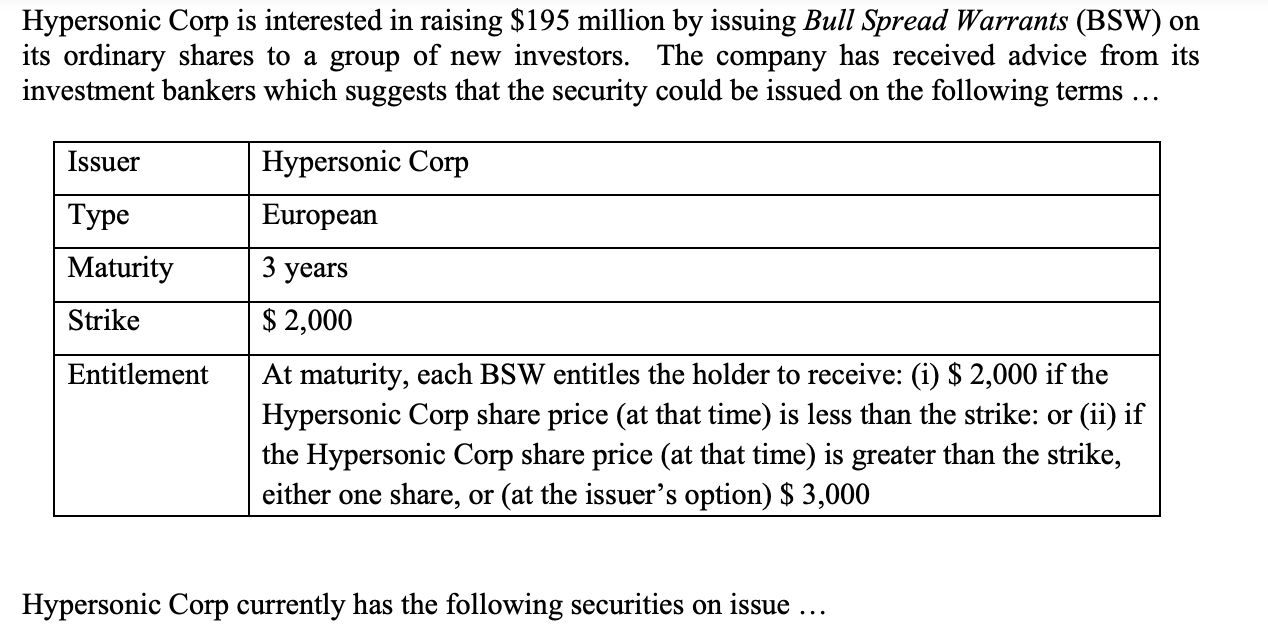

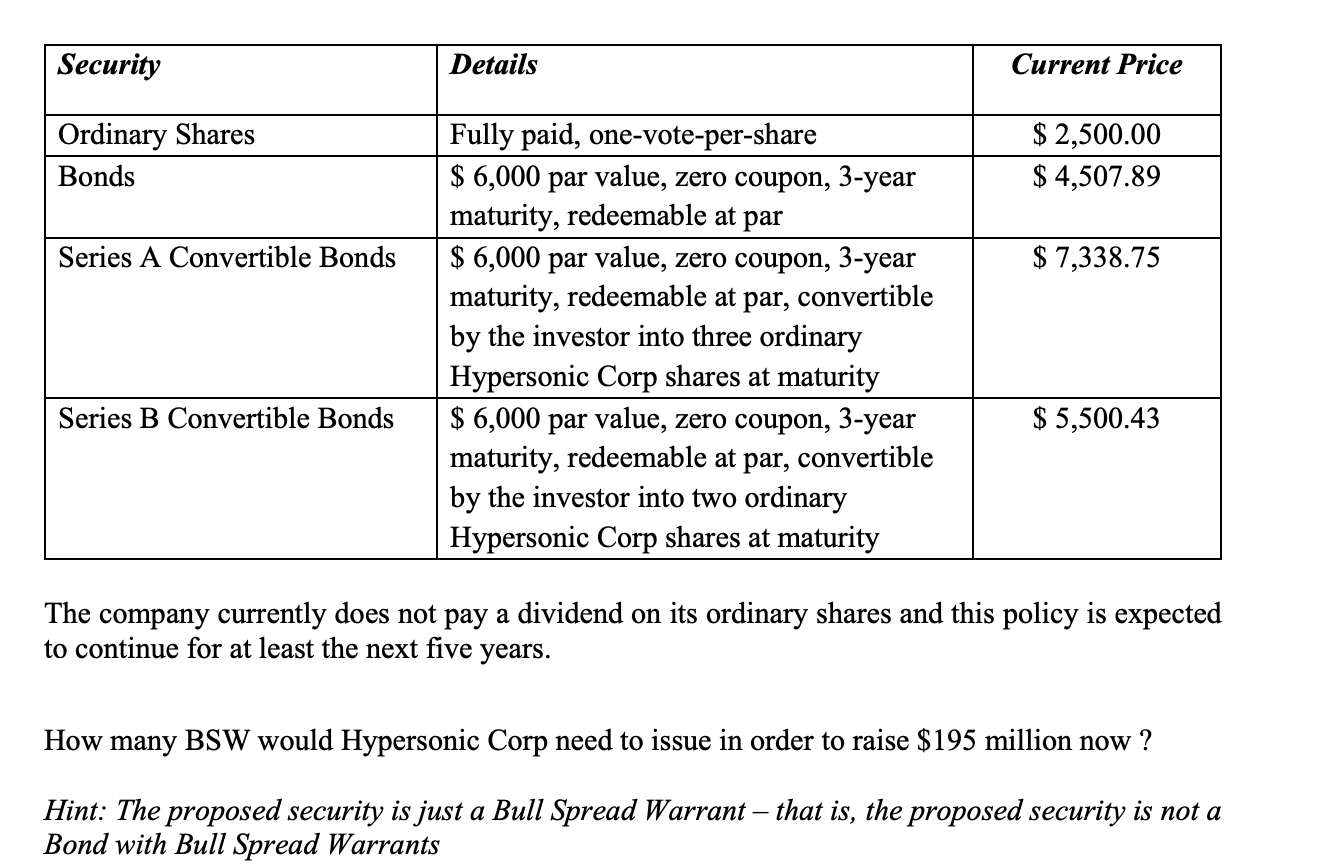

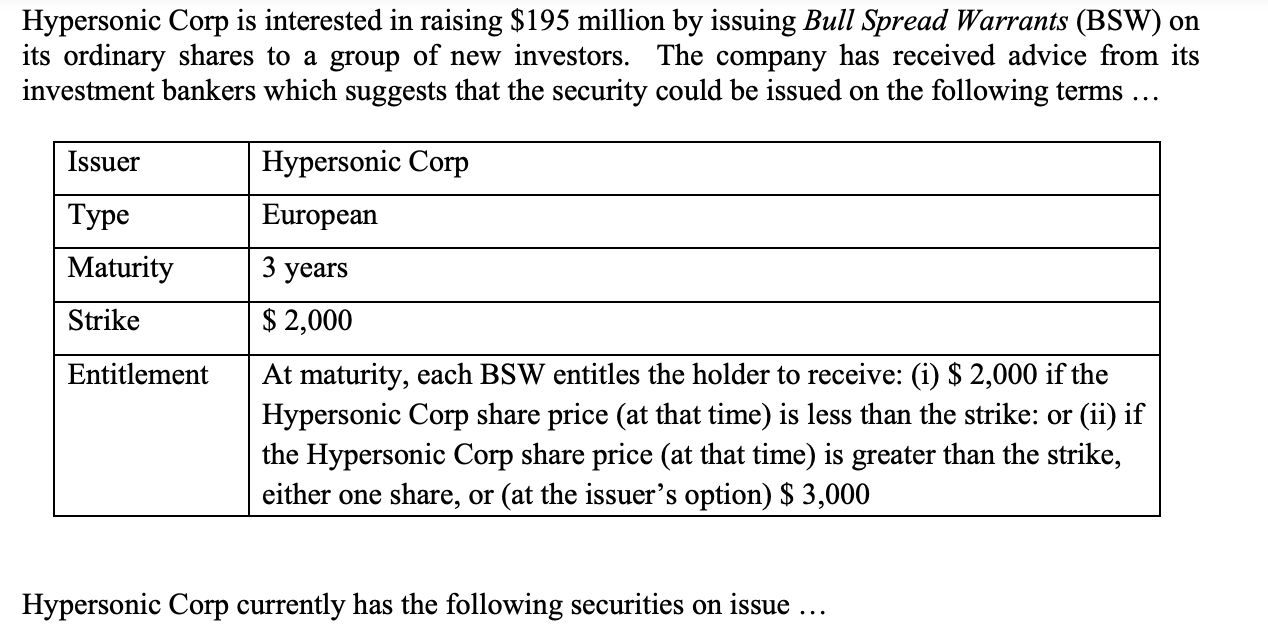

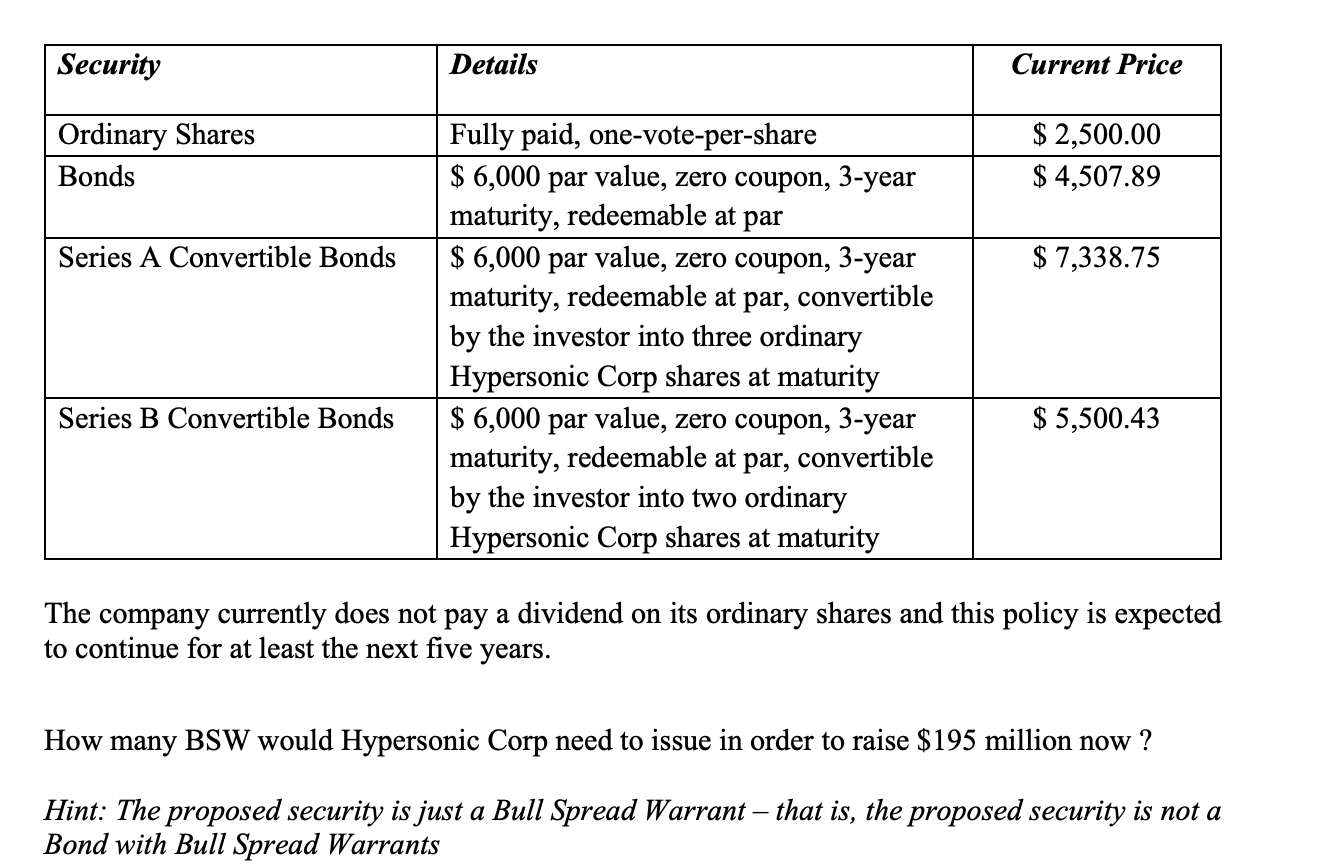

Hypersonic Corp is interested in raising $195 million by issuing Bull Spread Warrants (BSW) on its ordinary shares to a group of new investors. The company has received advice from its investment bankers which suggests that the security could be issued on the following terms ... Issuer Hypersonic Corp Type European Maturity 3 years Strike $ 2,000 Entitlement At maturity, each BSW entitles the holder to receive: (i) $ 2,000 if the Hypersonic Corp share price (at that time) is less than the strike: or (ii) if the Hypersonic Corp share price (at that time) is greater than the strike, either one share, or (at the issuer's option) $ 3,000 Hypersonic Corp currently has the