Answered step by step

Verified Expert Solution

Question

1 Approved Answer

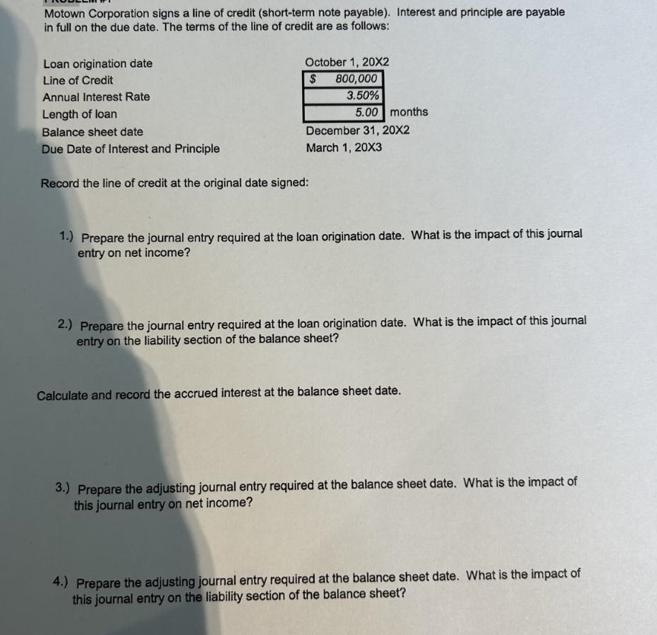

Motown Corporation signs a line of credit (short-term note payable). Interest and principle are payable in full on the due date. The terms of

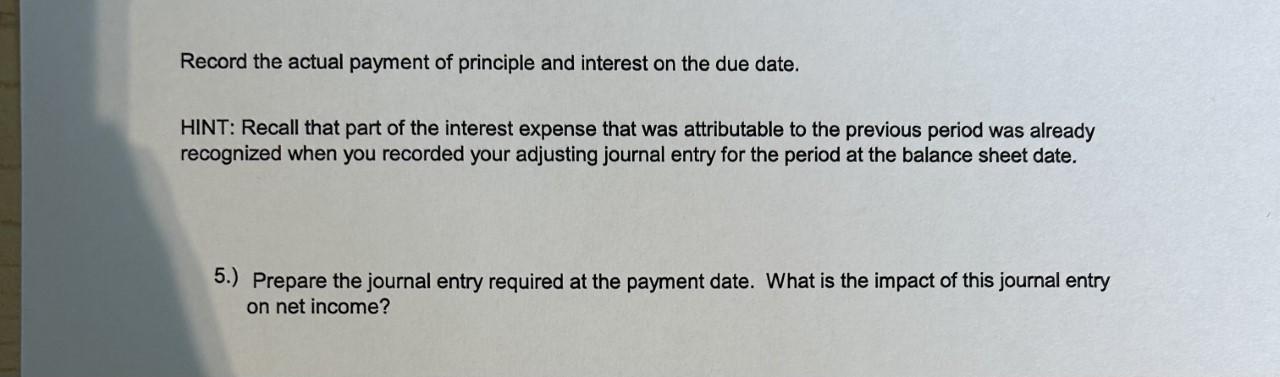

Motown Corporation signs a line of credit (short-term note payable). Interest and principle are payable in full on the due date. The terms of the line of credit are as follows: Loan origination date Line of Credit Annual Interest Rate Length of loan Balance sheet date Due Date of Interest and Principle October 1, 20X2 $ 800,000 3.50% Record the line of credit at the original date signed: 5.00 months December 31, 20X2 March 1, 20X3 1.) Prepare the journal entry required at the loan origination date. What is the impact of this journal entry on net income? 2.) Prepare the journal entry required at the loan origination date. What is the impact of this journal entry on the liability section of the balance sheet? Calculate and record the accrued interest at the balance sheet date. 3.) Prepare the adjusting journal entry required at the balance sheet date. What is the impact of this journal entry on net income? 4.) Prepare the adjusting journal entry required at the balance sheet date. What is the impact of this journal entry on the liability section of the balance sheet? Record the actual payment of principle and interest on the due date. HINT: Recall that part of the interest expense that was attributable to the previous period was already recognized when you recorded your adjusting journal entry for the period at the balance sheet date. 5.) Prepare the journal entry required at the payment date. What is the impact of this journal entry on net income?

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal Entry at Loan Origination Date Date October 1 20X2 Debit Cash 800000 Loan proceeds receive...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started