Question

Hypothesis Testing for Single Populations: Frito-Lay Targets the Hispanic Market Frito Company was founded in 1932 in San Antonio, Texas, by Elmer Doolin. H. W.

Hypothesis Testing for Single Populations:

Frito-Lay Targets the Hispanic Market

Frito Company was founded in 1932 in San Antonio, Texas, by Elmer Doolin. H. W. Lay & Company was founded in Atlanta, Georgia, by Herman W. Lay in 1938. In 1961, the two companies merged to form Frito-Lay, Inc., with headquarters in Texas. Frito-Lay produced, distributed, and marketed snack foods with particular emphasis on various types of chips. In 1965, the company merged with Pepsi-Cola to form PepsiCo, Inc. Three decades later, Pepsi-Cola combined its domestic and international snack food operations into one business unit called Frito-Lay Company. Currently, there are about 55,000 Frito-Lay employees in the United States and Canada.

In the late 1990s, despite its overall popularity, Frito-Lay faced a general lack of appeal to Hispanics, a fast-growing U.S. market. In an effort to better penetrate that market, Frito-Lay hired various market researchers to determine why Hispanics were not purchasing their products as often as company officials had hoped and what could be done about the problem. In the studies, market researchers discovered that Hispanics thought Frito-Lay products were too bland, Frito-Lay advertisements were not being widely viewed by Hispanics, and Hispanics tended to purchase snacks in small bags at local grocery stores rather than in the large family-style bags sold at large supermarkets.

Focus groups composed of male teens and male young adults?a group that tends to consume a lot of chips?were formed. The researchers determined that even though many of the teens spoke English at school, they spoke Spanish at home with their family. From this discovery, it was concluded that Spanish advertisements would be needed to reach Hispanics. In addition, the use of Spanish rock music, a growing movement in the Hispanic youth culture, could be effective in some ads.

Researchers also found that using a "Happy Face" logo, which is an icon of Frito-Lay's sister company in Mexico, was effective. Because it reminded the 63% of all Hispanics in the United States who are Mexican American of snack foods from home, the logo increased product familiarity.

As a result of this research, Frito-Lay launched its first Hispanic products in San Antonio in 1997. Within a few years, sales of the Doritos brand improved 32% in Hispanic areas. In May 2002, Frito-Lay teamed up with its Mexican affiliate, Sabritas, to launch a new line of products to further appeal to Hispanic customers. Included in these offerings are Sabritas Adobadas tomato and chile potato chips, Sabritones Churrumais fried corn strips with chile and lime seasonings, Crujitos queso and chile flavor puffed corn twists, Fritos Sabrositas lime and chile chips, El Isleno Plantains, and others.

More recently, Frito-Lay has been relying on input and guidance from the Adelante employee network, which is a multicultural Latina/Hispanic professional organization associated with PepsiCo. At Frito-Lay, the organization's mission is to help develop a diverse, inclusive culture accelerating growth opportunities for associates while providing a competitive advantage in an increasingly diverse marketplace. As part of this effort, Adelante has been used to help develop new flavors and advertising programs for Hispanics. Based on information gleaned from Adelante members, new Frito-Lay snack products are being test-marketed in several states, and guacamole-flavored Doritos became one of the most successful new-product launches in the company's history. Today, Frito-Lay brands account for almost 73% of the torilla/tostada chip market and 77.5% of the corn snack market (excluding tortilla chips).

2.The statistical mean can be used to measure various aspects of the Hispanic culture and the Hispanic market, including size of purchase, frequency of purchase, age of consumer, size of store, and so on. Use techniques presented in this chapter to analyze each of the following and discuss how the results might affect marketing decisions.

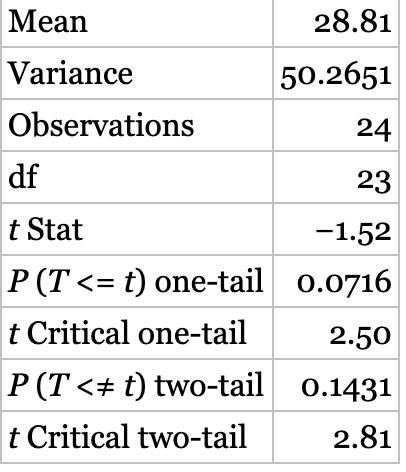

- a.What is the average age of a purchaser of Doritos Salsa Verde? Suppose initial tests indicate that the mean age is 31. Is this figure really correct? To test whether it is, a researcher randomly contacts 24 purchasers of Doritos Salsa Verde, with results shown in the following Excel output. Discuss the output in terms of a hypothesis test to determine whether the mean age is actually 31. Let?be .01. Assume that ages of purchasers are normally distributed in the population.

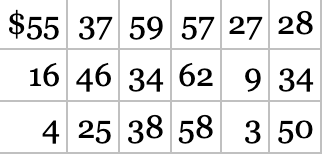

- b.What is the average expenditure of a Hispanic customer on chips per year? Suppose it is hypothesized that the figure is $45 per year. A researcher who knows the Hispanic market believes that this figure is too high and wants to prove her case. She randomly selects 18 Hispanics, has them keep a log of grocery purchases for one year, and obtains the following figures for expenditures on chips. Analyze the data using techniques from this chapter and an alpha of .05. Assume that expenditures per customer are normally distributed in the population.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started