following securities on issue . Security Details Current Price Ordinary Shares Bonds $ 2,500.00 $ 4,507.89 Series A Convertible Bonds $ 7,338.75 Fully paid, one-vote-per-share $ 6,000 par value, zero coupon, 3-year maturity, redeemable at par $ 6,000 par value, zero coupon, 3-year maturity, redeemable at par, convertible by the investor into three ordinary Hypersonic Corp shares at maturity $ 6,000 par value, zero coupon, 3-year maturity, redeemable at par, convertible by the investor into two ordinary Hypersonic Corp shares at maturity Series B Convertible Bonds $ 5,500.43 The company currently does not pay a dividend on its ordinary shares and this policy is expected to continue for at least the next five years. How many BSW would Hypersonic Corp need to issue in order to raise $195 million now? Hint: The proposed security is just a Bull Spread Warrant that is, the proposed security is not a Bond with Bull Spread Warrants Hypersonic Corp is interested in raising $195 million by issuing Bull Spread Warrants (BSW) on its ordinary shares to a group of new investors. The company has received advice from its investment bankers which suggests that the security could be issued on the following terms ... Issuer Hypersonic Corp Type European Maturity 3 years Strike $ 2,000 Entitlement At maturity, each BSW entitles the holder to receive: (i) $ 2,000 if the Hypersonic Corp share price (at that time) is less than the strike: or (ii) if the Hypersonic Corp share price (at that time) is greater than the strike, either one share, or (at the issuer's option) $ 3,000 Hypersonic Corp currently has the following securities on issue . Security Details Current Price Ordinary Shares Bonds $ 2,500.00 $ 4,507.89 Series A Convertible Bonds $ 7,338.75 Fully paid, one-vote-per-share $ 6,000 par value, zero coupon, 3-year maturity, redeemable at par $ 6,000 par value, zero coupon, 3-year maturity, redeemable at par, convertible by the investor into three ordinary Hypersonic Corp shares at maturity $ 6,000 par value, zero coupon, 3-year maturity, redeemable at par, convertible by the investor into two ordinary Hypersonic Corp shares at maturity Series B Convertible Bonds $ 5,500.43 The company currently does not pay a dividend on its ordinary shares and this policy is expected to continue for at least the next five years. How many BSW would Hypersonic Corp need to issue in order to raise $195 million now? Hint: The proposed security is just a Bull Spread Warrant that is, the proposed security is not a Bond with Bull Spread Warrants