Answered step by step

Verified Expert Solution

Question

1 Approved Answer

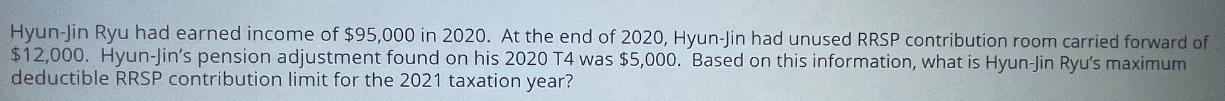

Hyun-Jin Ryu had earned income of $95,000 in 2020. At the end of 2020, Hyun-Jin had unused RRSP contribution room carried forward of $12,000.

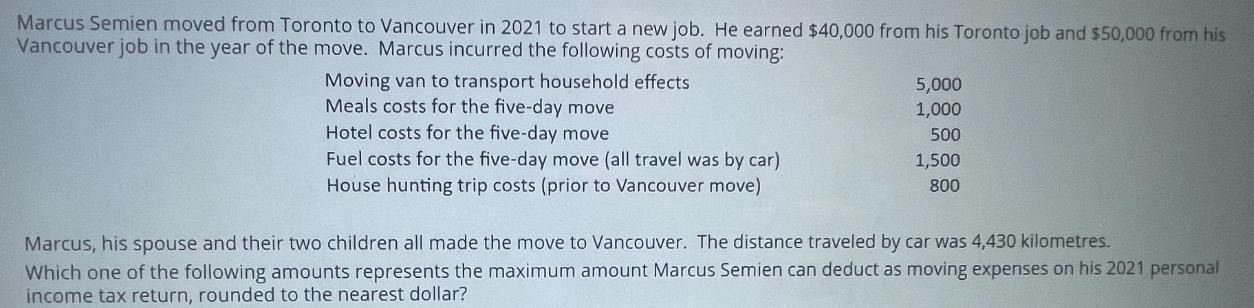

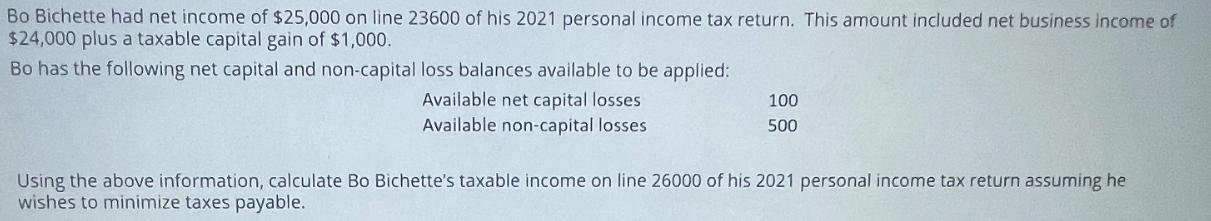

Hyun-Jin Ryu had earned income of $95,000 in 2020. At the end of 2020, Hyun-Jin had unused RRSP contribution room carried forward of $12,000. Hyun-Jin's pension adjustment found on his 2020 T4 was $5,000. Based on this information, what is Hyun-Jin Ryu's maximum deductible RRSP contribution limit for the 2021 taxation year? Marcus Semien moved from Toronto to Vancouver in 2021 to start a new job. He earned $40,000 from his Toronto job and $50,000 from his Vancouver job in the year of the move. Marcus incurred the following costs of moving: Moving van to transport household effects Meals costs for the five-day move Hotel costs for the five-day move Fuel costs for the five-day move (all travel was by car) House hunting trip costs (prior to Vancouver move) 5,000 1,000 500 1,500 800 Marcus, his spouse and their two children all made the move to Vancouver. The distance traveled by car was 4,430 kilometres. Which one of the following amounts represents the maximum amount Marcus Semien can deduct as moving expenses on his 2021 personal income tax return, rounded to the nearest dollar? Bo Bichette had net income of $25,000 on line 23600 of his 2021 personal income tax return. This amount included net business income of $24,000 plus a taxable capital gain of $1,000. Bo has the following net capital and non-capital loss balances available to be applied: Available net capital losses Available non-capital losses 100 500 Using the above information, calculate Bo Bichette's taxable income on line 26000 of his 2021 personal income tax return assuming he wishes to minimize taxes payable.

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Calculate HyunJin Ryus maximum deductible RRSP contribution limit for the 2021 taxation year Given t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started