Answered step by step

Verified Expert Solution

Question

1 Approved Answer

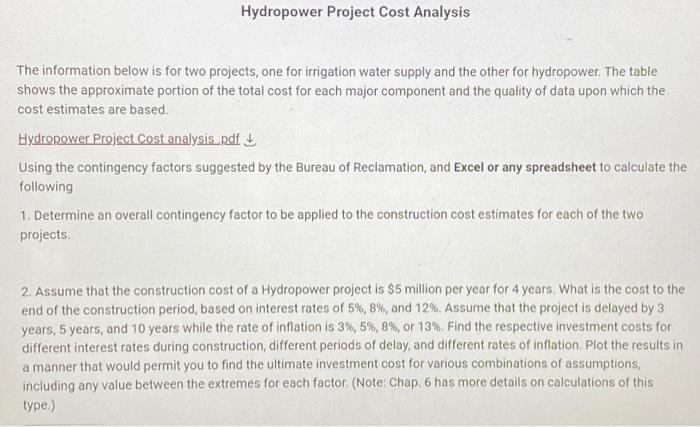

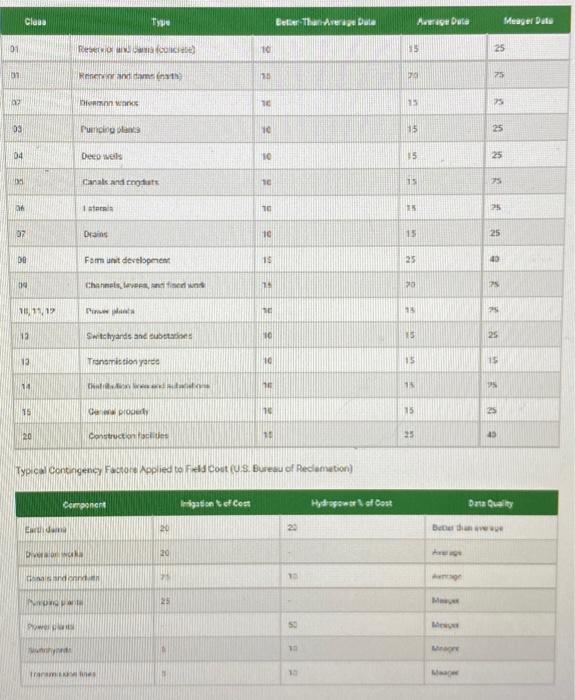

Hydropower Project Cost Analysis The information below is for two projects, one for irrigation water supply and the other for hydropower. The table shows the

Hydropower Project Cost Analysis The information below is for two projects, one for irrigation water supply and the other for hydropower. The table shows the approximate portion of the total cost for each major component and the quality of data upon which the cost estimates are based. Hydropower Project Cost analysis.pdf Using the contingency factors suggested by the Bureau of Reclamation, and Excel or any spreadsheet to calculate the following 1. Determine an overall contingency factor to be applied to the construction cost estimates for each of the two projects. 2. Assume that the construction cost of a Hydropower project is $5 million per year for 4 years. What is the cost to the end of the construction period, based on interest rates of 5%, 8%, and 12%. Assume that the project is delayed by 3 years, 5 years, and 10 years while the rate of inflation is 3%, 5%, 8%, or 13%. Find the respective investment costs for different interest rates during construction, different periods of delay, and different rates of inflation. Plot the results in a manner that would permit you to find the ultimate investment cost for various combinations of assumptions, including any value between the extremes for each factor. (Note: Chap. 6 has more details on calculations of this type.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started