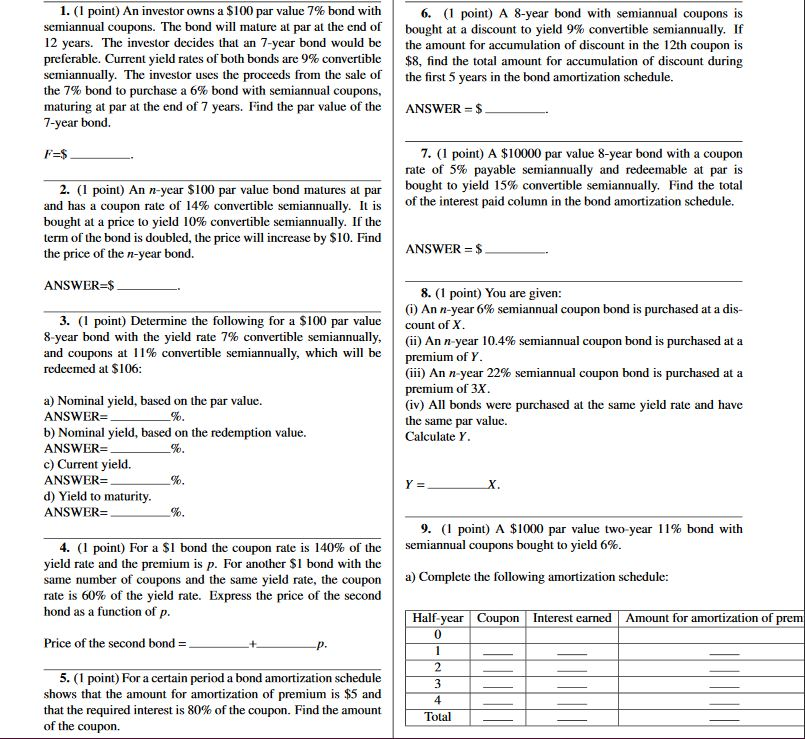

I. (1 point) An investor owns a $100 par value 7% bond with semiannual c 12 years. The investor decides that an 7-year bon preferable. Current yield rates of both bonds are 9% convertible $8 find the total amount for accumulation of discount during semiannually. The investor uses the proceeds from the sale of the first 5 years in the bond amortization schedule. the 7% bond to purchase a 6% bond with semiannual coupons, maturing at par at the end of 7 years. Find the par value of the | ANSWER 6. (1 point) A 8-year bond with semiannual coupons is bought at a discount to yield 9% convertible semiannually. If d would bethe amount for accumulation of discount in the 12th coupon is oupons. The bond will mature at par at the end of r bond. 7. (1 point) A $10000 par value 8-year bond with a coupon rate of 5% payable semiannually and redeemable at par is bought to yield 15% convertible semiannually. Find the total of the interest paid column in the bond amortization schedule. 2. (1 point) An n-year $100 par value bond matures at par and has a coupon rate of 14% convertible semiannually. It is bought at a price to yield 10% convertible semiannually. If the term of the bond is doubled, the price will increase by $10. Find the price of the n-year bond. ANSWER$ ANSWER-$ 8. (1 point) You are given (i) An n-year 6% semiannual coupon bond is purchased at a dis- 3. (I point) Determine the following for a S100 par value count of X 8-year bond with the yield rate 7% convertible semiannually, (ii) Ann-year 10.4% semiannual coupon bond is purchased at a and coupons at 11% convertible semiannually, which will be redeemed at $106 a) Nominal yield, based on the par value. ANSWER -% b) Nominal yield, based on the redemption value. ANSWER- premium of Y (iii) An n-year 22% semiannual coupon bond is purchased at a premium of 3X (iv) All bonds were purchased at the same yield rate and have the same par value Calculate Y. 1e ANSWER- d) Yield to maturity ANSWER 9" (1 point) A $1000 par value two-year 11% bond with 4. (1 point) For a $1 bond the coupon rale is l 40% of the | semiannual coupons bought to yield 6% yield rate and the premium is p. For another $1 bond with the same number of coupons and the same yield rate, the coupon rate is 60% of the yield rate. Express the price hond as a function of p a Complete the wing amortization schedule: of the second Half pon Interest earned Amount for amortization of prem Cou Price of the second bond 5. (1 point) For a certain period a bond amortization schedule shows that the amount for amortization of premium is $5 and that the required interest is 80% of the coupon. Find the amount of the coupon. 3 4 Total I. (1 point) An investor owns a $100 par value 7% bond with semiannual c 12 years. The investor decides that an 7-year bon preferable. Current yield rates of both bonds are 9% convertible $8 find the total amount for accumulation of discount during semiannually. The investor uses the proceeds from the sale of the first 5 years in the bond amortization schedule. the 7% bond to purchase a 6% bond with semiannual coupons, maturing at par at the end of 7 years. Find the par value of the | ANSWER 6. (1 point) A 8-year bond with semiannual coupons is bought at a discount to yield 9% convertible semiannually. If d would bethe amount for accumulation of discount in the 12th coupon is oupons. The bond will mature at par at the end of r bond. 7. (1 point) A $10000 par value 8-year bond with a coupon rate of 5% payable semiannually and redeemable at par is bought to yield 15% convertible semiannually. Find the total of the interest paid column in the bond amortization schedule. 2. (1 point) An n-year $100 par value bond matures at par and has a coupon rate of 14% convertible semiannually. It is bought at a price to yield 10% convertible semiannually. If the term of the bond is doubled, the price will increase by $10. Find the price of the n-year bond. ANSWER$ ANSWER-$ 8. (1 point) You are given (i) An n-year 6% semiannual coupon bond is purchased at a dis- 3. (I point) Determine the following for a S100 par value count of X 8-year bond with the yield rate 7% convertible semiannually, (ii) Ann-year 10.4% semiannual coupon bond is purchased at a and coupons at 11% convertible semiannually, which will be redeemed at $106 a) Nominal yield, based on the par value. ANSWER -% b) Nominal yield, based on the redemption value. ANSWER- premium of Y (iii) An n-year 22% semiannual coupon bond is purchased at a premium of 3X (iv) All bonds were purchased at the same yield rate and have the same par value Calculate Y. 1e ANSWER- d) Yield to maturity ANSWER 9" (1 point) A $1000 par value two-year 11% bond with 4. (1 point) For a $1 bond the coupon rale is l 40% of the | semiannual coupons bought to yield 6% yield rate and the premium is p. For another $1 bond with the same number of coupons and the same yield rate, the coupon rate is 60% of the yield rate. Express the price hond as a function of p a Complete the wing amortization schedule: of the second Half pon Interest earned Amount for amortization of prem Cou Price of the second bond 5. (1 point) For a certain period a bond amortization schedule shows that the amount for amortization of premium is $5 and that the required interest is 80% of the coupon. Find the amount of the coupon. 3 4 Total