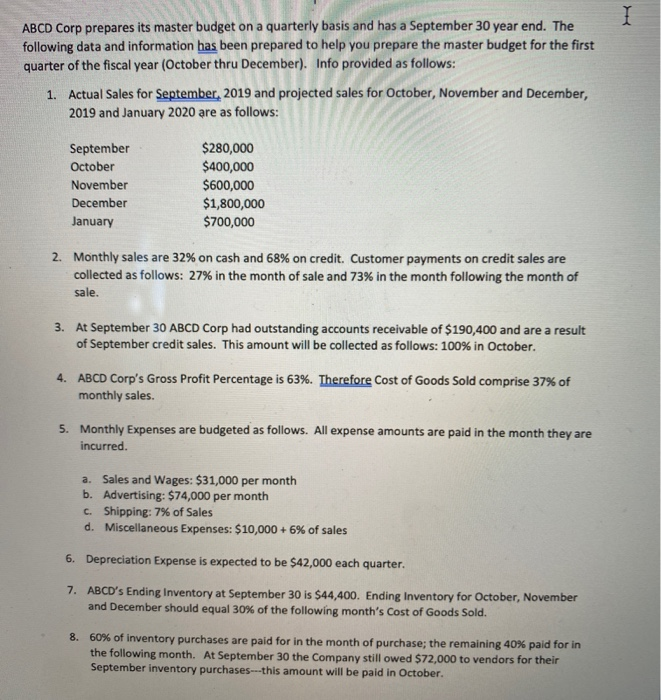

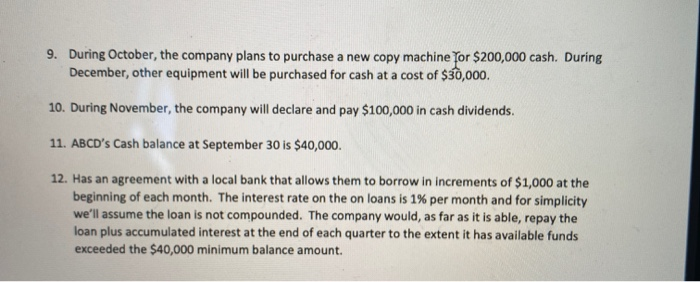

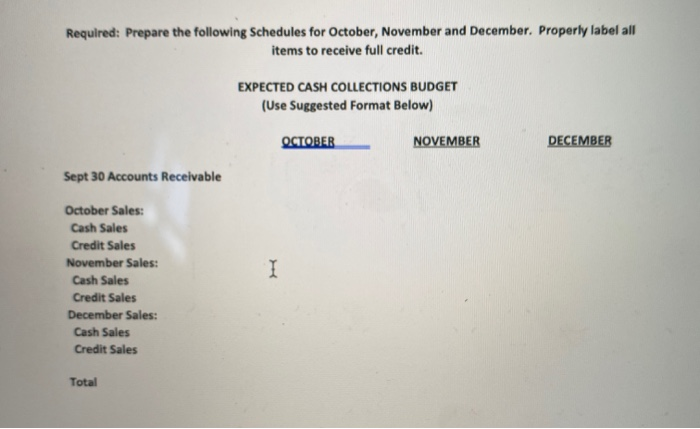

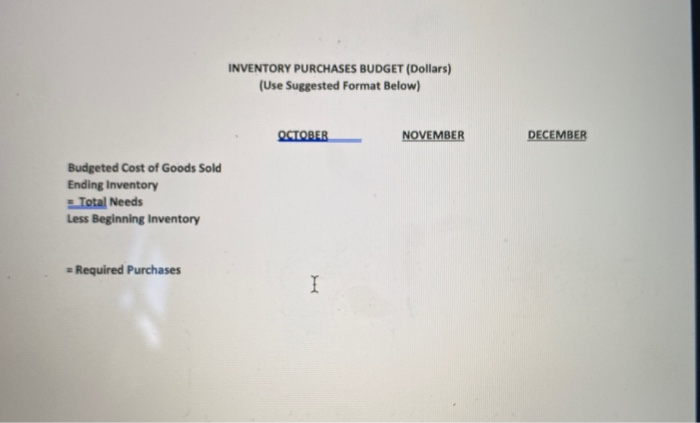

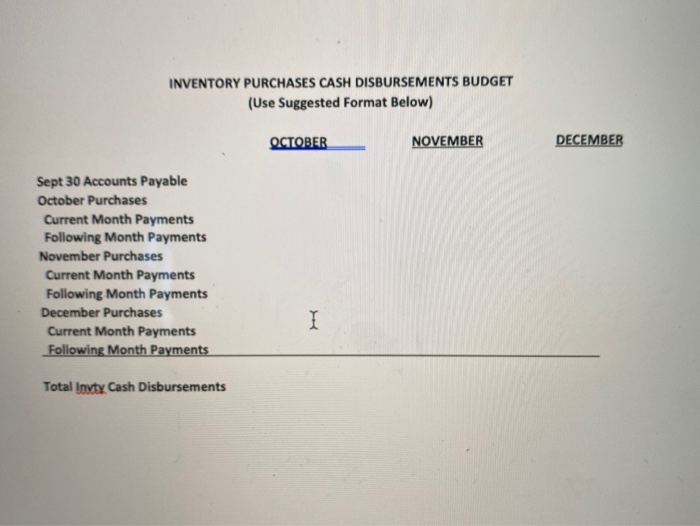

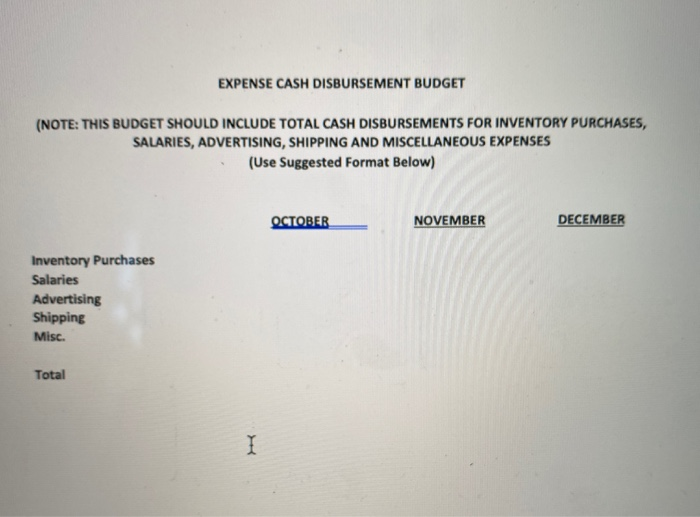

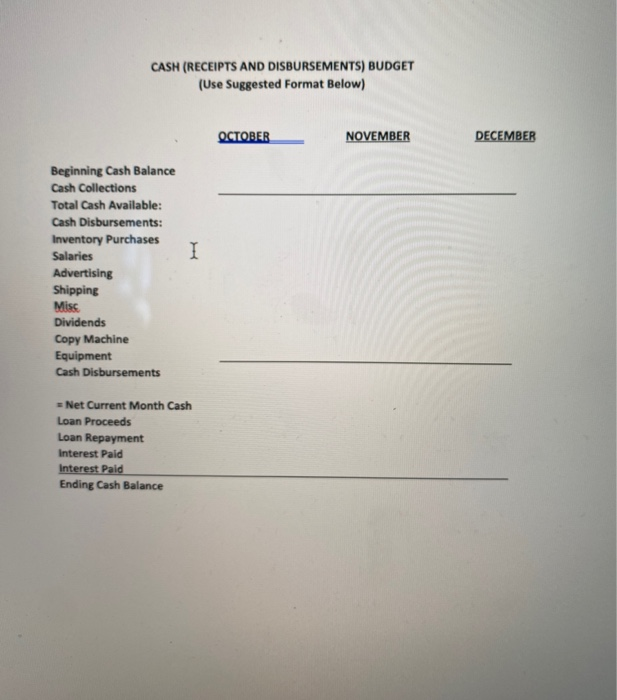

I ABCD Corp prepares its master budget on a quarterly basis and has a September 30 year end. The following data and information has been prepared to help you prepare the master budget for the first quarter of the fiscal year (October thru December). Info provided as follows: 1. Actual Sales for September, 2019 and projected sales for October, November and December, 2019 and January 2020 are as follows: September October November December January $280,000 $400,000 $600,000 $1,800,000 $700,000 2. Monthly sales are 32% on cash and 68% on credit. Customer payments on credit sales are collected as follows: 27% in the month of sale and 73% in the month following the month of sale. 3. At September 30 ABCD Corp had outstanding accounts receivable of $190,400 and are a result of September credit sales. This amount will be collected as follows: 100% in October. 4. ABCD Corp's Gross Profit Percentage is 63%. Therefore Cost of Goods Sold comprise 37% of monthly sales. 5. Monthly Expenses are budgeted as follows. All expense amounts are paid in the month they are incurred. a. Sales and Wages: $31,000 per month b. Advertising: $74,000 per month c. Shipping: 7% of Sales d. Miscellaneous Expenses: $10,000 + 5% of sales 6. Depreciation Expense is expected to be $42,000 each quarter. 