Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i. (15 points) Construct the Cash Flow from Financing Activities section for the Statement of Cash Flows for Sozo Corp. for 20Y6. Be sure to

i. (15 points) Construct the Cash Flow from Financing Activities section for the Statement of Cash Flows for Sozo Corp. for 20Y6. Be sure to indicate the total net cash flow from financing activities. Do not construct the entire Statement of Cash Flows. Please use the template below. There are more lines than you actually need, so dont let that confuse you.

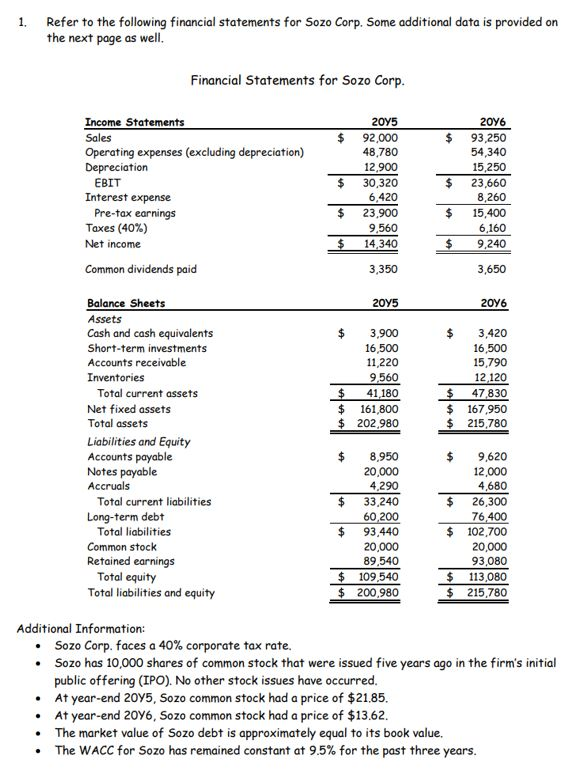

1. Refer to the following financial statements for Sozo Corp. Some additional data is provided on the next page as well Financial Statements for Sozo Corp. $ $ $ Income Statements Sales Operating expenses (excluding depreciation) Depreciation EBIT Interest expense Pre-tax earnings Taxes (40%) Net income Common dividends paid 2015 92,000 48,780 12,900 30,320 6,420 23,900 9,560 14,340 $ 2016 93,250 54,340 15,250 23,660 8,260 15,400 6,160 9,240 $ $ $ $ 3,350 3,650 2015 2016 $ 3,900 16,500 11, 220 9,560 $ 41 180 $ 161,800 $ 202,980 $ 3,420 16,500 15,790 12 120 $ 47,830 $ 167,950 $ 215,780 Balance Sheets Assets Cash and cash equivalents Short-term investments Accounts receivable Inventories Total current assets Net fixed assets Total assets Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total equity Total liabilities and equity $ 8,950 20,000 4,290 $ 33,240 60,200 $ 93.440 20,000 89,540 $ 109,540 $ 200,980 9,620 12,000 4,680 $ 26,300 76,400 $ 102,700 20,000 93,080 $ 113,080 $ 215,780 Additional Information: Sozo Corp. faces a 40% corporate tax rate. Sozo has 10,000 shares of common stock that were issued five years ago in the firm's initial public offering (IPO). No other stock issues have occurred. At year-end 2075, Sozo common stock had a price of $21.85. At year-end 2076, Sozo common stock had a price of $13.62. The market value of Sozo debt is approximately equal to its book value. The WACC for Sozo has remained constant at 9.5% for the past three years. . 2016

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started