Answered step by step

Verified Expert Solution

Question

1 Approved Answer

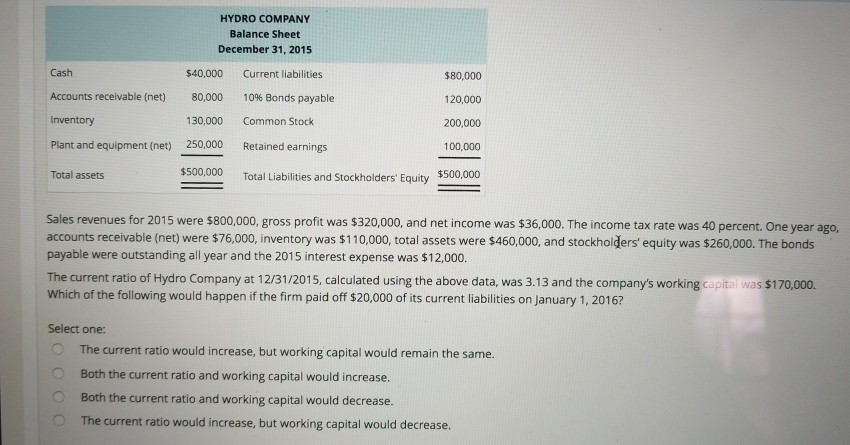

HYDRO COMPANY Balance Sheet December 31, 2015 Cash Accounts receivable (net) Inventory Plant and equipment (net) Total assets $40,000 Current liabilities 80,000 130,000 Common Stock

HYDRO COMPANY Balance Sheet December 31, 2015 Cash Accounts receivable (net) Inventory Plant and equipment (net) Total assets $40,000 Current liabilities 80,000 130,000 Common Stock 250,000 $500,000 $80,000 120,000 200,000 100,000 $500,000 1096 Bonds payable Retained earnings Total Liabilities and Stockholders' Equity Sales revenues for 2015 were $800,000, gross profit was $320,000, and net income was $36,000. The income tax rate was 40 percent. One year ago, accounts receivable (net) were $76,000, inventory was $110,000, total assets were $460,000, and stockholders' equity was $260,000. The bonds payable were outstanding all year and the 2015 interest expense was $12,000. The current ratio of Hydro Company at 12/31/2015, calculated using the above data, was 3.13 and the company's working capital was $170,000. Which of the following would happen if the firm paid off $20,000 of its current liabilities on January 1, 2016? Select one: The current ratio would increase, but working capital would remain the same. Both the current ratio and working capital would increase Both the current ratio and working capital would decrease. The current ratio would increase, but working capital would decrease. O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started