hybrid costing system use a combination of

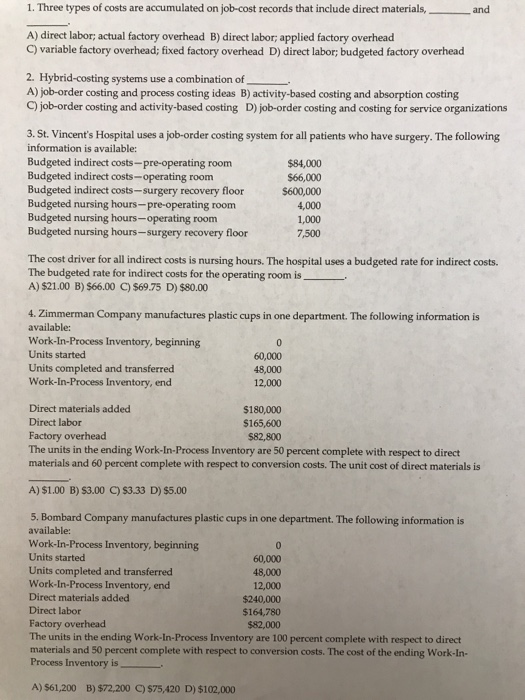

1. Three types of costs are accumulated on job-cost records that include direct materials, and A) direct labor; actual factory overhead B) direct labor; applied factory overhead C) variable factory overhead; fixed factory overhead D) direct labor; budgeted factory overhead 2. Hybrid-costing systems use a combination of A) job-order costing and process costing ideas B) activity-based costing and absorption costing ) job-order costing and activity-based costing D) job-order costing and costing for service organizations 3. St. Vincent's Hospital uses a job-order costing system for all patients who have surgery. The following information is available: Budgeted indirect costs-pre-operating room Budgeted indirect costs-operating room Budgeted indirect costs-surgery recovery floor Budgeted nursing hours-pre-operating room Budgeted nursing hours-operating room Budgeted nursing hours-surgery recovery floor $84,000 $66,000 $600,000 4,000 1,000 7,500 The cost driver for all indirect costs is nursing hours. The hospital uses a budgeted rate for indirect costs. The budgeted rate for indirect costs for the operating room is A) $21.00 B) $66.00 C) $69.75 D) $80.00 4. Zimmerman Company manufactures plastic cups in one department. The following information is available: Work-In-Process Inventory, beginning 0 Units started 60,000 Units completed and transferred Work-In-Process Inventory, end 48,000 12,000 Direct materials added Direct labor Factory overhead The units in the ending Work-In-Process Inventory are 50 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs. The unit cost of direct materials is $180,000 $165,600 $82,800 A) $1.00 B) $3.00 C) $3.33 D) $5.00 5. Bombard Company manufactures plastic cups in one department. The following information is available: Work-In-Process Inventory, beginning Units started 0 60,000 48,000 Units completed and transferred Work-In-Process Inventory, end Direct materials added 12,000 $240,000 $164,780 Direct labor Factory overhead The units in the ending Work-In-Process Inventory are 100 percent complete with respect to direct materials and 50 percent complete with respect to conversion costs. The cost of the ending Work-In- Process Inventory is $82,000 A) $61,200 B) $72,200 C) $75,420 D) $102,000