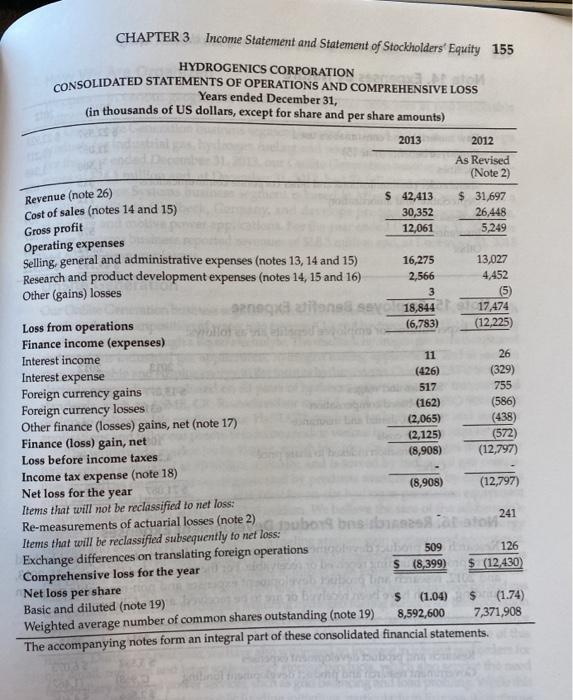

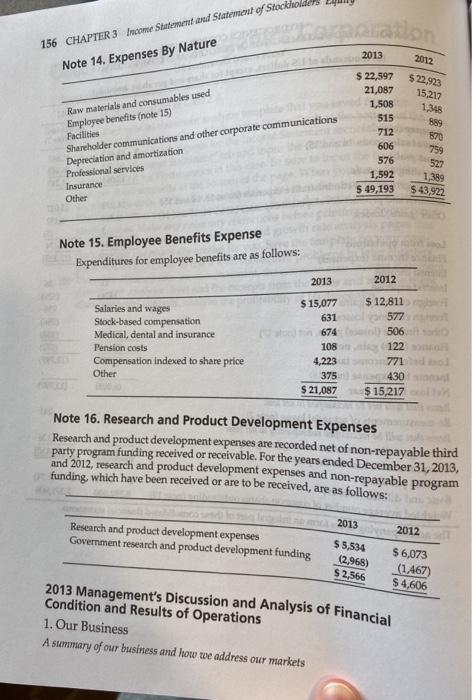

Hydrogenics Corporation Required: This case is a continuation of Case 2.4. (a) Open the financial statement analysis template that you saved from the Chapter 2 Hydrogenics Case Click on the "Cover" tab at the bottom of the screen. Input the check figures for the Income Statement section of this page. Click on the "Income Statement" tab and input the data from the income statement included for Hydrogenics in this case. Be sure to input the basic earnings per share amounts at the bottom of the page. When you have finished inputting the data, review the income statement to make sure there are no red blocks indicating that your numbers do not match the cover sheet information check figures. Make any necessary corrections before printing out your input and the common-size income statement and growth rate analysis pages that the template automatically creates for you. Save the template on your computer or a disk in order to use it with subsequent problems in later chapters h. (b) Using the Hydrogenics income statement, the common size-income statement growth rate analysis sheet and the excerpts from the notes and management discussion and analysis analyze the profitability of Hydrogenics CHAPTER 3 Income Statement and Statement of Stockholders' Equity 155 HYDROGENICS CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS Years ended December 31, (in thousands of US dollars, except for share and per share amounts) 2013 2012 As Revised (Note 2) 3 Revenue (note 26) S 42,413 $ 31,697 Cost of sales (notes 14 and 15) 30,352 26,448 Gross profit 12,061 5,249 Operating expenses Selling, general and administrative expenses (notes 13, 14 and 15) 16,275 13,027 Research and product development expenses (notes 14, 15 and 16) 2,566 4,452 Other (gains) losses HPTER 72TH SE 18,844 17,474 Loss from operations (6,783) (12,225 Finance income (expenses) Interest income 11 26 Interest expense (426) (329) Foreign currency gains 517 755 Foreign currency losses (162) (586) Other finance (losses) gains, net (note 17) (2,065) (438) Finance (loss) gain, net (2,125) (572 Loss before income taxes (8,908) (12,797) Income tax expense (note 18) Net loss for the year (8,908) (12,797) Items that will not be reclassified to net loss: Re-measurements of actuarial losses (note 2) 241 puboss ons bases Items that will be reclassified subsequently to net loss: Exchange differences on translating foreign operations 509 126 Comprehensive loss for the year S (8,399) $ (12,430 Net loss per share s Basic and diluted (note 19) (1.04) (1.74) Weighted average number of common shares outstanding (note 19) 8,592,600 7,371,908 The accompanying notes form an integral part of these consolidated financial statements. person 156 CHAPTER 3 Income Statement and Statement of Stockh 2013 2012 Note 14. Expenses By Nature Raw materials and consumables used Employee benefits (note 15) Facilities Shareholder communications and other corporate communications Depreciation and amortization Professional services Insurance $ 22,597 21,087 1,508 515 712 606 576 1,592 $ 49,193 $ 22,923 15,217 1,348 889 570 759 527 1,389 $43,922 Other Note 15. Employee Benefits Expense Expenditures for employee benefits are as follows: 2013 2012 Salaries and wages Stock-based compensation Medical, dental and insurance Pension costs Compensation indexed to share price Other $ 15,077 631 674 108 4,223 375 $ 21,087 $ 12,811 577 506 122 771 430 $ 15,217 Note 16. Research and Product Development Expenses Research and product development expenses are recorded net of non-repayable third party program funding received or receivable. For the years ended December 31, 2013, and 2012, research and product development expenses and non-repayable program funding, which have been received or are to be received, are as follows: 2013 Research and product development expenses Government research and product development funding 2012 $5,534 (2,968) $ 2,566 $ 6,073 (1.467) $4,606 2013 Management's Discussion and Analysis of Financial Condition and Results of Operations 1. Our Business A summary of