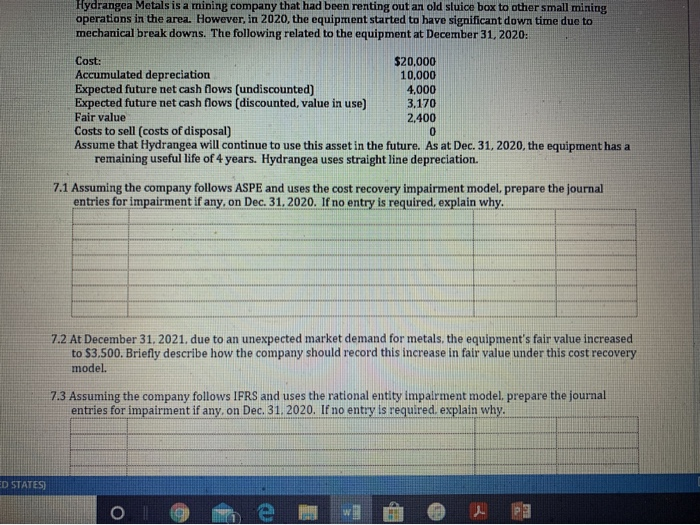

Hydrangea Metals is a mining company that had been renting out an old sluice box to other small mining operations in the area. However, in 2020, the equipment started to have significant down time due to mechanical break downs. The following related to the equipment at December 31, 2020: Cost: $20,000 Accumulated depreciation 10,000 Expected future net cash flows (undiscounted) 4,000 Expected future net cash flows (discounted value in use) 3,170 Fair value 2.400 Costs to sell (costs of disposal) 0 Assume that Hydrangea will continue to use this asset in the future. As at Dec. 31, 2020, the equipment has a remaining useful life of 4 years. Hydrangea uses straight line depreciation. 7.1 Assuming the company follows ASPE and uses the cost recovery impairment model, prepare the journal entries for impairment if any, on Dec. 31, 2020. If no entry is required, explain why. 7.2 At December 31, 2021, due to an unexpected market demand for metals, the equipment's fair value increased to $3.500. Briefly describe how the company should record this increase in fair value under this cost recovery model. 7.3 Assuming the company follows IFRS and uses the rational entity impairment model, prepare the journal entries for impairment if any, on Dec. 31. 2020. If no entry is required explain why. ED STATES 09 Hydrangea Metals is a mining company that had been renting out an old sluice box to other small mining operations in the area. However, in 2020, the equipment started to have significant down time due to mechanical break downs. The following related to the equipment at December 31, 2020: Cost: $20,000 Accumulated depreciation 10,000 Expected future net cash flows (undiscounted) 4,000 Expected future net cash flows (discounted value in use) 3,170 Fair value 2.400 Costs to sell (costs of disposal) 0 Assume that Hydrangea will continue to use this asset in the future. As at Dec. 31, 2020, the equipment has a remaining useful life of 4 years. Hydrangea uses straight line depreciation. 7.1 Assuming the company follows ASPE and uses the cost recovery impairment model, prepare the journal entries for impairment if any, on Dec. 31, 2020. If no entry is required, explain why. 7.2 At December 31, 2021, due to an unexpected market demand for metals, the equipment's fair value increased to $3.500. Briefly describe how the company should record this increase in fair value under this cost recovery model. 7.3 Assuming the company follows IFRS and uses the rational entity impairment model, prepare the journal entries for impairment if any, on Dec. 31. 2020. If no entry is required explain why. ED STATES 09