Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hypothetical Ltd is planning to raise Rs 20,00,000 additional long-term funds to finance its additional capital budget of the current year. The debentures of

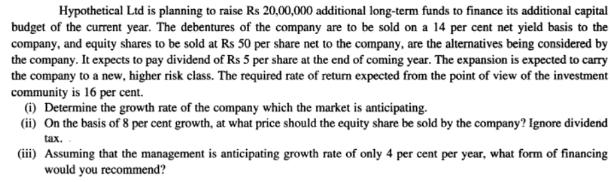

Hypothetical Ltd is planning to raise Rs 20,00,000 additional long-term funds to finance its additional capital budget of the current year. The debentures of the company are to be sold on a 14 per cent net yield basis to the company, and equity shares to be sold at Rs 50 per share net to the company, are the alternatives being considered by the company. It expects to pay dividend of Rs 5 per share at the end of coming year. The expansion is expected to carry the company to a new, higher risk class. The required rate of return expected from the point of view of the investment community is 16 per cent. (i) Determine the growth rate of the company which the market is anticipating. (ii) On the basis of 8 per cent growth, at what price should the equity share be sold by the company? Ignore dividend tax. (iii) Assuming that the management is anticipating growth rate of only 4 per cent per year, what form of financing would you recommend?

Step by Step Solution

★★★★★

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

i K 016 Rs 5Rs 50 g 016 010 g or g 016 010 6 per ce...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started