7. ABCD's Ending Inventory at September 30 is $44,400. Ending Inventory for October, November and December should equal 30% of the following month's Cost of Goods Sold. 8. 60% of inventory purchases are paid for in the month of purchase; the remaining 40% paid for in the following month. At September 30 the Company still owed $72,000 to vendors for their September inventory purchases--this amount will be paid in October 9. During October, the company plans to purchase a new copy machine for $200,000 cash. During December, other equipment will be purchased for cash at a cost of $30,000. 10. During November, the company will declare and pay $100,000 in cash dividends. 11. ABCD's Cash balance at September 30 is $40,000. 12. Has an agreement with a local bank that allows them to borrow in increments of $1,000 at the beginning of each month. The interest rate on the on loans is 1% per month and for simplicity we'll assume the loan is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of each quarter to the extent it has available funds exceeded the $40,000 minimum balance amount. Required: Prepare the following Schedules for October, November and December. Properly label all items to receive full credit. EXPECTED CASH COLLECTIONS BUDGET (Use Suggested Format Below) OCTOBER NOVEMBER DECEMBER Sept 30 Accounts Receivable October Sales: Cash Sales Credit Sales November Sales: Cash Sales Credit Sales December Sales: Cash Sales Credit Sales I Total INVENTORY PURCHASES BUDGET (Dollars) (Use Suggested Format Below) OCTOBER NOVEMBER DECEMBER Budgeted Cost of Goods Sold Ending Inventory - Total Needs Less Beginning Inventory = Required Purchases I INVENTORY PURCHASES CASH DISBURSEMENTS BUDGET (Use Suggested Format Below) OCTOBER NOVEMBER DECEMBER Sept 30 Accounts Payable October Purchases Current Month Payments Following Month Payments November Purchases Current Month Payments Following Month Payments December Purchases Current Month Payments Following Month Payments I Total Inyty Cash Disbursements EXPENSE CASH DISBURSEMENT BUDGET (NOTE: THIS BUDGET SHOULD INCLUDE TOTAL CASH DISBURSEMENTS FOR INVENTORY PURCHASES, SALARIES, ADVERTISING, SHIPPING AND MISCELLANEOUS EXPENSES (Use Suggested Format Below) OCTOBER NOVEMBER DECEMBER Inventory Purchases Salaries Advertising Shipping Misc. Total I CASH (RECEIPTS AND DISBURSEMENTS) BUDGET (Use Suggested Format Below) OCTOBER NOVEMBER DECEMBER I Beginning Cash Balance Cash Collections Total Cash Available: Cash Disbursements: Inventory Purchases Salaries Advertising Shipping Miss Dividends Copy Machine Equipment Cash Disbursements = Net Current Month Cash Loan Proceeds Loan Repayment Interest Paid Interest Paid Ending Cash Balance