our business and how we address our markets Hydrogenics Corporation Required: This case is a continuation of Case 2.4. (a) Open the financial statement analysis template that you saved from the Chapter 2 Hydrogenics Case Click on the "Cover" tab at the bottom of the screen. Input the check figures for the Income Statement section of this page. Click on the "Income Statement" tab and input the data from the income statement included for Hydrogenics in this case. Be sure to input the basic earnings per share amounts at the bottom of the page. When you have finished inputting the data, review the income statement to make sure there are no red blocks indicating that your numbers do not match the cover sheet information check figures. Make any necessary corrections before printing out your input and the common-size income statement and growth rate analysis pages that the template automatically creates for you. Save the template on your computer or a disk in order to use it with subsequent problems in later chapters h. (b) Using the Hydrogenics income statement, the common size-income statement growth rate analysis sheet and the excerpts from the notes and management discussion and analysis analyze the profitability of Hydrogenics CHAPTER 3 Income Statement and Statement of Stockholders' Equity 155 HYDROGENICS CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS Years ended December 31, (in thousands of US dollars, except for share and per share amounts) 2013 2012 As Revised (Note 2) 3 Revenue (note 26) S 42,413 $ 31,697 Cost of sales (notes 14 and 15) 30,352 26,448 Gross profit 12,061 5,249 Operating expenses Selling, general and administrative expenses (notes 13, 14 and 15) 16,275 13,027 Research and product development expenses (notes 14, 15 and 16) 2,566 4,452 Other (gains) losses HPTER 72TH SE 18,844 17,474 Loss from operations (6,783) (12,225 Finance income (expenses) Interest income 11 26 Interest expense (426) (329) Foreign currency gains 517 755 Foreign currency losses (162) (586) Other finance (losses) gains, net (note 17) (2,065) (438) Finance (loss) gain, net (2,125) (572 Loss before income taxes (8,908) (12,797) Income tax expense (note 18) Net loss for the year (8,908) (12,797) Items that will not be reclassified to net loss: Re-measurements of actuarial losses (note 2) 241 puboss ons bases Items that will be reclassified subsequently to net loss: Exchange differences on translating foreign operations 509 126 Comprehensive loss for the year S (8,399) $ (12,430 Net loss per share s Basic and diluted (note 19) (1.04) (1.74) Weighted average number of common shares outstanding (note 19) 8,592,600 7,371,908 The accompanying notes form an integral part of these consolidated financial statements. person 156 CHAPTER 3 Income Statement and Statement of Stockh 2013 2012 Note 14. Expenses By Nature Raw materials and consumables used Employee benefits (note 15) Facilities Shareholder communications and other corporate communications Depreciation and amortization Professional services Insurance $ 22,597 21,087 1,508 515 712 606 576 1,592 $ 49,193 $ 22,923 15,217 1,348 889 570 759 527 1,389 $43,922 Other Note 15. Employee Benefits Expense Expenditures for employee benefits are as follows: 2013 2012 Salaries and wages Stock-based compensation Medical, dental and insurance Pension costs Compensation indexed to share price Other $ 15,077 631 674 108 4,223 375 $ 21,087 $ 12,811 577 506 122 771 430 $ 15,217 Note 16. Research and Product Development Expenses Research and product development expenses are recorded net of non-repayable third party program funding received or receivable. For the years ended December 31, 2013, and 2012, research and product development expenses and non-repayable program funding, which have been received or are to be received, are as follows: 2013 Research and product development expenses Government research and product development funding 2012 $5,534 (2,968) $ 2,566 $ 6,073 (1.467) $4,606 2013 Management's Discussion and Analysis of Financial Condition and Results of Operations 1. Our Business A summary of our business and how we address our markets