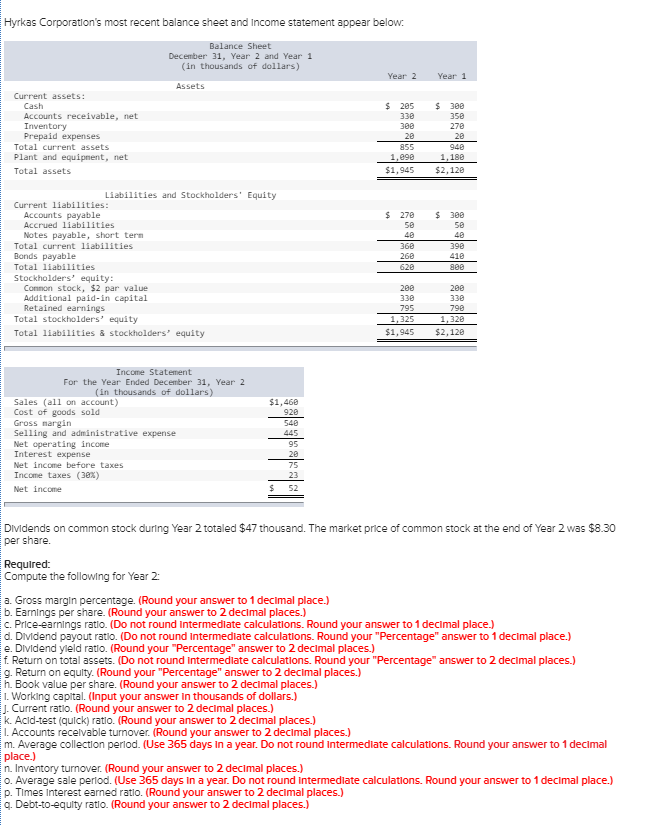

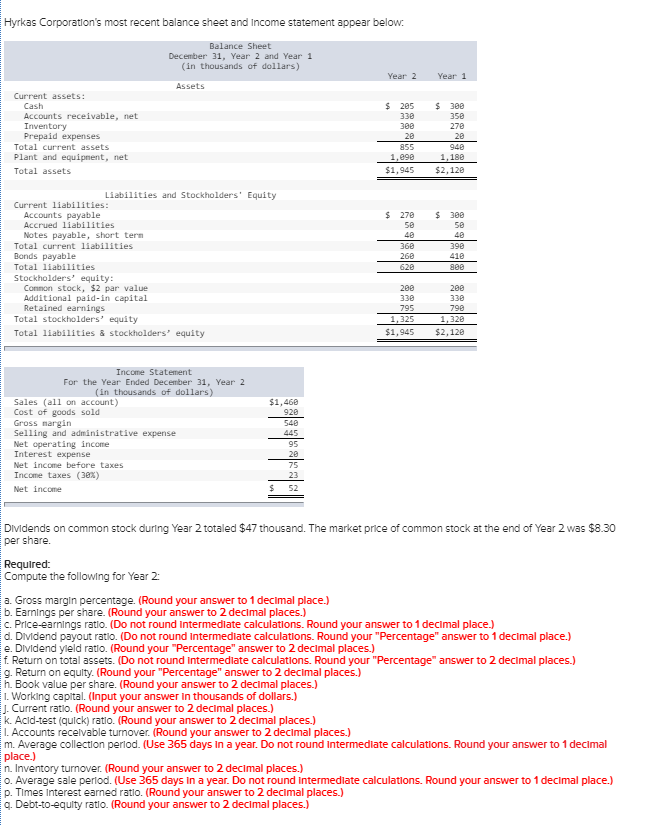

Hyrkas Corporation's most recent balance sheet and Income statement appear below: Balance Sheet December 31, Year 2 and Year1 (in thousands of dollars) Year 2 Year1 Assets Current assets: $ 285 388 Accounts receivable, net Inventory Prepaid expenses 330 308 28 855 350 28 1,188 Total current assets Plant and equipnent, net Total assets $1,945 $2,128 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $ 270 388 Accrued liabilities Notes payable, short tern Total current 1iabilities Bonds payable Total liabilities Stockholders' equity 48 366 268 48 398 418 808 Connon stock, $2 par value Additional paid-in capital Retained earnings 280 338 795 1,325 $1,945 280 338 798 Total stockholders equity Total liabilities & stockholders' equity $2,128 Income Statement For the Year Ended December 31, Year 2 in thousands of dollars) $1,468 928 Sales (all on account) Cost of goods sold Gross nargin Selling and administrative expense Net operating income Interest expense Net income before taxes Income taxes (30%) Net income 445 95 28 75 23 $ 52 Divdends on common stock during Year 2 totaled $47 thousand. The market price of common stock at the end of Year 2 was $8.30 per share. Compute the following for Year 2 a. Gross margin percentage. (Round your answer to 1 decimal place.) b. Earnings per share. (Round your answer to 2 decimal places.) C. Price arnings ratio. (Do not round intermediate calculations. Round your answer to 1 decimal place.) d. DivMdend payout ratio. (Do not round Intermedlate calculations. Round your "Percentage" answer to 1 decimal place.) e. Dividend yield ratio. (Round your "Percentage" answer to 2 decimal places.) f. Return on total assets. (Do not round Intermediate calculations. Round your "Percentage" answer to 2 decimal places.) g. Return on equlty. (Round your "Percentage" answer to 2 decimal places.) h. Book value per share. (Round your answer to 2 declmal places.) I. Working captal. (Input your answer in thousands of dollars.) J. Current ratlo. (Round your answer to 2 declmal places.) k. Acid-test (quick) ratlo. (Round your answer to 2 decimal places.) I. Accounts recelvable turnover. (Round your answer to 2 decimal places.) m. Average collection perlod. (Use 365 days in a year. Do not round Intermediate calculations. Round your answer to 1 declmal n. Inventory turnover. (Round your answer to 2 decimal places.) o. Average sale perlod. (Use 365 days In a year. Do not round intermediate calculations. Round your answer to 1 decimal place.) p. Tlmes Interest earned ratio. (Round your answer to 2 decimal places.) q. Debt-to-equity ratio. (Round your answer to 2 decimal places.)