journal entry to adjust the accounting records.

f. If the previous estimates for collection will be used on the current transactions – 75% of the gross sales availing of 2% discount - how much discounts should have been given to the current year’s gross sales?

g. If the previous estimates for bad debts – 3% of the gross sales – how much bad debts expense could have been provided for the current year?

h. How can the company improve its accounts receivable situation? Recommend at least three (3) ways to improve its receivables management.

Month June July August September October November December January February March April May Gross Sales $ 775,200.00 820,800.00 1,083,000.00 741,000.00 866,400.00 912,000.00 1,174,200.00 866,400.00 1,368,000.00 820,800.00 946,200.00 1,026,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the amount accrued for bad debts based on the monthly schedule of gross sales we first need to calculate the monthly provision for bad debts using the given information The monthly gros...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started